FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

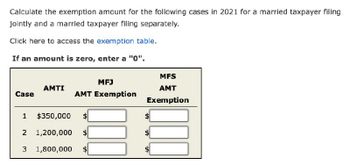

Transcribed Image Text:Calculate the exemption amount for the following cases in 2021 for a married taxpayer filing

jointly and a married taxpayer filing separately.

Click here to access the exemption table.

If an amount is zero, enter a "0".

MFS

AMTI

Case

MFJ

AMT Exemption

AMT

Exemption

1 $350,000

2 1,200,000

3 1,800,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For each of the following taxpayers, indicate the filing status for the taxpayer(s) for 2023 using the following legend: A - Single B- Married filing a joint return D Head of household E-Surviving spouse [qualifying widow(er)] C- Married filing separate returnsarrow_forwardplease answer within 30 minutes...arrow_forwardhr.4arrow_forward

- Only typed solutionarrow_forwardProblem Renee and Sanjeev Patel, who are married, reported taxable income of $1,008,000 for 2022. They incurred positive AMT modifications of $142,500. Click here to access the exemption table. a. Compute the Patels' alternative minimum taxable income (AMTI) for 2022. 1,008,000 Taxable income Plus: Equals: AMTI AMTI b. Compute the Patel's tentative minimum tax. Computation of AMT Base and Tax 8) AMT modifications AMT exemption AMT base TMT $ 75,000 1,083,000 1,083,000arrow_forwardEach of the following taxpayers has 2022 taxable income before the standard deduction as shown. Determine from the tax table provided, the amount of the income tax (before an credits) for each of the following taxpayers for 2022: Taxpayer(s) Allen Boyd Caldwell Dell Evans Filing Status Single MFS MFJ H of H Single Taxable Income Before the Standard Deduction $34,600 37,175 62,710 49,513 57,397 Income Taxarrow_forward

- 2. Determine from the tax table or the tax rate schedule, whichever is appropriated, the amount of the income tax for each of the following taxpayers for 2022. Taxpayer(s) Filling Status Single MFS Elisha Leo Tommy Emilia H of H Single Taxable Income Income Tax 74,580 $86,200 $20,350 $49,650 $ $ $12312arrow_forward< Daniel's standard deduction for 2023 is $13,850. a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible". Payment of alimony (divorce finalized in March 2021) Mortgage interest on residence Property tax on residence Contribution to traditional IRA (assume the amount is fully deductible) Contribution to United Church Loss on the sale of real estate (held for investment) Medical expenses State income tax Federal income tax What is Daniel's gross income and his AGI? Gross income: $ AGI: $ b. Should Daniel itemize his deductions from AGI or take the standard deduction? Because Daniel's total itemized deductions (after any limitations) are $ he would benefit from 10:34arrow_forwardFor a 24-year-old taxpayer with two dependents who is qualified to use the filing status of "head of household," what is the California AGI that will cause him to be required to file a tax return for 2022? a. $41,988 • b. $46,171 c. $58,724 • d. $40,000 Answer: a. $41,988arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education