FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

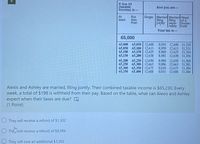

Transcribed Image Text:**Tax Information for Educational Purposes**

**Table Summary:**

The table shows tax amounts based on specific ranges of taxable income and filing status. It divides incomes into $50 brackets, from $65,000 to $65,400. The tax is calculated separately for individuals who are:

- Single

- Married filing jointly

- Married filing separately

- Head of a household

For example, if your taxable income is at least $65,200 but less than $65,250 and you are married filing jointly, your tax is $8,994.

**Scenario:**

Alexis and Ashley, who are married and file taxes jointly, have a combined taxable income of $65,230. Each week, $198 is withheld from their paychecks. Using the table, determine what Alexis and Ashley might expect at tax time.

**Question:**

Based on the information given:

- They will receive a refund of $1,302

- They will receive a refund of $8,994

- They will owe an additional $1,302

**Note:** The correct answer can be determined using the tax table and calculating their total withheld amount for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $320,000. Do not round Intermediate calculation. a. What is their federal tax liability? Round your answer to the nearest dollar. $ b. What is their marginal tax rate? Round your answer to the nearest whole number. % c. What is their average tax rate? Round your answer to two decimal places. %arrow_forward6. A married couple are calculating their federal income tax using the tax rate tables: Then Estimated Taxes Are If Taxpayer's Income Is Between So $16,700 $67,900 $137,050 $208,850 $372,950 But Not Over $16,700 $67,900 $137,050 $208,850 $372,950 Base TaxRate $0 10% $1,670.00 15% $9,350.00 25% $26,637.50 28% $46,741.50 33% $100,894.50 35% S0 $16,700 $67,900 $137,050 $208,850 $372,950 How much tax will they have to pay on their taxable income of $202,000? (4arrow_forward1. Daniel Simmons arrived at the following tax information: Gross salary, Page 121 Standard deduction, $12,400 Interest earnings, $75 $62,250 Dividend income, Adjustments to $140 income, $850 What amount would Daniel report as taxable income? (LO3.2)arrow_forward

- Use the chart below to answer the question: Married Filing Jointly and Widow(er) Tax Rate Single Married Filing Separately Head of Household 10% $1 - $9075 $1 - $18,150 $1 - $9075 $1 - $12,950 15% S9076 - $36,900 $18,151 - $73,800 $9076 - $36.900 $12,951 - $49,400 25% $36,901 - $89,350 S73,801 - $148.850 $36,901 - $74,425 $49,401 - $127,550 28% S89,351 - $186,350 $148,851 - $226.850 $74,426 - $113,425 $127,551 - $206,600 33% $186,351 - $405,100 $226,851 - $405,100 $113,426 - $202,500 $206,601 - $405,100 35% $405,101 - $406,750 $405,101 - $457,600 $202,551 - $228,800 $405,101 - $432,200 39.6% over $406,750 over $457,600 over $228,800 over $432,200 Calculate the tax a person who files head of household would pay if their salary was $321,854. Round to the nearest penny.arrow_forwardTax Drill - Social Security Benefits Determine the taxable amount of social security benefits for the following situations. If an amount is zero, enter "0". a. Erwin and Eleanor are married and file a joint tax return. They have adjusted gross income of $36,000, no tax-exempt interest, and $12,400 of Social Security benefits. As a result, s 0X of the Social Security benefits are taxable. b. Assume Erwin and Eleanor have adjusted gross income of $12,000, no tax-exempt interest, and $16,000 of Social Security benefits. As a result, s O✓ of the Social Security benefits are taxable. c. Assume Erwin and Eleanor have adjusted gross income of $85,000, no tax-exempt interest, and $15,000 of Social Security benefits. As a result, s 0X of the Social Security benefits are taxable.arrow_forwardMatharrow_forward

- Question 13: Louisa is an employee of Maroon Corp. Louisa files as Married Filing Jointly on her tax return. Over what amount will Maroon Corp. begin to withhold the additional Medicare tax from her earnings? Answer: A. SO В. O $125.000 C. O $200,000 D. $250,000arrow_forwardThe Tax Formula for Individuals, Filing Status and Tax Computation, The Standard Deduction (LO 1.3, 1.5, 1.8) Alicia, age 27, is a single, full-time college student. She earns $13,200 from a part-time job and has taxable interest income of $1,450. Her itemized deductions are $845. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, filing separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 Calculate Alicia's taxable income for 2020. $fill in the blank 1arrow_forward| Problem 1-16 Filing Status and Tax Computation, Qualifying Dependents (LO 1.5, 1.6) For each of the following taxpayers, indicate the filing status for the taxpayer(s) for 2022 using the following legend: A - Single B - Married filing a joint return C - Married filing separate returns Case a. b. C. d. e. D - Head of household E - Surviving spouse [qualifying widow(er)] Linda is single and she supports her mother (who has no income), including paying all the costs of her housing in an apartment across town. Frank is single and claims his unrelated significant other as a qualifying relative as the significant other lives in the home Frank pays for and the significant other has no income. Arthur is single and he supports his 30-year-old brother, who lives in his own home. Leslie's spouse died in 2022. She has no dependents and did not remarry. Lester's spouse died in 2021. He has one 17-year-old dependent child that lives with him in the home Lester pays for. Filing Statusarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education