Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

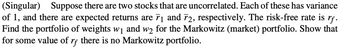

Transcribed Image Text:(Singular) Suppose there are two stocks that are uncorrelated. Each of these has variance

of 1, and there are expected returns are 7₁ and 72, respectively. The risk-free rate is rf.

Find the portfolio of weights w₁ and w2 for the Markowitz (market) portfolio. Show that

for some value of rf there is no Markowitz portfolio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Evaluate this statement: For any two-stock portfolio, a correlation coefficient of -1.0 guarantees a portfolio risk of zero.arrow_forwardSuppose the utility function is U = E(r) - 0.5Ao2. Draw the indifference curve corresponding to a utility level of 0.2 for an investor with a risk aversion coefficient of 3. Please note the vertical line indicates expected return, and plot standard deviation on the horizontal line.arrow_forward2. Suppose that you have a riskfree asset and N risky assets for investment. The rate of return on the riskfree asset is r,, while the (Nx1) vector of the rate of return on the N risky assets is r, which is multivariate normal, i.e., r N(u, E). Your utility function for a portfolio that consists of the riskfree asset and the N risky asset is u(r,)=r,-=o, 2 Suppose that the sum of investment proportions on the riskfree and risky assets is one. Answer the following question. A. What is your optimal investment proportion in the risky assets? How is your investment on the riskfree asset affected by different values of 2? B. Suppose that there is only one risky asset i. Show the effects of the Sharpe ratio (4,/0, ) on the investment proportion in the risky asset.arrow_forward

- Suppose you have an investment portfolio with fraction x invested in a market portfolio and (1-x) in a risk- free asset. Increasing fraction x invested in the market portfolio and consequently decreasing (1-x) invested in the risk-free asset shall (select any correct answer, if there are multiple correct answers) Select one or more: O decrease the Sharpe ratio of the resulting portfolio O decrease the expected return of the resulting portfolio increase the Sharpe ratio of the resulting portfolio increase the expected return of the resulting portfolio Dincrease the risk of the resulting portfolioarrow_forwardchoose which one ? 3.Assume CAPM holds. What is the correlation between an efficient portfolio and the market portfolio?a.1b.-1c.0d.Not enough informationarrow_forwardConsider the following single factor specification: R₁ = a¡ + ßi, Rµ + €i. Where R; is the return on security i, RM is the return on index M (a broad market index) and e, is a zero- mean white noise random variable not correlated with anything. Assume that the single factor specification above correctly describes the return generating processes of all securities. Furthermore, you have the following descriptive statistics for returns of well-diversified Portfolios X, Y, and index M. Portfolio X Portfolio Y Index M Risk-Free Expected return 14% 17% ?? ?? B₁ 1.2 1.6 1 0 a. Assume that the corresponding single factor APT correctly prices Portfolios X and Y. In other words, the expected returns of Portfolios X and Y shown above - 14% and 17% respectively - are equal to their APT-predicted expected returns. Calculate the expected return of Index M and risk-free rate. b. Another well-diversified portfolio Z has a beta, ßz, of 0.8 while its expected return is 10%. Form a portfolio consisting…arrow_forward

- Use the following table to answer the questions a-c below. Risky Portfolio Expected return on risky portfolio Standard Risk-free Sharpe-ratio deviation of risky | return portfolio 3 1 8 3 2 10 4 3 3 12 4.9 3 4 14 6 3 a. Calculate the Sharpe ratio for each portfolio b. Identify the optimal portfolio from the above 4arrow_forwardA3arrow_forwardThe CAPM states that the expected (required) return on an asset is : E(Ri)=Rf+βi[E(RM)−Rf] where the term in square brackets is the risk-premium earned by the market portfolio. Therefore, the beta of the market portfolio (βM) must be equal to __________ . A) zero B) 0.5 C) 1.0 D) an unknown estimatearrow_forward

- Portfolio theory with two assets E(R1)=0.15 E(01)= 0.10 W1=0.5 E(R2)=0.20 E(02) = 0.20 W2=0.5 Calculate the expected return and the standard deviation of the two portfolios if r1,2 = 0.4 and -0.60 respectively.arrow_forward9. Suppose you plan to form your overall investment portfolio in two steps: STEP 1: Choose a portfolio of stocks with a zero position in the risk-free asset. STEP 2: Allocate your money between the portfolio from Step 1 and the risk-free asset. Suppose you can borrow and lend as much as you want at the risk-free rate in Step 2. Let Erp be the expected return of the Step 1 portfolio. Let Var(rp) be the variance of the return of the Step 1 portfolio. Let rf be the risk-free rate. How will you form the Step 1 Portfolio? Set the Step 1 portfolio to maximize Erp SettheStep1portfoliotominimizeVar(rp) Set the Step 1 portfolio to maximize Erp - Var(rp) Set the Step 1 portfolio to maximize the ratio Erp/Var(rp) Set the Step 1 portfolio to maximize the ratio (Erp- rf)/Var(rp) None of the above.arrow_forwardWhich ones of the following statements about portfolio beta are correct? O 1. If portfolio beta is between 0 and 1, then the portfolio expected return is between risk-free rate and the market expected return. O 2. If the return of an asset has zero correlation with the market portfolio returns, the beta of this asset must be zero. O 3. A portfolio that has the same portfolio weights as the market portfolio should have a beta of 1. O 4. Diversification is not a way to reduce portfolio beta. O 5. If two portfolios have the same portfolio weights, but different dollar values, their betas are the same.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education