FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

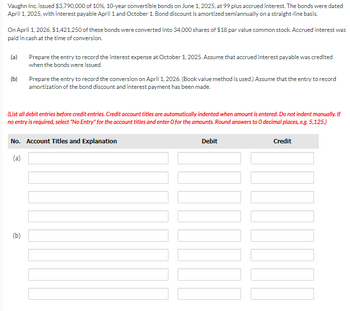

Transcribed Image Text:Vaughn Inc. issued $3,790,000 of 10%, 10-year convertible bonds on June 1, 2025, at 99 plus accrued interest. The bonds were dated

April 1, 2025, with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line basis.

On April 1, 2026, $1,421,250 of these bonds were converted into 34,000 shares of $18 par value common stock. Accrued interest was

paid in cash at the time of conversion.

(a)

(b)

Prepare the entry to record the interest expense at October 1, 2025. Assume that accrued interest payable was credited

when the bonds were issued.

Prepare the entry to record the conversion on April 1, 2026. (Book value method is used.) Assume that the entry to record

amortization of the bond discount and interest payment has been made.

(List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If

no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,125.)

No. Account Titles and Explanation

Debit

Credit

(a)

(b)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On April 1, 2024, Déjà Vu Company issued 12% bonds that have a total face value of $140,000 (each bond has a face value of $1,000). The bonds sold for $164,023 and mature in 20 years. The effective interest rate for the bonds was 10% on 4/1/24. Interest is paid semiannually on September 30 and March 31. The market value of the bonds was 102 on 12/31/24 and $104 on 12/31/25. The market rate of interest on the bonds fell to 9% on 8/1/24. David Company purchased all of the bonds as an investment on 4/1/2024. A partial amortization schedule appears below. 9/30/2024 8,400 3/31/2025 8,400 9/30/2025 8,400 3/31/2026 8,400 9/30/2026 8,400 3/31/2027 8,400 9/30/2027 8,400 Cash Interest $__ Interest Income 8,201 8,191 8,181 8,170 8,158 8,146 8,134 $_ Premium Amortized 199 209 219 230 242 254 266 What is the amount of assets related to the bonds on David's balance sheet: As of 12/31/24 if the bonds are accounted for as held-to-maturity. Carrying Value 164,023 163,824 163,615 $_ As of 12/31/2024 if…arrow_forwardOn January 1, 2016, Cooper Corporation issued $800,000 of 12.5% bonds due January 1, 2023, at 102. The bonds pay interest semiannually on June 30 and December 31. Each $1,000 bond carried 10 warrants which allowed the acquired to exchange 1 share of $10 par common stock for $50. Sometime after the bonds were issued the bonds were quoted at 98 ex-rights and each individual warrant was quoted at $5. Subsequently, on April 30, 2017, 2,000 rights were exercised. Required: 1. Prepare the journal entry to record the bond issue. 2. Prepare the journal entries on April 30, 2017, to record the exchange of the warrants for common shares.arrow_forwardSarasota Inc. Issued $4,200,000 of convertible 5-year bonds on July 1, 2025. The bonds provide for 6% interest payable semiannually on January 1 and July 1. The discount in connection with the issue was $102,000, which is being amortized monthly on a straight-line basis. The bonds are convertible after one year into 15 shares of Sarasota Inc.'s $1 par value common stock for each $1,000 of bonds. On October 1, 2026, $504,000 of bonds were turned in for conversion into common stock. Interest has been accrued monthly and paid as due. At the time of conversion, any accrued interest on bonds being converted is paid in cash. Prepare the journal entries to record the conversion, amortization, and interest in connection with the bonds as of the following dates. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit…arrow_forward

- ABC Co. issued 1.000 convertible bonds at the beginning of 2019. The bonds have a four-year term with a stated rate of interest of 6 percent, and are issued at par with a face value of Rp1.000 per bond (the total proceeds received from issuance of the bonds are Rp1.000.000). Interest is payable annually at December 31. Each bond is convertible into 250 ordinary shares with a par value of Rp1. The market rate of interest on similar non-convertible debt is 9 percent. On December 31, 2020, ABC wishes to reduce its annual interest cost. The company agrees to pay the holder of its convertible bonds an additional Rp40.000 if they will convert. Assuming conversion occurs, ABC’s journal entry to record the conversion will include all of the following, except:arrow_forwardOn February 1, 2024, Strauss-Lombardi issued 9% bonds, dated February 1, with a face amount of $860,000. The bonds sold for $786,220 and mature on January 31, 2044 (20 years). The market yield for bonds of similar risk and maturity was 10%. Interest is paid semiannually on July 31 and January 31. Strauss-Lombardi’s fiscal year ends December 31. Question: 1 to 4. Prepare the journal entries to record their issuance by Strauss-Lombardi on February 1, 2024, interest on July 31, 2024 (at the effective rate), adjusting entry to accrue interest on December 31, 2024 and interest on January 31, 2025. Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardMango Co. issued bonds payable on January 1, 2022. Each $1,000 bond is convertible to 10 shares of common stock after January 1, 2024. The bonds have a 5-year term, a stated rate of 8%, and pay interest annually on January 1. The bonds were issued at a premium of $25,274 which provides an effective interest rate of 6%. (Hint: Prepare an amortization table for the five-year term of the bonds. Note that 2023 is the second year in the term of the bonds.) Prepare the adjusting entry at Dec. 31 , 2023.arrow_forward

- Kingbird Inc. issued $3,000,000 of convertible 10-year bonds on July 1, 2025. The bonds provide for 11% interest payable semiannually on January 1 and July 1. The discount in connection with the issue was $56,400, which is being amortized monthly on a straight-line basis. The bonds are convertible after one year into 9 shares of Kingbird Inc's $100 par value common stock for each $1,000 of bonds. On August 1, 2026, $300,000 of bonds were turned in for conversion into common stock. Interest has been accrued monthly and paid as due. At the time of conversion, any accrued interest on bonds being converted is paid in cash. Prepare the journal entries to record the conversion, amortization, and interest in connection with the bonds as of the following dates. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the…arrow_forwardOn September 30, 2023, Sunland Inc. issued $3,280,000 of 10-year, 8% convertible bonds for $3,772,000. The bonds pay interest on March 31 and September 30 and mature on September 30, 2033. Each $1,000 bond can be converted into 80 no par value common shares. In addition, each bond included 20 detachable warrants. Each warrant can be used to purchase one common share at an exercise price of $15. Immediately after the bond issuance, the warrants traded at $3 each. Without the warrants and the conversion rights, the bonds would have been expected to sell for $3,444,000. On March 23, 2026, half of the warrants were exercised. The common shares of Sunland were trading at $20 each on this day. Immediately after the payment of interest on the bonds, on September 30, 2028, all bonds outstanding were converted into common shares. Assume the entity follows IFRS. (e) Your answer is partially correct. Prepare the journal entry to account for the exercise of the warrants on March 23, 2026. (Credit…arrow_forwardOn August 1, 2024, Perez Communications issued $36 million of 12% nonconvertible bonds at 105. The bonds are due on July 31, 2044. Each $1,000 bond was issued with 25 detachable stock warrants, each of which entitled the bondholder to purchase, for $50, one share of Perez Communications’ no par common stock. Interstate Containers purchased 20% of the bond issue. On August 1, 2024, the market value of the common stock was $48 per share and the market value of each warrant was $8. In February 2035, when Perez common stock had a market price of $62 per share and the unamortized discount balance was $2 million, Interstate Containers exercised the warrants it held. Questions: Prepare the journal entries on August 1, 2024, to record (a) the issuance of the bonds by Perez and (b) the investment by Interstate. Prepare the journal entries for both Perez and Interstate in February 2035, to record the exercise of the warrants.arrow_forward

- Telta Inc. issued $15,000,000 of 12%, 40-year convertible bonds on November 1, 2025, at 97 plus accrued interest. The bonds were dated July 1, 2025, with interest payable January 1 and July 1. Bond discount (premium) is amortized semiannually on a straight-line basis. On July 1, 2026, one-half of these bonds were converted into 60,000 shares of $1 par value common stock. Accrued interest was paid in cash at the time of conversion. (a) (b) Prepare the entry to record the interest expense at December 31, 2025. Assume that accrued interest payable was credited when the bonds were issued. Credit Interest Payable for the full amount due; debit Interest Payable for the amount recognized at insurance. (Round to nearest dollar.) Prepare the entry to record the conversion on July 1, 2026. (Book value method is used.) Assume that the entry to record amortization of the bond discount and interest payment has been made.arrow_forwardOn March 1, 2024, Baddour, Incorporated, issued 10% bonds, dated January 1, with a face amount of $160 million. The bonds were priced at $142.00 million (plus accrued interest) to yield 12%. The price if issued on January 1 would have been $139.25 million. Interest is paid semiannually on June 30 and December 31. Baddour’s fiscal year ends September 30. Required: 1. to 3. What would be the amount(s) related to the bonds Baddour would report in its balance sheet, income statement and statement of cash flows for the year ended September 30, 2024?arrow_forwardLibertine Co. issued $10,000,000 of 9%, 10-year, convertible bonds on January 1, 2020. Interest is paid annually on December 31. At the time of the bonds issuance, the market rate for non-convertible bonds was 10%. Each $1,000 bond is convertible into 15 common shares. In 2025, half of the bondholders decided to convert their bonds into common shares. How many shares were issued as a result of the conversion? Question 10 options: 75,000 140,783 15,000 150,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education