FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

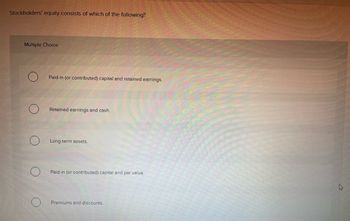

Transcribed Image Text:Stockholders' equity consists of which of the following?

Multiple Choice

Paid-in (or contributed) capital and retained earnings.

Retained earnings and cash.

Long-term assets.

Paid-in (or contributed) capital and par value.

Premiums and discounts.

k

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 13. For available-for-sale equity securities, receipt of a cash dividend would be reported as a. a reduction from retained earningsb. an increase in the investments available for sale accountc. a reduction in the investments available for sale accountd. dividend revenuearrow_forwardTreasury Stock is a(n) * contra asset account. O retained earnings account. asset account. contra stockholders' equity account.arrow_forwardFor fi nancial assets classifi ed as held to maturity, how are unrealized gains and losses refl ected in shareholders’ equity?B . Th ey fl ow through retained earnings.arrow_forward

- The category of equity that tracks the events relating to stockholder transactions is known as: Group of answer choices Retained Earnings Treasury Stock Paid-In Capital Awesome Categoryarrow_forwardDescribe retained earnings and distinguish it from paid-in capital.arrow_forward4. Define the following terms. Signaling hypothesis; clientele effect Residual distribution model; extra dividend Declaration date; holder-of-record date; ex-dividend date; payment date Dividend reinvestment plan (DRIP) Stock split; stock dividend; stock repurchasearrow_forward

- ASSETS LIABILITIES AND CAPITALa. Current assets b. Investments c. Plant and equipment d. Intangiblese. Other assets f. Current liabilities g. Long-term liabilitiesh. Preferred stock i. Common stock j. Additional paid-in capitalk. Retained earningsl. Items excluded from balance sheetUsing the letters above, classify the following accounts according to the preferred and ordinary balance sheet presentation. _____ 1. Bond sinking fund_____ 2. Common stock distributable_____ 3. Appropriation for plant expansion_____ 4. Bank overdraft_____ 5. Bonds payable (due 2010)_____ 6. Premium on common stock_____ 7. Securities owned by another company which are collateral for that company's note_____ 8. Trading securities_____ 9. Inventory_____ 10. Unamortized discount on bonds payable_____ 11. Patents_____ 12. Unearned revenuearrow_forwardWhich of the following is the definition of return on common equity?A. Net income / Average common equityB. Operating income / Average common equityC. Comprehensive income / Average common equityD. None of the abovearrow_forwardThe two main categories of stockholders’ equity area. assets and liabilities.b. retained earnings and common stock.c. common stock and preferred stock.d. retained earnings and paid-in capitalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education