FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

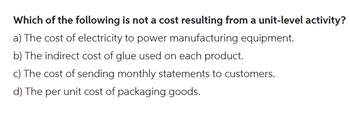

Transcribed Image Text:Which of the following is not a cost resulting from a unit-level activity?

a) The cost of electricity to power manufacturing equipment.

b) The indirect cost of glue used on each product.

c) The cost of sending monthly statements to customers.

d) The per unit cost of packaging goods.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is an example of direct labor cost for a cell phone manufacturer? Oa. cost of oil lubricants for factory machinery Ob. salary of plant supervisor Oc. cost of wages of assembly worker Od. cost of phone componentsarrow_forwardA manufacturer reports three activities: assembling components into products; product design; and sales order processing. Determine whether each of the following cost drivers relates to assembly, design, or order processing. Cost Driver 1. Direct labor hours to assemble components 2. Number of design changes 3. Number of components assembled 4. Number of design hours 5. Number of shipments made 6. Number of sales orders processed Activityarrow_forwarda. Road Warrior Motor is a company that manufactures and sells cars. Indicate whether each of the following should be considered a product cost or a period cost for the company. If you identify the item as a product cost, also indicate whether it is a direct material cost, direct labor cost, or overhead cost. Write “1” under the correct answer. For example, the answer to item 0 is “product cost” and “overhead cost.” 0. Property taxes on factory building. 1. Cost of buying the metal needed to manufacture cars. 2. Depreciation on the furniture used in the sales showroom. 3. Cost of electricity used in the factories. 4. Salaries of factory workers who manufacture cars. 5. Salaries of factory security guards. 6. Salaries of office workers in the financial department. 7. Depreciation on the warehouse used to store raw materials. 8. Income taxes paid to the government. b. The company manufactured 100 cars in January 2023 and has not sold any of them by the end of January. If the company…arrow_forward

- Identify the following as fixed costs (F), variable costs (V), or mixed costs(M). insurance on factory building advertising expensearrow_forwardClassify each of the following costs as Product (direct/indirect) or Period and Variable, Fixed or Mixed. Costs Raw materials Staples used to secure packed boxes of product Plant janitors' wages Order processing clerks' wages Advertising expenses Production workers' wages Production supervisors' salaries Sales force commissions Maintenance supplies used President's salary Electricity cost for office building Real estate taxes for Factory Real estate taxes for Office building Product-direct Product-indirect Period Period Variable Fixed Variable Fixedarrow_forwardWhat types of costs are customarily included in the cost of manufactured products under (a) the absorption costing concept and (b) the variable costing concept? Which of the following costs would be included in the cost of a manufactured product according to the variable costing concept: (a) rent on factory building, (b) direct materials, (c) property taxes on factory building, (d) electricity purchased to operate factory equipment, (e) salary of factory supervisor, (f) depreciation on factory building, (g) direct labor? Marley Company has the following information for March: Sales $912,000 Variable cost of goods sold 474,000 Fixed manufacturing costs 82,000 Variable selling and administrative expenses 238,100 Fixed selling and administrative expenses 54,700 Determine (a) the manufacturing margin, (b) the contribution margin, and (c) operating income for Marley Company for the month of March.arrow_forward

- Indicate whether each cost is: A. Fixed or Variable b. Selling, General/Administrative, or Manufacturingarrow_forwardUse the information to prepare a schedule of cost of goods manufactured and an income statement. Assume no indirect materials are used and all amounts are shown in millions.arrow_forwardWhich of the following is an example of a variable cost? a.Insurance on the production equipment b.Direct materials c.The production supervisor's salary d.Depreciation of the factory building e.None of thesearrow_forward

- Use the information to prepare a schedule of cost of goods manufactured and an income statement. Assume no indirect materials are used and all amounts are shown in millions.arrow_forwardUnder variable costing, which of the following costs would not be included in finished goods inventory? a. electricity used by factory machinery b. steel costs for a machine tool manufacturer c. salary of factory supervisor d. wages of machine operatorarrow_forwardThe Dorilane Company produces a set of wood patio furniture consisting of a table and four chairs. The company has enough customer demand to justify producing its full capacity of 3,800 sets per year. Annual cost data at full capacity follow: Direct labor Advertising Factory supervision Property taxes, factory building Sales commissions Insurance, factory Depreciation, administrative office equipment Lease cost, factory equipment Indirect materials, factory Depreciation, factory building Administrative office supplies (billing) Administrative office salaries Direct materials used (wood, bolts, etc.) Utilities, factory $ 89,000 $ 103,000 $70,000 $ 23,000 $ 65,000 $ 6,000 $ 2,000 $ 17,000 $ 18,000 $ 106,000 $ 5,000 $ 111,000 $ 426,000 $ 46,000 Required: 1. Enter the dollar amount of each cost item under the appropriate headings. Note that each cost item is classified in two ways: first, as variable or fixed with respect to the number of units produced and sold; and second, as a selling…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education