Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

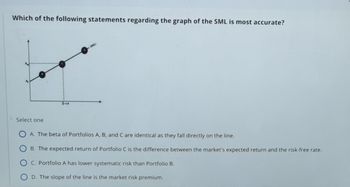

Transcribed Image Text:Which of the following statements regarding the graph of the SML is most accurate?

A Select one

OA. The beta of Portfolios A, B, and C are identical as they fall directly on the line.

B. The expected return of Portfolio C is the difference between the market's expected return and the risk-free rate.

C. Portfolio A has lower systematic risk than Portfolio B.

D. The slope of the line is the market risk premium.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio X Y Z Market Risk-free Rp 14.0% 13.0 .8.5 12.0 7.2 Ор 39.00% 34.00 24.00 29.00 0 Bp 1.50 1.15 0.90 1.00 0 Assume that the correlation of returns on Portfolio Y to returns on the market is 0.90. What percentage of Portfolio Y's return is driven by the market? Note: Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places. R-squaredarrow_forwardYou are given the following information concerning three portfolios, the market portfolio, and the risk- free asset: Portfolio X Y Z Market Risk-free Rp 14.5% R-squared 13.5 9.1 10.7 5.4 op 36% 31 21 26 0 6p 1.60 1.30 .80 1.00 0 Assume that the correlation of returns on Portfolio Y to returns on the market is 72. What percentage of Portfolio Y's return is driven by the market? (Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places.)arrow_forward(Singular) Suppose there are two stocks that are uncorrelated. Each of these has variance of 1, and there are expected returns are 7₁ and 72, respectively. The risk-free rate is rf. Find the portfolio of weights w₁ and w2 for the Markowitz (market) portfolio. Show that for some value of rf there is no Markowitz portfolio.arrow_forward

- The slope of the security market line is the: Group of answer choices reward-to-risk ratio portfolio weight beta coefficient risk-free interest rate market risk premiumarrow_forwardBaghibenarrow_forwardFor a market timer, the ________ will be higher when the market risk premium is higher Select one: a. portfolio’s idiosyncratic risk b. portfolio’s standard deviation c. portfolio’s beta d. security selection component of the portfolio e. portfolio’s alphaarrow_forward

- Consider the following linear regression model: (R₁-r)= a; + b(RMkt - rf) + e; The b; in the regression: O measures the deviation from the best fitting line and is zero on aver- measures the sensitivity of the security to market risk. measures the diversifiable risk in returns.arrow_forwardBaghibenarrow_forwardThe beta of a portfolio is: A. A measure of the correlation of betas of the securities in the portfolio. B. Always greater than one. C. The market value weighted average beta of the securities in the portfolio. D. The geometric average of the beta of the securities in the portfolio.arrow_forward

- Baghibenarrow_forwardThe CAPM states that the expected (required) return on an asset is : E(Ri)=Rf+βi[E(RM)−Rf] where the term in square brackets is the risk-premium earned by the market portfolio. Therefore, the beta of the market portfolio (βM) must be equal to __________ . A) zero B) 0.5 C) 1.0 D) an unknown estimatearrow_forwardFind the weights of the two pure factor portfolios constructed from the following three securities: r1 = .06 + 2F¡ + 2F, r2 = .05 + 3F, + IF, r3 = .04 + 3F, + OF, Then write out the factor equations for the two pure factor portfolios, and determine their risk premiums. Assume a risk-free rate that is implied by the factor equations and no arbitrage.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education