FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

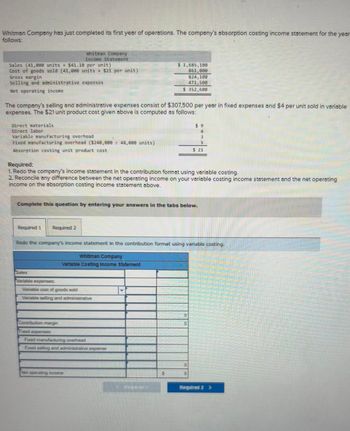

Transcribed Image Text:Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year

follows:

Sales (41,000 units $41.10 per unit)

Cost of goods sold (41,000 units $21 per unit)

Gross margin

Selling and administrative expenses

Net operating income

Whitman Company

Income Statement

The company's selling and administrative expenses consist of $307,500 per year in fixed expenses and $4 per unit sold in variable

expenses. The $21 unit product cost given above is computed as follows:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead ($240,000+ 48,000 units)

Absorption costing unit product cost

Required 1 Required 2

Required:

1. Redo the company's income statement in the contribution format using variable costing.

2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating

income on the absorption costing income statement above.

Complete this question by entering your answers in the tabs below.

Sales

Variable expenses:

Redo the company's income statement in the contribution format using variable costing.

Whitman Company

Variable Coating Income Statement

Variable cast of goods sold

Variable selling and administrative

Contribution margin

$1,685,100

861,000

824,188

471,508

$ 352,600

Fixed expenses.

Fixed manufacturing overhead

Fixed selling and administrative expense

Net operating income

3

5

$ 21

CY

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please do not give solution in image format thankuarrow_forwardWhitman Company Income Statement Sales (38,000 units $41.60 per unit) Cost of goods sold (38,000 units x $23 per unit) Gross margin Selling and administrative expenses $ 1,580,800 874,000 706,800 475,000 Net operating income $ 231,800 The company's selling and administrative expenses consist of $285,000 per year in fixed expenses and $5 per unit sold in variab expenses. The $23 unit product cost given above is computed as follows: Direct materials Direct labor Variable manufacturing overhead $ 11 4 4 Fixed manufacturing overhead ($216,000 + 54,000 units) Absorption costing unit product cost 4 $ 23 Required: 1. Redo the company's Income statement in the contribution format using variable costing. 2. Reconcile any difference between the net operating Income on your variable costing Income statement and the net operating Income on the absorption costing Income statement above. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Redo the company's…arrow_forwardDo not give solution in imagearrow_forward

- Zachary Company operates three segments Income statements for the segments imply that profitability could be improved if Segment A were eliminated. ZACHARY COMPANY Income Statements for Year 2 Segment Sales Cost of goods sold Sales commissions Contribution margin General fixed operating expenses (allocation of president's salary) Advertising expense (specific to individual divisions) Net income (loss) Required a. Prepare a schedule of relevant sales and costs for Segment A A $ 168,000 (126,000) (20,000) 22,000 (34,000) (6,000) B $ 235,000 (79,000) (32,000) 124,000 (51,000) (19,000) $ (18,000) $ 54,000 $ 253,000 (82,000) (28,000) 143,000 (34,000) $ 109,000 b. Prepare comparative income statements for the company as a whole under two alternatives (1) the retention of Segment A and (2) the elimination of Segment A Complete this question by entering your answers in the tabs below.. Required A Required B Prepare a schedule of relevant sales and costs for Segment A. Relevant Revenue and Cost…arrow_forwardWhitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: Whitman Company Income Statement Sales (40,000 units x $44.60 per unit) Cost of goods sold (40,000 units x $22 per unit) Gross margin Selling and administrative expenses Net operating income $ 1,784,000 880,000 904,000 460,000 $ 444,000 The company's selling and administrative expenses consist of $300,000 per year in fixed expenses and $4 per unit sold in variable expenses. The $22 unit product cost given above is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($180,000 + 45,000 units) Absorption costing unit product cost Required: $ 10 5 3 4 $ 22 1. Redo the company's income statement in the contribution format using variable costing. 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption…arrow_forwardD’Souza Company sold 12,000 units of its product for $76.00 per unit. Cost of goods sold is $54.60 per unit. Each unit had $49.20 in variable cost of goods sold and variable selling and administrative expenses are $9.60 per unit. Compute gross profit under absorption costing.arrow_forward

- answer in text form please (without image)arrow_forwardPlease do not give solution in image format thankuarrow_forwardHi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Incorporated Income Statement Sales Cost of goods sold Selling and administrative expenses Gross margin Net operating loss $ 1,651,800 1,211,394 440,406 640,000 $ (199,594) Hi-Tek produced and sold 60,200 units of B300 at a price of $19 per unit and 12,700 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold B300 $ 400,700 $ 162,000 $ 120,200 $ 42,000 T500 Total $ 562,700 162,200 486,494 $ 1,211,394 The company has created an activity-based costing system to evaluate the profitability…arrow_forward

- Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: Whitman Company Income Statement Sales (42,000 units x $43.60 per unit) Cost of goods sold (42,000 units x $23 per unit) Gross margin Selling and administrative expenses Net operating income $ 1,831, 200 966,000 865,200 483,000 $ 382,200 The company's selling and administrative expenses consist of $315,000 per year in fixed expenses and $4 per unit sold in variable expenses. The $23 unit product cost given above is computed as follows: Direct materials. Direct labor $ 10 4 Variable manufacturing overhead 3 Fixed manufacturing overhead ($276,000 46,000 units) 6 Absorption costing unit product cost $ 23 Required: 1. Redo the company's income statement in the contribution format using variable costing. 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption…arrow_forwardPlease do not give solution in image format thankuarrow_forwardHi-Tek Manufacturing, Incorporated, makes two industrial component parts-B300 and T500. An absorption costing income state for the most recent period is shown below: Hi-Tek Manufacturing, Incorporated Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss. Hi-Tek produced and sold 60,300 units of B300 at a price of $20 per unit and 12,500 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labo dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold $ 1,706,000 1,221,008 484,992 570,000 $ (85,008) Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other (organization-sustaining costs) Total manufacturing overhead…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education