Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

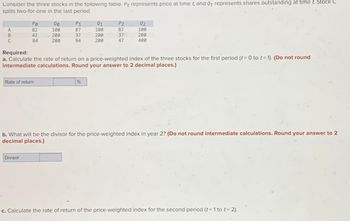

Transcribed Image Text:Consider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C

splits two-for-one in the last period.

A

B

C

Po

82

42

84

Rate of return

00

100

Divisor

200

200

P1

87

37

94

01

100

200

200

%

P2

87

Required:

a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t= 1). (Do not round

intermediate calculations. Round your answer to 2 decimal places.)

370

47

92

100

200

400

b. What will be the divisor for the price-weighted index in year 2? (Do not round intermediate calculations. Round your answer to 2

decimal places.)

c. Calculate the rate of return of the price-weighted index for the second period (t=1 to t=2).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that the financial markets are in equilibrium. Information on three particular shares is provided in the table below. Find the risk free rate and the expected return on the market portfolio. Asset A B C A. 6%, 18% B. 6%, 14% C. 5%, 18% D. 7%, 16% E. 5%, 14% Expected Return 7.6% 12.4% 15.6% Beta 0.2 0.8 1.2arrow_forwardPlease do both questions QUESTION 1 Assume the following data for a stock: beta = 0.9; risk-free rate = 4 percent; market rate of return = 24 percent; and expected rate of return on the stock = 23 percent. Then the stock is: correctly priced. overpriced. this is the wrong answer underpriced. The answer cannot be determined. QUESTION 2 Assume the following data for a stock: beta = 1.5; risk-free rate = 8 percent; market rate of return = 18 percent; and expected rate of return on the stock = 22 percent. Then the stock is: overpriced. underpriced. this is the wrong answer correctly priced. cannot be determinedarrow_forwardConsider the following table, which gives a security analyst’s expected return on two stocks and the market index in two scenarios: Scenario Probability Market Return Aggressive Stock Defensive Stock 1 0.5 6% 2.6% 4.4% 2 0.5 16 27 14 Required: a. What are the betas of the two stocks? (Round your answers to 2 decimal places.) b. What is the expected rate of return on each stock? (Round your answers to 2 decimal places.) c. If the T-bill rate is 7%, what are the alphas of the two stocks? (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forward

- The index model has been estimated using historical excess return data for stocks A, B, and C, with the following results: RA = 0.02 + 0.9RM + eA RB = 0.04 + 1.2RM + eB RC = 0.10 + 1.ORM + eC OM oM = 0.22 o(eA) = 0.21 o(eB ) = 0.11 o(eC ) = 0.23 a. What are the standard deviations of stocks A, B, and C? b. Break down the variances of stocks A, B, and C into their systematic and firm-specific components. c. What is the covariance between the returns on each pair of stocks? d. What is the covariance between each stock and the market index?arrow_forwardWhat is the required rate of return on a preferred stock with a $50 par value, a stated annual dividend of 9% of par, and a current market price of (a) $31, (b) $40, (c) $52, and (d) $74 (assume the market is in equilibrium with the required return equal to the expected return)? Do not round intermediate calculations. Round the answers to two decimal places.arrow_forwardConsider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. A B с Po 81 41 82 Rate of return 20 100 200 200 Divisor P1₁ 86 36 92 21 100 200 200 Required: a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t= 1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) % P2 86 36 46 Q2 100 200 400 b. What will be the divisor for the price-weighted index in year 2? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- Data: So 101; X= 114; 1+r= 1.12. The two possibilities for sr are 143 and 85.arrow_forwardb) Suppose that you observe the following information in Table 2 for stocks A and B: Table 2 Expected Return (%) 11% Stock Beta A 0.8 В 14% 1.5 The risk-free rate of return is 6% and the expected rate of return on the market index is 12%. Using the Single-Index Model, calculate the alpha of both stocks. Show your calculations. Explain what the alpha of the single-factor model represents and interpret your results.arrow_forwardpm.3arrow_forward

- Ο A stock has a required return of 16%, the risk-free rate is 5.5%, and the market risk premium is 4%. a. What is the stock's beta? Round your answer to two decimal places. b. If the market risk premium increased to 7%, what would happen to the stock's required rate of return? Assume that the risk-free rate and the beta remain unchanged. Do not round intermediate calculations. Round your answer to two decimal places. I. If the stock's beta is greater than 1.0, then the change in required rate of return will be greater than the change in the market risk premium. II. If the stock's beta is less than 1.0, then the change in required rate of return will be greater than the change in the market risk premium. III. If the stock's beta is greater than 1.0, then the change in required rate of return will be less than the change in the market risk premium. IV. If the stock's beta is equal to 1.0, then the change in required rate of return will be greater than the change in the market risk…arrow_forwardUse the following information on Stocks X and Y to answer questions 1 through 3 (round to the nearest percent). Bear Market Normal Market Bull Market Probability 0.2 0.5 0.3 Stock X’s return -25% 10% 50% Stock Y’s return -15% 20% 10% What are the standard deviations of returns on Stocks X and Y?arrow_forwardConsider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. ABC Po 86 46 92 le 100 200 200 Rate of return P1 91 41 102 Q1 100 1.89 % 200 200 P2 91 41 51 Required: a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t = 1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) 22 100 200 400arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education