Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Don't use ai please help me Accounting question

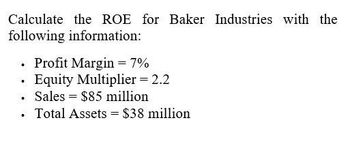

Transcribed Image Text:Calculate the ROE for Baker Industries with the

following information:

. Profit Margin = 7%

Equity Multiplier = 2.2

Sales $85 million

• Total Assets = $38 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Here’s some info for a company: Total assets = $50,000 Total liabilities = $30,000,000 Coverage ratio = 4.0 Profit margin = 10% Sales = $50,000,000 What is the company’s return on equity? Answer as percentage.arrow_forwardWhat is the profit margin ?arrow_forwardFind out the financial leverage from the following data:Net Worth Rs. 25,00,000Debt / Equity 3:1Interest rate 12%Operating Profit Rs. 20,00,000arrow_forward

- You are given the following information on Kaleb's Heavy Equipment: Profit margin Capital intensity ratio 6.8% 77 Debt-equity ratio Net income .9 $84,000 $ 16,600 Dividends Calculate the sustainable growth rate. Sustainable growth rate %arrow_forwardAssume that a firm has sales of $11,700,000, total assets of $4,500,000, total common equity of $1,500,000, and an ROE of 37.4985 percent. Given this information, and using the DuPont equation, determine the profit margin for this firm. 4.81% O 6.02% O 6.41% Ⓒ 5.24% Ⓒ 5.63%arrow_forwardIf Roten Rooters, Inc., has an equity multiplier of 1.32, total asset turnover of 1.32, and a profit margin of 6.50 percent. What is its ROE? Multiple Choice -2.75% 10.19% 11.33% 12.46% 10.87%arrow_forward

- Please help me with show all calculation thankuarrow_forwardBased on the following information, calculate the sustainable growth rate for Kaleb's Heavy Equipment: Profit margin Capital intensity ratio Debt-equity ratio Net income Dividends 8.1% .51 .67 $ 29,000 $19,720arrow_forwardAssume that a firm has sales of $11,700,000, total assets of $4,500,000 total common equity of $2,000,000 and an ROE of 37.4985 percent. Using DuPont equation, determine the profit margin for this firm.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning