FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

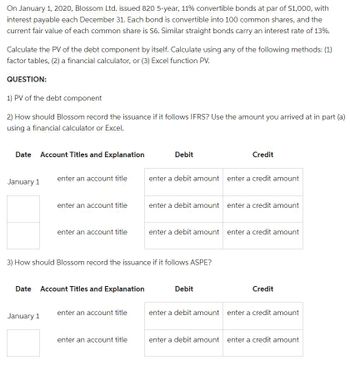

Transcribed Image Text:On January 1, 2020, Blossom Ltd. issued 820 5-year, 11% convertible bonds at par of $1,000, with

interest payable each December 31. Each bond is convertible into 100 common shares, and the

current fair value of each common share is $6. Similar straight bonds carry an interest rate of 13%.

Calculate the PV of the debt component by itself. Calculate using any of the following methods: (1)

factor tables, (2) a financial calculator, or (3) Excel function PV.

QUESTION:

1) PV of the debt component

2) How should Blossom record the issuance if it follows IFRS? Use the amount you arrived at in part (a)

using a financial calculator or Excel.

Date Account Titles and Explanation

January 1

enter an account title

enter an account title

January 1

enter an account title

Date Account Titles and Explanation

enter an account title

Debit

3) How should Blossom record the issuance if it follows ASPE?

enter an account title

enter a debit amount enter a credit amount

Credit

enter a debit amount enter a credit amount

enter a debit amount enter a credit amount

Debit

Credit

enter a debit amount enter a credit amount

enter a debit amount enter a credit amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, Anne Teak Furniture issued $100,000 of 12% bonds, dated January 1. Interest is payable semiannually on June 30 and December 31. The bonds mature in 4 years. The annual market rate for bonds of similar risk and maturity is 14%. What was the issue price of the bonds? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Multiple Choice $89,460 $120,942 $95,460 $94,029arrow_forwardOn January 1, 2020, Blindo Corp. issued ten - year, 12% bonds with a face value of $ 500,000, with interest payable semi-annually on June 30 and December 31. At the time, the market rate was 10%. Required: a) Find PMT and Use your calculator to calculate the issue price of the bonds. Round the answer to the nearest dollar. b) Independent of your solution to part a), assume that the issue price was $ 562, 000. Prepare the amortization table for 2020. Round values to the nearest dollar.arrow_forwardOn January 1, 2024, Cool Universe issued 10% bonds dated January 1, 2024, with a face amount of $20.1 million. The bonds mature in 2033 (10 years). For bonds of similar risk and maturity, the market yield is 12%. Interest is paid semiannually on June 30 and December 31. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Determine the price of the bonds on January 1, 2024. 2. Prepare the journal entry to record the bond issuance by Cool on January 1, 2024. 3. Prepare the journal entry to record interest on June 30, 2024, using the straight-line method. 4. Prepare the journal entry to record interest on December 31, 2024, using the straight-line method. Complete this question by entering your answers in the tabs below. Req 1 Req 2 to 4 Check n Determine the price of the bonds on January 1, 2024. Note: Enter your answers in whole dollars not in millions (l.e., 1,000,000 not 1). Round your intermediate…arrow_forward

- On January 1, 2016, Instaform, Inc., issued 10% bonds with a face amount of $50 million, dated January 1. The bonds mature in 2035 (20 years). The market yield for bonds of similar risk and maturity is 12%. Interest is paid semiannually. Required: 1. Determine the price of the bonds at January 1, 2016, and prepare the journal entry to record their issuance by Instaform. 2. Assume the market rate was 9%. Determine the price of the bonds at January 1, 2016, and prepare the journal entry to record their issuance by Instaform. 3. Assume Broadcourt Electronics purchased the entire issue in a private placement of the bonds. Using the data in requirement 2, prepare the journal entry to record the purchase by Broadcourt.arrow_forwardEnviro Company issues 12.00%, 10-year bonds with a par value of $460,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 9.00%, which implies a selling price of 128.625. The straight-line method is used to allocate interest expense. What are the issuer's cash proceeds from issuance of these bonds? What total amount of bond interest expense will be recognized over the life of these bonds? What is the amount of bond interest expense recorded on the first interest payment date?arrow_forwardYour answer is partially correct. Swifty Ltd. issued a $1,184,000, 10-year bond dated January 1, 2023. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Swifty followed IFRS. Using 1. factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond.arrow_forward

- On March 1, 2024, Baddour, Incorporated, issued 10% bonds, dated January 1, with a face amount of $160 million. The bonds were priced at $142.00 million (plus accrued interest) to yield 12%. The price if issued on January 1 would have been $139.25 million. Interest is paid semiannually on June 30 and December 31. Baddour’s fiscal year ends September 30. Required: 1. to 3. What would be the amount(s) related to the bonds Baddour would report in its balance sheet, income statement and statement of cash flows for the year ended September 30, 2024?arrow_forwardFlorence Inc. issued 8,000, 5-year convertible bonds of $2,000 each for $4,000,000 at the beginning of 2021. The bonds have a stated rate of interest of 9% and interest is payable annually. Each bond can be convertible into 100 shares with a par value of $10. The market rate of similar nonconvertible debt is 10%. Determine the fair value of the equity component using the “with-and-without” method is a. $3,848,288 b. $2,483,600 c. $1,365,688 d. $151,712arrow_forwardOn January 1, 2021, Ithaca Corp. purchases Cortland Inc. bonds that have a face value of $210,000. The Cortland bonds have a stated interest rate of 10%. Interest is paid semiannually on June 30 and December 31, and the bonds mature in 10 years. For bonds of similar risk and maturity, the market yield on particular dates is as follows: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): January 1, 2021 11.0 % June 30, 2021 12.0 % Required:1. Calculate the price Ithaca would have paid for the Cortland bonds on January 1, 2021 (ignoring brokerage fees), and prepare a journal entry to record the purchase.2. Prepare all appropriate journal entries related to the bond investment during 2021, assuming Ithaca accounts for the bonds as a held-to-maturity investment. Ithaca calculates interest revenue at the effective interest rate as of the date it purchased the bonds.3. Prepare all appropriate…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education