FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

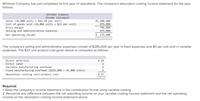

Transcribed Image Text:Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year

follows:

Whitman Company

Income Statement

Sales (38,000 units x $41.60 per unit)

Cost of goods sold (38,000 units x $23 per unit)

Gross margin

Selling and administrative expenses

$1,580,800

874,000

706,800

475,000

Net operating income

$

231,800

The company's selling and administrative expenses consist of $285,000 per year in fixed expenses and $5 per unit sold in variable

expenses. The $23 unit product cost given above is computed as follows:

Direct materials

$ 10

Direct labor

4

Variable manufacturing overhead

4

Fixed manufacturing overhead ($225,000 ÷ 45,000 units)

Absorption costing unit product cost

$ 23

Required:

1. Redo the company's income statement in the contribution format using variable costing.

2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating

income on the absorption costing income statement above.

Transcribed Image Text:Required 1

Required 2

Redo the company's income statement in the contribution format using variable costing.

Whitman Company

Variable Costing Income Statement

Required 1

Required 2

Reconcile any difference between the net operating income on your variable costing income statement and the net operating

Income on the absorptlon costing Income statement above. (Enter any losses or deductions as a negative value.)

Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes

Variable costing net operating income

Absorption costing net operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Whitman Company Income Statement Sales (38,000 units $41.60 per unit) Cost of goods sold (38,000 units x $23 per unit) Gross margin Selling and administrative expenses $ 1,580,800 874,000 706,800 475,000 Net operating income $ 231,800 The company's selling and administrative expenses consist of $285,000 per year in fixed expenses and $5 per unit sold in variab expenses. The $23 unit product cost given above is computed as follows: Direct materials Direct labor Variable manufacturing overhead $ 11 4 4 Fixed manufacturing overhead ($216,000 + 54,000 units) Absorption costing unit product cost 4 $ 23 Required: 1. Redo the company's Income statement in the contribution format using variable costing. 2. Reconcile any difference between the net operating Income on your variable costing Income statement and the net operating Income on the absorption costing Income statement above. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Redo the company's…arrow_forwardDarby Company, operating at full capacity, sold 124,200 units at a price of $84 per unit during the current year. Its income statement is as follows: Sales $10,432,800 Cost of goods sold 3,696,000 Gross profit $6,736,800 Expenses: Selling expenses $1,848,000 Administrative expenses 1,120,000 Total expenses 2,968,000 Income from operations $3,768,800 The division of costs between variable and fixed is as follows: Variable Fixed Cost of goods sold 60% 40% Selling expenses 50% 50% Administrative expenses 30% 70% Management is considering a plant expansion program for the following year that will permit an increase of $924,000 in yearly sales. The expansion will increase fixed costs by $123,200, but will not affect the relationship between sales and variable costs. 1. Determine the total variable costs and the total fixed costs for the current year. Total variable costs $fill in the blank 1 Total fixed…arrow_forwardKenzi, a manufacturer of kayaks, began operations this year. During this year, the company produced 1,000 kayaks and sold 750 at a price of $1,000 each. At year-end, the company reported the following income statement information using absorption costing. Sales (750 x $1,000) Cost of goods sold (750 x $425) Gross profit Selling and administrative expenses Income Additional Information $ 750,000 318,750 431,250 240,000 $ 191,250 a. Product cost per kayak under absorption costing totals $425, which consists of $325 in direct materials, direct labor, and variable overhead costs and $100 in fixed overhead cost. Fixed overhead of $100 per unit is based on $100,000 of fixed overhead per year divided by 1,000 kayaks produced. b. The $240,000 in selling and administrative expenses consists of $95,000 that is variable and $145,000 that is fixed. Prepare an income statement for the current year under variable costing. Income KENZI Income Statement (Variable Costing)arrow_forward

- During Heaton Company’s first two years of operations, it reported absorption costing net operating income as follows: Year 1 Year 2 Sales (@ $62 per unit) $ 1,178,000 $ 1,798,000 Cost of goods sold (@ $42 per unit) 798,000 1,218,000 Gross margin 380,000 580,000 Selling and administrative expenses* 306,000 336,000 Net operating income $ 74,000 $ 244,000 * $3 per unit variable; $249,000 fixed each year. The company’s $42 unit product cost is computed as follows: Direct materials $ 8 Direct labor 11 Variable manufacturing overhead 5 Fixed manufacturing overhead ($432,000 -: 24,000 units) 18 Absorption costing unit product cost $ 42 Production and cost data for the first two years of operations are: Year 1 Year 2 Units produced 24,000 24,000 Units sold 19,000 29,000 Required: Using variable costing, what is the unit product cost for both years? What is the variable costing net operating income in Year 1 and in Year 2? Reconcile the absorption costing and the variable costing net operating…arrow_forward2. A condensed income statement by product line for Master Energy Co. indicated the following for the Master Energy product line for the past year: Revenues and Costs Dollar Amount Sales $12,500,000 Cost of goods sold Gross profit Operating expenses Loss from operations 8,250,000 4,250,000 6,010,000 (1,760,000) It is estimated that 25% of the cost of goods sold represents fixed factory overhead costs and that 15% of the operating expenses are fixed. Because Master Energy is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis dated January 31st to determine whether Master Energy should be continued (Alternative 1) or discontinued (Alternative 2). b. Should Master Energy be retained? Explain.arrow_forwardWhitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: Whitman Company Income Statement Sales (40,000 units x $44.60 per unit) Cost of goods sold (40,000 units x $22 per unit) Gross margin Selling and administrative expenses Net operating income $ 1,784,000 880,000 904,000 460,000 $ 444,000 The company's selling and administrative expenses consist of $300,000 per year in fixed expenses and $4 per unit sold in variable expenses. The $22 unit product cost given above is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($180,000 + 45,000 units) Absorption costing unit product cost Required: $ 10 5 3 4 $ 22 1. Redo the company's income statement in the contribution format using variable costing. 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption…arrow_forward

- answer in text form please (without image)arrow_forwardWhitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: Whitman Company Income Statement Sales (42,000 units x $43.60 per unit) Cost of goods sold (42,000 units x $23 per unit) Gross margin Selling and administrative expenses Net operating income $ 1,831, 200 966,000 865,200 483,000 $ 382,200 The company's selling and administrative expenses consist of $315,000 per year in fixed expenses and $4 per unit sold in variable expenses. The $23 unit product cost given above is computed as follows: Direct materials. Direct labor $ 10 4 Variable manufacturing overhead 3 Fixed manufacturing overhead ($276,000 46,000 units) 6 Absorption costing unit product cost $ 23 Required: 1. Redo the company's income statement in the contribution format using variable costing. 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption…arrow_forwardWhipple Company has sales revenue of $585,000. Cost of goods sold before adjustment is $335,000. The company uses machine hours to allocate manufacturing overhead and estimated 10,450 machine hours would be used during the year. For the year, manufacturing overhead was under-allocated by $13,400. The company's actual manufacturing overhead is $91,000. What is the actual gross profit? Select one: a. $250,000 b. $159,000 c. $236,600 d. $104,400 e. $263,400arrow_forward

- Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow. Income Statements (Absorption Costing) Sales ($52 per unit) Cost of goods sold ($36 per unit) Year 2 Year 1 $ 1,508,000 1,044,000 $ 2,756,000 1,908,000 Gross profit Selling and administrative expenses Income Additional Information a. Sales and production data for these first two years follow. Units Units produced Units sold Year 1 41,000 29,000 Year 2 41,000 53,000 464,000 366,000 848,000 462,000 $ 98,000 $ 386,000 b. Variable costs per unit and fixed costs per year are unchanged during these years. The company's $36 per unit product cost using absorption costing consists of the following. Direct materials Direct labor Variable overhead Fixed overhead ($451,000/41,000 units) Total product cost per unit $ 11 11 3 11 $ 36 c. Selling and administrative expenses consist of the following. Selling and Administrative Expenses Variable selling and administrative…arrow_forwardWhitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: Whitman Company Income Statement Sales (39,000 units x $41.60 per unit) Cost of goods sold (39,000 units x $24 per unit) Gross margin Selling and administrative expenses Net operating income $ 1,622,400 936,000 686,400 448,500 $ 237,900 The company's selling and administrative expenses consist of $292,500 per year in fixed expenses and $4 per unit sold in variable expenses. The $24 unit product cost given above is computed as follows: Direct materials $ 11 Direct labor 5 Variable manufacturing overhead 3 Fixed manufacturing overhead ($260,000 + 52,000 units) Absorption costing unit product cost 5 $ 24 Required: 1. Redo the company's income statement in the contribution format using variable costing. 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education