FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

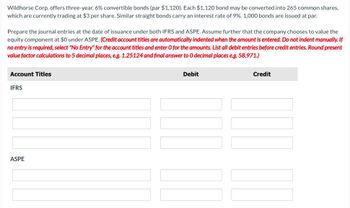

Transcribed Image Text:Wildhorse Corp. offers three-year, 6% convertible bonds (par $1,120). Each $1,120 bond may be converted into 265 common shares,

which are currently trading at $3 per share. Similar straight bonds carry an interest rate of 9%. 1,000 bonds are issued at par.

Prepare the journal entries at the date of issuance under both IFRS and ASPE. Assume further that the company chooses to value the

equity component at $0 under ASPE. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If

no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Round present

value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to O decimal places e.g. 58,971.)

Account Titles

IFRS

ASPE

Debit

Credit

JU

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Enviro Company issues 8%, 10-year bonds with a par value of $340,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%, which implies a selling price of 87 1/2. The straight-line method is used to allocate interest expense. 1. What are the issuer's cash proceeds from issuance of these bonds? 2. What total amount of bond interest expense will be recognized over the life of these bonds? 3. What is the amount of bond interest expense recorded on the first interest payment date? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What total amount of bond interest expense will be recognized over the life of these bonds? Note: Round final answers to the nearest whole dollar amount. Total Bond Interest Expense Over Life of Bonds: Amount repaid: 20 payments of Par value at maturity $ 13,600 $ Total repayments Less amount borrowed (cash proceeds from part 1) Total bond interest expense < $ Required…arrow_forwardplease help mearrow_forwardGerard Corporation has the following convertible bonds. A $100,000 convertible bond was issued at par on January 1, 2021, at 4%. The bond is convertible into 30,000 shares of common stock. Additionally, there was a convertible bond that was purchased on November 1, 2021, at par, for $200,000 with an interest rate of 6%, this bond is convertible into 20,000 shares of common stock. Both bonds pay interest annually. Gerard Corporation has total revenue of 800,000 and expenses of 400,000, which does not include interest expense or taxes. The tax rate is 40%. Additionally, the organization currently has 300,000 shares of common stock outstanding for the entire year. No dividends were paid in 2021. Calculate Earnings per share. Calculate Dilutive Earnings per share using the if converted method.arrow_forward

- Enviro Company issues 12.00%, 10-year bonds with a par value of $460,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 9.00%, which implies a selling price of 128.625. The straight-line method is used to allocate interest expense. What are the issuer's cash proceeds from issuance of these bonds? What total amount of bond interest expense will be recognized over the life of these bonds? What is the amount of bond interest expense recorded on the first interest payment date?arrow_forwardOn January 1, 2024, Madison Products issued $45 million of 8%, 10-year convertible bonds at a net price of $45.5 million. ■ Madison recently issued similar, but nonconvertible, bonds at 99 (that is, 99% of face amount). . The bonds pay interest on June 30 and December 31. • Each $1,000 bond is convertible into 30 shares of Madison's no par common stock. • Madison records interest by the straight-line method. ⚫ On June 1, 2026, Madison notified bondholders of its intent to call the bonds at face value plus a 1% call premium on July 1, 2026. ■ By June 30, all bondholders had chosen to convert their bonds into shares as of the interest payment date. ⚫ On June 30, Madison paid the semiannual interest and issued the requisite number of shares for the bonds being converted. Required: Assume that Madison Products prepares its financial statements according to International Financial Reporting Standards using the net method. 1. & 2. Prepare the journal entries for the issuance of the bonds by…arrow_forwardNichols Corporation has the following convertible bonds. A $100,000 convertible bond was issued at par on January 1, 2021, at 4%. The bond is convertible into 30,000 shares of common stock. Additionally, there was a convertible bond that was purchased on November 1, 2021, at par, for $200,000 with an interest rate of 6%, this bond is convertible into 20,000 shares of common stock. Both bonds pay interest annually. Nichols Corporation has total revenue of 800,000 and expenses of 400,000, which does not include interest expense or taxes. The tax rate is 40%. Additionally, the organization currently has 300,000 shares of common stock outstanding for the entire year. No dividends were paid in 2021. A. Calculate Earnings per share. B. Calculate Dilutive Earnings per share using the if converted method.arrow_forward

- On September 30, 2023, Sunland Inc. issued $3,280,000 of 10-year, 8% convertible bonds for $3,772,000. The bonds pay interest on March 31 and September 30 and mature on September 30, 2033. Each $1,000 bond can be converted into 80 no par value common shares. In addition, each bond included 20 detachable warrants. Each warrant can be used to purchase one common share at an exercise price of $15. Immediately after the bond issuance, the warrants traded at $3 each. Without the warrants and the conversion rights, the bonds would have been expected to sell for $3,444,000. On March 23, 2026, half of the warrants were exercised. The common shares of Sunland were trading at $20 each on this day. Immediately after the payment of interest on the bonds, on September 30, 2028, all bonds outstanding were converted into common shares. Assume the entity follows IFRS. (e) Your answer is partially correct. Prepare the journal entry to account for the exercise of the warrants on March 23, 2026. (Credit…arrow_forwardGarcia Company issues 8.0%, 15-year bonds with a par value of $290,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 6.0%, which implies a selling price of 114 3/4. Prepare the journal entry for the issuance of these bonds for cash on January 1. View transaction list Journal entry worksheet < Record the issue of bonds with a par value of $290,000 at a selling price of 114 3/4. Note: Enter debits before credits. Date January 01 Record entry General Journal Clear entry Debit Credit He View general Journalarrow_forwardFlorence Inc. issued 8,000, 5-year convertible bonds of $2,000 each for $4,000,000 at the beginning of 2021. The bonds have a stated rate of interest of 9% and interest is payable annually. Each bond can be convertible into 100 shares with a par value of $10. The market rate of similar nonconvertible debt is 10%. Determine the fair value of the equity component using the “with-and-without” method is a. $3,848,288 b. $2,483,600 c. $1,365,688 d. $151,712arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education