Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Hy expert provide correct answer

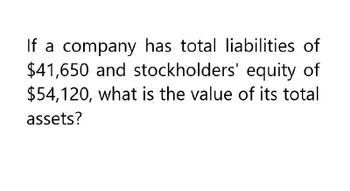

Transcribed Image Text:If a company has total liabilities of

$41,650 and stockholders' equity of

$54,120, what is the value of its total

assets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You find the following financial information about a company: net working capital = $7, 809; total assets $11,942; and long-term debt Multiple Choice $9, 115 $4, 507 $10, 339 $6, 129 $4, 133 = = = $1, 287; fixed assets $4,589. What is the company's total equity?arrow_forwardIf Mitchell Company has Assets of $5,000,000, Liabilities of $3,000,000, and Retained Earnings of $1,200,000, how much is total Stockholders' Equity?arrow_forwardSuppose a company has debt of $71 million and a debt to total assets ratio of 0.1. This means that the company's debt-equity ratio is _____arrow_forward

- The assets and liabilities of a company are $85,696 and $44,373, respectively. Stockholders' equity should equal whatarrow_forwardA firm has total assets of $638,727, current assets of $203,015, current liabilities of $122,008, and total debt of $348,092. What is the debt-equity ratio? Can you provide the forumla?arrow_forwardA company's balance sheet has the following account values: current assets $625; current liabilities $550; fixed assets $1,580; and long-term debt $700. What is the value of equity? 330 1655 1505 955 625arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub