Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need help with this question solution general accounting

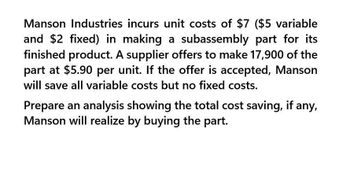

Transcribed Image Text:Manson Industries incurs unit costs of $7 ($5 variable

and $2 fixed) in making a subassembly part for its

finished product. A supplier offers to make 17,900 of the

part at $5.90 per unit. If the offer is accepted, Manson

will save all variable costs but no fixed costs.

Prepare an analysis showing the total cost saving, if any,

Manson will realize by buying the part.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Skip Consulting helped Schmidt Roofers put various cost saving techniques into place. Thecontract specifies that Skip will receive a flat fee of $70,000 and an additional $19,000 if Schmidtattains a target amount of cost savings. Skip estimates a 20% chance that Schmidt will reach thetarget for cost savings. Assuming that Skip uses the expected-value approach, what is thetransaction price for this product?a. $19,000b. $70,000c. $73,800d. $89,000arrow_forwardSaran Company has contacted Truckel with an offer to sell it 5,000 of the wickets for $18 each. If Truckel makes the wickets, variable costs are $16 per unit. Fixed costs are $8 per unit; however, $5 per unit is unavoidable. Should Truckel make or buy the wickets? a. Buy; savings = $15,000 b. Buy; savings = $5,000 c. Make; savings = $10,000 d. Make; savings = $5,000arrow_forwardViking Corporation’s variable cost per unit produced is $100. Wholesaler Y offers to buy 2,000 additional units at $120 each. Wholesaler Z proposes to buy 1,500 additional units at $140 per unit. Viking has enough excess capacity to produce one but not both of the orders. Fixed costs are not affected by accepting either offer. Required: Which offer should Viking accept and why?arrow_forward

- Yes Co. has the option to either further process product Y to produce Product Z. The selling price of product Y is $30 per unit and it costs $28 to produce each unit of product Y. Product Z would be sold for $55 and would require an additional $31 cost for production. What is the differential cost to produce product Z? a. $3 per unit b. $28 per unit c. $31 per unit d. $25 per unitarrow_forwardCharleston Affair currently makes the King Component, incurring variable costs of $18 per unit and fixed costs of $4 per unit. The company has the option to purchase the component for $20 per unit. Prepare a differential analysis to determine if the company should make (Alternative 1) or buy (Alternative 2) the King Component. Assume that the fixed costs will be incurred in each situation up to 40,000 units. Determine at what want point of sales does it make sense to produce rather than buy)arrow_forwardValue Electronics uses a standard part in the manufacture of different types of radios. The total cost of producing 32,000 parts is $90,000, which includes fixed costs of $30,000 and variable costs of $60,000. The company can buy this part from an external supplier for $5 per unit and avoid 10% of the fixed costs. If Value Electronics decides to outsource the production of the part, how will it impact its operating income? A. Operating income increases by $97,000. B. Operating income decreases by $100,000. C. Operating income decreases by $97,000. D. Operating income increases by $100,000.arrow_forward

- 1. McIntosh Enterprises produces giant stuffed bears. Each bear consists of $12 of variable costs, $9 of fixed costs, and sells for $45. A wholesaler offers to buy 8,000 units at $14 each of which McIntosh has the capacity to produce. McIntosh will incur extra shipping costs of $1.25 per bear. Instructions Determine the incremental income or loss that McIntosh Enterprises would realize by accepting the special order.arrow_forwardAssume that HASF furniture Inc., as described, currently purchases the chair cushions for its lawn set from an outside vendor for $30 per set. Modern Furniture’s chief operations officer wants an analysis of the comparative costs of manufacturing these cushions to determine whether bringing the manufacturing in-house would save the firm money. Additional information shows that if Modern furniture’s were to manufacture the cushions, the materials cost would be $16 and the labor cost would be $10 per set and that it would have to purchase cutting and sewing equipment, which would add $25,000 to annual fixed costs. Required Computation for 10,000 units What amount should have been inccrued if company produce 10,000 units What amount should have been inccrued if company purhcase 10,000 units from outside What amount company save if company make 10,000 cushionsarrow_forwardMarikina Shoe Manufacturing Company will produce a special-style shoe if the order size is large enough to provide a reasonable profit. For each special -style order, the company incurs a fixed cost of P20,000 for the production set up. The variable cost is P600 per pair, and each pair sells for P800. a. Let x indicate the number of pairs of shoes produced. Develop a mathematical model for total cost of producing x paiars of shoes. b. Let P indicate the total profit. Develop a mathematical model for the total profit realized from an order for x pairs of shoes. c. How large must the order be for Marikina to breakeven?arrow_forward

- Answer the following questions. Required 1. Deibler Computers makes 5,600 units of a circuit board, CB76, at a cost of $210 each. Variable cost per unit is $150, and fixed cost per unit is $60. HT Electronics offers to supply 5,600 units of CB76 for $185. If Deibler buys from HT, it will be able to save $25 per unit of fixed costs but continue to incur the remaining $35 per unit. Should Deibler accept HT's offer? Explain. 2. QT Manufacturing is deciding whether to keep or replace an old machine. It obtains the following information: (Click the icon to view the information.) QT Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should QT replace the old machine? Explain. A Requirement 1. Deibler Computers makes 5,600 units of a circuit board, CB76, at a cost of $210 each. Variable cost per unit is $150, and fixed cost per unit is $60. HT Electronics offers to supply 5,600 units of CB76 for $185. If Deibler buys from HT, it will be able to…arrow_forwardWinter Sports manufactures snowboards. Its cost of making 1,700 bindings is as follows: (Click the icon to view the costs.) Suppose Livingston will sell bindings to Winter Sports for $14 each. Winter Sports would pay $1 per unit to transport the bindings to its manufacturing plant, where it would add its own logo at a cost of $0.40 per binding. Read the requirements. Requirement 1. Winter Sports' accountants predict that purchasing the bindings from Livingston will enable the company to avoid $2,200 of fixed overhead. Prepare an analysis to show whether Winter Sports should make or buy the bindings. (Only enter the net relevant costs. For the Difference column, use a minus sign or parentheses only when the cost of outsourcing exceeds the cost of making the bindings in-house.) Make Bindings Outsource Bindings Difference (Make-Outsource) - X Binding costs Data table Variable costs: $ 49 Direct materials Direct labor Variable overhead Fixed costs Durahan minn fram manten ? 7 Q A 2 W S 43…arrow_forwardSprite company must decide on a make or buy decision. A supplier has offered to make the product at the same quality. Fixed marketing costs would be unaffected but variable marketing costs would be reduced by 30%. What is the maximum amount per unit that Sprite can pay the supplier without decreasing its operating income? P6.75 P9.75 P5.75 P5.05arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning