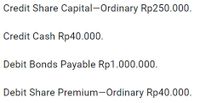

ABC Co. issued 1.000 convertible bonds at the beginning of 2019. The bonds have a four-year term with a stated rate of interest of 6 percent, and are issued at par with a face value of Rp1.000 per bond (the total proceeds received from issuance of the bonds are Rp1.000.000). Interest is payable annually at December 31. Each bond is convertible into 250 ordinary shares with a par value of Rp1. The market rate of interest on similar non-convertible debt is 9 percent. On December 31, 2020, ABC wishes to reduce its annual interest cost. The company agrees to pay the holder of its convertible bonds an additional Rp40.000 if they will convert. Assuming conversion occurs, ABC’s

Step by stepSolved in 2 steps

- If the bonds payable account has a balance of $900,000 and the discount on bonds payable account has a balance of $72,000, what is the carrying amount of bonds? A. $828,000 B. $900,000 C. $972,000 D. $580,000arrow_forwardConsider the relative liquidity of the following assets: Assets 1. A bond issued by a publicly traded company 2. The funds in a money market account 3. A $20 bill 4. Your truck Select the assets in order o Most Liquid Second-Most Liquid Third-Most Liquid Least Liquid Bond 520.00 bill Truck Funds held in a money market account quid.arrow_forwardIf $470,000 of 10% bonds are issued at 97, the amount of cash received from the sale isarrow_forward

- Bonds Payable has a balance of $1,000,000 and Discount on Bonds Payable has a balance of $15,500. If the issuing corporation redeems the bonds at 98 1/2, what is the amount of gain or loss on redemption? a. $500 loss Ob. $15,500 gain Oc. $500 gain Od. $15,500 loss 43 0 77777777777arrow_forwardIf $1,000,000 of 10% bonds are issued at 98, the amount of cash received from the sale is: O a. $987,500. Ob. $980,000. c. $1,000,000. Od. $975,000.arrow_forwardWhat is the amount of cash Essie..arrow_forward

- If $1,012,000 of 12% bonds are issued at 102 1/2, the amount of cash received from the sale is Oa. $1,037,300 O b. $1,012,000 O c. $759,000 O d. $1,133,440arrow_forwardVikrambahiarrow_forwardIf $457,000 of 8% bonds are issued at 94, what is the amount of cash received from the sale? Select the correct answer. A. $420,440 B. $457,000 C. $429,580 D. $493,560arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education