Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Need Answer. Subject:- general account

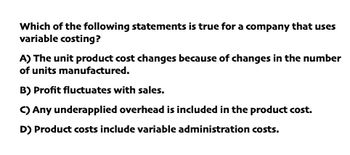

Transcribed Image Text:Which of the following statements is true for a company that uses

variable costing?

A) The unit product cost changes because of changes in the number

of units manufactured.

B) Profit fluctuates with sales.

C) Any underapplied overhead is included in the product cost.

D) Product costs include variable administration costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For which cost concept used in applying (he cost-plus, approach to product pricing are fixed manufacturing costs, fixed selling and administrative expenses, and desired profit allowed for in determining the markup? A. Total cost B. Product cost C. Variable cost D. Standard costarrow_forwardProduct costs under variable costing are typically: A. higher than under absorption costing B. lower than under absorption costing C. the same as with absorption costing D. higher than absorption costing when inventory increasesarrow_forwardThe contribution margin is the a. amount by which sales exceed total fixed cost. b. difference between sales and total cost. c. difference between sales and operating income. d. difference between sales and total variable cost. e. difference between variable cost and fixed cost.arrow_forward

- Which of the following statements is true for a company that uses variable costing? Profit fluctuates with sales. Product costs include variable administration costs. Any underapplied overhead is included in the product cost. The unit product cost changes because of changes in the number of units manufactured.arrow_forwardWhich of the following statements is true for a firm that uses variable costing? A. The cost of a unit of product changes because of changes in number of units manufactured.B. Profits fluctuate with sales.C. An idle facility variation is calculated.D. Product costs include variable administrative costs.arrow_forwardOn an income statement prepared using variable costing, to calculate contribution margin, a company will subtract what from sales? Question options: a) variable manufacturing costs. b) variable manufacturing and operating costs. c) variable cost of goods sold. d) cost of goods sold.arrow_forward

- Which of the following is NOT true of variable costing? a. Profits may increase though sales decrease. b. Profits fluctuate with sales. c. The cost of the product consists of all variable production costs. d. The income statement under variable costing does not include overhead volume variance.arrow_forwardOn the variable costing income statement, the figure representing the difference between manufacturing margin and contribution margin is the: Fixed selling and administrative expenses. Fixed manufacturing costs. Variable selling and administrative expenses. Variable cost of goods sold.arrow_forwardWhich of the following is not a true statement about variable costs? a. Total cost is known to change in proportion to any changes in related level of volume or activity. O b. When considering total cost behaviour, focus on fixed and variable costs. O c. A total cost that can change in proportion to changes in the number of products produced. O d. Total cost never changes in proportion to any changes in related levels of volume or activity. O e. An important cost to identify so managers can make important management decisions.arrow_forward

- The production manager wants to achieve real and permanently decrease in the unit cost of the product. As you are the cost accountant of the company, which of the following concepts explains about real and permeant decrease in the unit cost of the product? a. Cost estimation b. Cost analysis c. Cost control d. Cost reductioarrow_forwardTRUE OR FALSE Net income under variable costing is closely tied to changes in sales levels.arrow_forwardWhat is the key difference between Absorption Costing and Marginal Costing? A Absorption Costing treats Manufacturing Overhead as a period cost. B Marginal Costing treats Fixed Manufacturing Overhead as a period cost. C Absorption Costing only considers variable costs to calculate net income. D Marginal Costing only considers variable costs to calculate net income.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College