FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

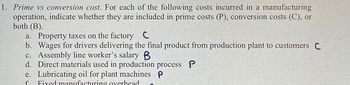

Transcribed Image Text:1. Prime vs conversion cost. For each of the following costs incurred in a manufacturing

operation, indicate whether they are included in prime costs (P), conversion costs (C), or

both (B).

a. Property taxes on the factory C

b. Wages for drivers delivering the final product from production plant to customers C

c. Assembly line worker's salary B

d. Direct materials used in production process P

e. Lubricating oil for plant machines P

f Fixed manufacturing overhead

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- which of the following is typically a mixed cost? a. Rent for a factory building b. Total Manufacturing Overhead c. Hourly wages of plant workers d. Straight-line depreciation of plant machinery e. Sales commissionsarrow_forwardClassify each of the following costs as either unit-level, batch-level, product-level, or facility-level. a. Engineering costs for a new product b. Order processing c. Depreciation on factory d. Direct labor e. Shipment of an order to a customer f. Product line manager salary g. Machine setup costs that are incurred whenever a new production order is started h. Patent for new product ore help Product-level Batch-level or Unit-level or Facility-level Facility-level Unit-level Unit-level Batch-level Batch-level or Facility-level Batch-level or Unit-level Batch-level or Unit-level or Facility-level Facility-level Facility-level or Product-level Facility-level or Unit-level Product-level Unit-level allarrow_forwardwhat will be the per unit cost?arrow_forward

- Classify each of the following costs as Product (direct/indirect) or Period and Variable, Fixed or Mixed. Costs Wages of assembly-line workers Depreciation of plant equipment Glue and nails for production Outbound delivery expense Raw materials handling costs Salary of marketing manager Production run setup costs Administrative office utilities Electricity cost of retail stores Research and development expense Product (Direct/Indirect) or Period Variable/Fixed/Miarrow_forwardSelect and “X” in the column that corresponds to the cost classification for each of the following scenarios. Some items may fit in more than one column.arrow_forwardIdentify the following as fixed costs (F), variable costs (V), or mixed costs(M). insurance on factory building advertising expensearrow_forward

- Required: Classify the following costs as period or traceable costs. Depreciation on office building Insurance expense for factory building Product liability insurance premium Transportation charges for raw materials Factory repairs and maintenance Rent for inventory warehouse Cost of raw materials Factory wages Salary to chief executive officer Depreciation on factory Bonus to factory workers Salary to marketing staff Administrative expenses Bad debt expense Advertising expense Research and development Warranty expense Electricity for plantarrow_forwardT or F Conversion cost per equivalent unit equals total conversion costs for the period divided by total equivalent units of conversion costs. T or F Product costs must be allocated to the units transferred out of thedepartment and the partially completed units on hand at the end of the period. T or F Ford is a process manufacturer.arrow_forwardFor each of the following costs, identify whether it is a Fixed, Variable or Both: Cost Wages of assembly-line workers Depreciation-office equipment Glue and fasteners Delivery costs Raw materials handling costs Salary of marketing manager Production run setup costs Plant utilities Electricity cost of manufacturing plant Research and development expenses Typearrow_forward

- Indicate whether each cost is: A. Fixed or Variable b. Selling, General/Administrative, or Manufacturingarrow_forward1. Property taxes on a manufacturing plant is an element of: a. Conversion cost b. Prime cost c. Period cost d. Fixed cost 2. Factory supplies for manufacturing plant are generally a. Prime cost b. Fixed cost c. Period cost d. Variable cost 3. Wages paid to timekeeper in a factory is a a. Prime cost b. Direct Material c. Conversion cost d. Direct laborarrow_forwardCost of Goods manufactured is equal to: A. Beginning W.I.P. + Manufacturing Cost less indirect cost applied – Ending W.I.P B. Beginning W.I.P. + Direct material used during current period + Direct Labour cost for current period + Manufacturing overhead applied for current period – Ending W.I.P C. Beginning W.I.P. less indirect manufacturing overhead + Direct material used during current period + Direct Labour cost for current period + Manufacturing overhead applied for current period – Ending W.I.P D. Beginning W.I.P. less period cost + Manufacturing Cost less indirect cost applied – Ending W.I.Parrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education