Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

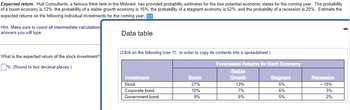

Transcribed Image Text:Expected return. Hull Consultants, a famous think tank in the Midwest, has provided probability estimates for the four potential economic states for the coming year. The probability

of a boom economy is 12%, the probability of a stable growth economy is 16%, the probability of a stagnant economy is 52%, and the probability of a recession is 20%. Estimate the

expected returns on the following individual investments for the coming year,

Hint: Make sure to round all intermediate calculations

answers you will type.

What is the expected return of the stock investment?

% (Round to two decimal places.)

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Investment

Stock

Corporate bond

Government bond

Boom

27%

10%

9%

Forecasted Returns for Each Economy

Stable

Growth

13%

7%

6%

Stagnant

6%

6%

5%

Recession

- 15%

3%

2%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is the expected return of the corporate bond investment?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is the expected return of the corporate bond investment?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What was the compound average annual return of a stock that earned -16.8%, -4.8%, 1%, and 13.1% per year? Answer in percent and round to one decimal place.arrow_forwardConsider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. A B C Po 82 42 84 00 100 200 200 Divisor P1 87 37 94 01 100 200 200 P2 87 37 47 92 100 200 400 Required: a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t=0 to t= 1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) Rate of return I % b. What will be the divisor for the price-weighted index in year 2? (Do not round intermediate calculations. Round your answer to 2 decimal places.) D c. Calculate the rate of return of the price-weighted index for the second period (t=1 to t = 2).arrow_forwardD (Solving a comprehensive problem) Use the end-of-year stock price data in the popup window, E, to answer the following questions for the Harris and Pinwheel companies. a. Compute the annual rates of return for each time period and for both firms. b. Calculate both the arithmetic and the geometric mean rates of return for the entire three-year period using your annual rates of return from part a. (Note: you may assume that neither firm pays any dividends.) c. Compute a three-year rate of return spanning the entire period (i.e., using the ending price for period 1 and ending price for period 4). d. Since the rate of return calculated in part c is a three-year rate of return, convert it to an annual rate of return by using the following equation: W S J-(₁. 1+ e. How is the annual rate of return calculated in part d related to the geometric rate of return? When you are evaluating the performance of an investment that has been held for several years, what Time 1 X 2 3 4 Time 1 3 2 3 4 #…arrow_forward

- You have purchased a property for $950,000 and expect its value to grow at 3 percent compounded annually for 10 years. You plan to sell it at that time hoping to capture your value estimate. In addition, the property is expected to provide a monthly cash flow of $4,000. You expect the monthly cash flow to remain constant over time. What is the expected annual rate of return on this investment given your expectations about its future cash flows?arrow_forwardUse the price and dividend information in the following table for stock ABC to answer the following questions. a) Assuming dividends are fully reinvested (at the ex-div stock price), what is the geometric average annual return for an investment in stock ABC from 26/4/2017 to 31/12/2020? Give your answer as a discrete annual rate. b) What is the IRR of an investment in stock ABC from 26/4/2017 to 31/12/2020 assuming you do not reinvest dividends? Give your answer as an annual continuously compounding rate. c) What is the IRR of an investment in stock ABC from 26/4/2017 to 31/12/2020 assuming you do not reinvest dividends and you liquidate half of your shareholding on 31/12/2019 at a stock price of $34.22? Give your answer as an annual continuously compounding rate. I need Quality solution. U will get up vote for quality answerarrow_forwardThe duration of a preferred stock is its maturity. OA. Greater than or less than, depending on its YTM OB. Less than OC. Greater than O D. Equal toarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education