FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

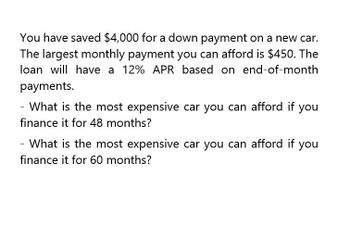

Transcribed Image Text:You have saved $4,000 for a down payment on a new car.

The largest monthly payment you can afford is $450. The

loan will have a 12% APR based on end-of-month

payments.

- What is the most expensive car you can afford if you

finance it for 48 months?

- What is the most expensive car you can afford if you

finance it for 60 months?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You have decided to purchase a new car that costs $44,500. You need to make a 20% down payment, then you will finance the rest with a loan. Your bank will extend you a car loan where the APR is 4.32% and you will make monthly payments over five years. What is the monthly payment on the vehicle? O $593.33 O $660.78 O $512.79 O $825.98arrow_forwardYou have saved $4,000 for a down payment on a new car. The largest monthly payment you can afford is $350. The loan will have a 6% APR based on end-of-month payments. What is the most expensive car you can afford if you finance it for 48 months? For 60 months? Do not round intermediate calculations. Round your answers to the nearest centarrow_forwardYou have saved $4,000 for a down payment on a new car. Thelargest monthly payment you can afford is $350. The loan will have a 12% APR based on end-of-month payments. What is the most expensive car you can afford if you finance it for 48 months? For 60 months?arrow_forward

- General Accountingarrow_forwardSolve this accounting questionarrow_forwardYou have saved $3,000 for a down payment on a new car. The largest monthly payment you can afford is $350. The loan will have a 15% APR based on end-of-month payments. What is the most expensive car you can afford if you finance it for 48 months? Do not round intermediate calculations. Round your answers to the nearest cent. $arrow_forward

- Now it's time for you to practice what you've learned. Suppose you have saved $3,500 for a down payment on a new car. The largest monthly payment you can afford is $375. The loan will have a 24% APR based on end-of-month payments. Use a financial calculator to determine the most expensive car you can afford if you finance it for 48 months versus 60 months. Months Financed Maximum Car Price 48 60 If you finance the car for a shorter period of time, you can afford a more expensive car. True Falsearrow_forwardYou are looking to buy a car and can afford to pay $195 per month. If the interest rate on a car loan is 0.74% per month for a 60-month loan, what is the most expensive car you can afford to buy? The amount that you can afford is $________________ (Round to the nearest dollar.)arrow_forwardYou can afford monthly payments of $400 per month. If you are financing a car at 10% APR and 60 months, how much car can you afford?arrow_forward

- You have saved $5,000 for a down payment on a new car. The largest monthly payment you can afford is $500. The loan will have a 6% APR based on end-of-month payments. What is the most expensive car you can afford if you finance it for 48 months? For 60 months? Do not round intermediate calculations. Round your answers to the nearest cent. Financed for 48 months: $ Financed for 60 months: $arrow_forwardSuppose you can afford to pay $ 250 a month for 8 years towards a new car with no down payment. If the current interest rates are 4.75%, how expensive a car can you afford? Car sticker price =arrow_forwardYou are looking to buy a car. You can afford $460 in monthly payments for four years. In addition to the loan, you can make a $1100 down payment. If interest rates are 7.25 percent APR, what price of car can you affordarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education