FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:At the beginning of the current year, Diamond Company

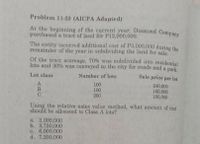

Problem 11-23 (AICPA Adapted)

purchased a tract of land for P12,000,000.

The entity incurred additional cost of Pa,000,000 during the

remainder of the year in subdividing the land for aale

Of the tract nccrenge, 70% was subdivided into residential

lots and 30% was conveyed to the city for roads and a park

Sale, price per lot

Lot elass

Number of lots

100

100

200

240,000

160,000

100,000

C.

Using the relative sales value method, what amount of cot

should be allocated to Class A lota?

a 3,000,000

b. 3,750,000

e. 6,000,000

d. 7,200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cost ConceptT On February 3, Gallatin Repair Service extended an offer of $152,000 for land that had been priced for sale at $173,000. On February 28, Gallatin Repair Service accepted the seller's counteroffer of $165,000. On October 23, the land was assessed at a value of $248,000 for property tax purposes. On January 15 of the next year, Gallatin Repair Service was offered $264,000 for the land by a national retail chain. At what value should the land be recorded in Gallatin Repair Service's records?arrow_forwardTimberly Construction makes a lump - sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of the purchased assets are building, $ 487,600; land, $285,200; land improvements, $73,600; and four vehicles, $73,600. Allocate the lump - sum purchase price to the separate assets purchased. Prepare the journal entry to record the purchase. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $31, 000 salvage value. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double - declining - balance depreciation.arrow_forwardManjiarrow_forward

- Coparrow_forwardTamarisk Realty Corporation purchased a tract of unimproved land for $110,000. This land was improved and subdivided into building lots at an additional cost of $68,920. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows. Group 1 2 3 No. of Lots 9 15 17 Price per Lot $6,000 8,000 4,800 Operating expenses for the year allocated to this project total $36,400. Lots unsold at the year-end were as follows. Group 1 Group 2 Group 3 5 lots 7 lots 2 lots At the end of the fiscal year Tamarisk Realty Corporation instructs you to arrive at the net income realized on this operation to date. (Round ratios for computational purposes to 4 decimal places, e.g. 78.7234% and final answer to 0 decimal places, e.g. 5,845.) Net incomearrow_forwardQuestion Content Area The president of Christmas Corporation donated a building to Tuesday Corporation. The building had an original cost of $675,000, a book value of $255,000, and a fair market value of $475,000. The journal entry by Tuesday Corporation to record this donation will include a debit Building for $675,000 and credit Gain for $200,000. debit Building for $255,000 and credit Gain for $255,000. debit Building for $475,000 and credit Gain for $200,000. debit Building for $475,000 and credit Gain for $475,000.arrow_forward

- Nonearrow_forwardRequired Information [The following information applies to the questions displayed below] Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $830,000. The estimated market values of the purchased assets are building, $467,500, land, $243,100; land improvements, $56,100; and four vehicles, $168,300. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Required 3 Allocate the lump-sum purchase price to the separate assets purchased. Required 1A Required 18 Required 2 Allocation of total cost Building…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education