Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

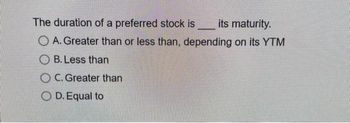

Transcribed Image Text:The duration of a preferred stock is

its maturity.

OA. Greater than or less than, depending on its YTM

OB. Less than

OC. Greater than

O D. Equal to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 2arrow_forwardThe required rate of return on a stock consists of two components, dividend growth rate on the stock measures which of the one component Capital gains yield Dividend yield Market growth rate Discount ratearrow_forwardThe par value of a stock reflects the most recent market price. is immaterial in the majority of cases. O is selected by the SEC. O is indicative of the worth of the stock.arrow_forward

- Based on the information in the previous question, Stock Z is currently... Group of answer choices underpiced overpriced correctly pricedarrow_forwardTreasury stock is generally accounted for by the * cost method. O market value method. O par value method. O stated value method.arrow_forwardA decrease in the will cause an increase in common stock value. O A. growth rate O B. required rate of return Oc. last paid dividend D. both B and Carrow_forward

- TRUE OR FLASE the dividend payout ratio is the dividend by the stock pricearrow_forwardPar value of a stock refers to the ________.arrow_forward1. 1- Calculate the beta adjusted by the degree of freedom for stock X relative to the equity market using the information from the table (performance): A B 0.82 1.22 42.07 Year 1 2 3 4 5 6 7 None of the options is true X -7 -11 21 15 8 9 -2 Market 7 15 20 17 10 7 -1arrow_forward

- When a market order is placed, the price that is paid for the stock is the a. stock's fundamental value. b. market price at time of the execution. c. quoted price. d. market price at time of the quote.arrow_forwardA stock's internal rate of return (IRR) is the discount rate that cause the present value of future dividends and the price at which a stock is expected to be sold to equal the current price of the stock. O True O False Carrow_forwardSuppose securities A, B, and C have the following expected return and risk. Stock Expected return Risk A 8% 6% B 7% 9% C 13% 9% What is the coefficient of variation for stock A?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education