SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Provide correct answer the accounting question

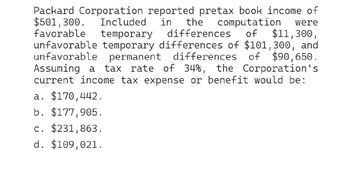

Transcribed Image Text:Packard Corporation reported pretax book income of

$501,300. Included in the computation were

favorable temporary differences of $11,300,

unfavorable temporary differences of $101,300, and

unfavorable permanent differences of $90,650.

Assuming a tax rate of 34%, the Corporation's

current income tax expense or benefit would be:

a. $170,442.

b. $177,905.

c. $231,863.

d. $109,021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Packard Corporation reported pretax book income of $501,100. Included in the computation were favorable temporary differences of $11,100, unfavorable temporary differences of $101,100, and unfavorable permanent differences of $90,550. Assuming a tax rate of 34%, the Corporation's current income tax expense or benefit would be: a. $231,761 b. $177,735 c. $170,374 d. $108,987arrow_forward1.Kumara Corporation reported pretax book income of $1,200,000. Kumara also reports an increase in the taxable temporary differences of $176,000, an increase in the deductible temporary differences of $171,000, and favorable permanent differences of $176,000. Assuming a tax rate of 21 percent, compute the company's deferred income tax expense or benefit. what is the deferred income expensearrow_forwardHello answer mearrow_forward

- Woodward Corporation reported pretax book income of $1,335,000. Included in the computation were favorable temporary differences of $355,000, unfavorable temporary differences of $98,250, and favorable permanent differences of $158,000. Compute the company’s current income tax expense or benefit. In picture- what is the tax rate and current income tax expense?arrow_forwardWoodward Corporation reported pretax book income of $1,132,500. Included in the computation were favorable temporary differences of $302,500, unfavorable temporary differences of $108,750, and favorable permanent differences of $180,000. Compute the company’s current income tax expense or benefit. Pretax book income Favorable temporary differences Unfavorable temporary differences Favorable permanent differences Taxable incomeTax rate%arrow_forwardAnn Corporation reported pretax book income of $1,190,000. Included in the computation were favorable temporary differences of $140,000, unfavorable temporary differences of $234,000, and favorable permanent differences of $138,000. Compute the company's book equivalent of taxable income. Use this number to compute the company's total income tax provision or benefit. Book equivalent of taxable income Total income tax provision or benefitarrow_forward

- A- 9arrow_forwardprovide account answerarrow_forwardRimas Corporation reported pretax book income of $1,360,000. Included in the computation were favorable temporary differences of $220,000, unfavorable temporary differences of $290,000, and favorable permanent differences of $146,000. Compute the company's book equivalent of taxable income. Use this number to compute the company's total income tax provision or benefit Book equivalent of taxable income Total income tax provision or benefitarrow_forward

- What is stellar enterprises current income tax expense or benefit on these financial accounting question?arrow_forwardShaw Corp reported pretax book income of $1,000,000. Included in the computation were favorable temporary differences of $200,000, unfavorable temporary differences of $50,000, and favorable permanent differences of $100,000. Assuming a tax rate of 21 percent, compute the company’s deferred income tax expense or benefit.arrow_forwardDo fast answer and step by step calculation for the questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT