FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

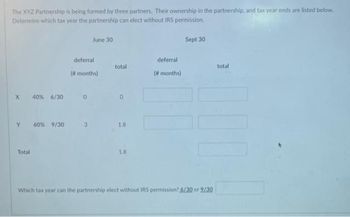

Transcribed Image Text:The XYZ Partnership is being formed by three partners. Their ownership in the partnership, and tax year ends are listed below.

Determine which tax year the partnership can elect without IRS permission.

X 40% 6/30

Y 60% 9/30

Total

deferral

(# months)

0

June 30

3

total

0

1.8

1.8

deferral

(# months)

Sept 30

total

101

Which tax year can the partnership elect without IRS permission? 6/30 or 9/30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- am.104.arrow_forwardQuestion 13: Louisa is an employee of Maroon Corp. Louisa files as Married Filing Jointly on her tax return. Over what amount will Maroon Corp. begin to withhold the additional Medicare tax from her earnings? Answer: A. SO В. O $125.000 C. O $200,000 D. $250,000arrow_forwardCalculate the exemption amount for the following cases in 2021 for a married taxpayer filing jointly and a married taxpayer filing separately. Click here to access the exemption table. If an amount is zero, enter a "0". MFS AMTI Case MFJ AMT Exemption AMT Exemption 1 $350,000 2 1,200,000 3 1,800,000arrow_forward

- K 2arrow_forwardPlease do Parts B, C, D. thank you.arrow_forwardIf line 43 (taxable Income) Is- And you are- At least But less than Single Married Married Head filing jointly of a house- rafely hold filing sepa- Your tax is 65,000 65,000 65,050 12,600 65,050 65,100 12,613 65,100 65,150 12.625 65,150 65,200 12,638 65,200 65,250 12,650 65,250 65,300 65350 12,675 65,350 65,400 12,688 8,951 12,600 11.319 8,959 12,613 11,331 8,969 12,625 11,344 8,981 12,638 11,356 8,994 12,650 11,369 9,006 12,663 11,381 9,019 12,675 11,394 9,031 12,688 11,406 65,300 12,663 Alexis and Ashley are married, filing jointly. Their combined taxable income is $65,230. Every week, a total of $198 is withheld from their pay. Based on the table, what can Alexis and Ashley expect when their taxes are due? (1 Point) O They will receive a refund of $1,302 Thế will receive a refund of $8,994 O They will owe an additional $1,302arrow_forward

- LO 8-1 49. In 2020, Jasmine and Thomas, a married couple, had taxable income of $150,000. If they were to file separate tax returns, Jasmine would have reported taxable in- come of $140,000 and Thomas would have reported taxable income of $10,000. What is the couple's marriage penalty or benefit?arrow_forwardThe deadline to file a gift tax return is December 31 of the year after the calendar year in which the gift is made. True Falsearrow_forwardIn 2021, Lisa and Fred, a married couple, had taxable income of $321,000. If they were to file separate tax returns, Lisa would have reported taxable income of $132,000 and Fred would have reported taxable income of $189,000. Use Tax Rate Schedule for reference. What is the couple's marriage penalty or benefit? (Do not round intermediate calculations.) Marriage benefitarrow_forward

- Calculate the total 2020 tax liability for a surviving spouse with one dependent child with a gross income of $60,620.00, assuming that the taxpayer takes the standard deduction. If the dependent child is under the age of 17 and $3,000.00 was withheld from the taxpayer's wages for federal income taxes, what is the amount of the taxpayer's refund or tax due? Assuming the single parent taxpayer's filing status is Married Filing Jointly or Surviving Spouse, the taxpayer's standard deduction for the 2020 tax year is $ to the nearest cent.) Click the following link for a standard deduction table: (Enter the amountarrow_forwardQuestion 3 of 10. Audrey is a South Carolina resident and is required to file a South Carolina return. She received $480 in South Carolina state bond interest. She also received $211 in Tennessee municipal bond interest. Both of these amounts are exempt from federal tax. How is the interest from each of these states' bonds han The Tennessee bond interest will be added to Audrey's federal taxable income. Reporting is not required for the South Carolina state bond interest. The total bond interest will be added to Audrey's federal taxable income. The South Carolina interest will be added to Audrey's federal taxable income, whereas the Tennessee interest will be subtracted from it. The Tennessee bond interest will be subtracted from Audrey's federal taxable income. Reporting is not required for the South Carolina state bond interest. Mark for follow uparrow_forwardFor each employee listed, use the percentage method to calculate federal income tax withholding for an employee who has submitted a 2020 Form W-4. Jesse Fineman files as married filing jointly on his tax return and earned weekly gross pay of 1450. He does not make any retirement plan contributions. Jesse entered 20 on line 4c of Form W-4 and did not enter any information in steps 2 & 3 of the form. Federal income tax withholding = $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education