FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

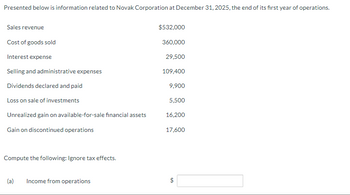

Transcribed Image Text:Presented below is information related to Novak Corporation at December 31, 2025, the end of its first year of operations.

Sales revenue

Cost of goods sold

Interest expense

Selling and administrative expenses

Dividends declared and paid

Loss on sale of investments

Unrealized gain on available-for-sale financial assets

Gain on discontinued operations

Compute the following: Ignore tax effects.

(a)

Income from operations

$532,000

360,000

29,500

109,400

9,900

5,500

16,200

17,600

$

GA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is net income, comprehensive income, and

Solution

by Bartleby Expert

Follow-up Question

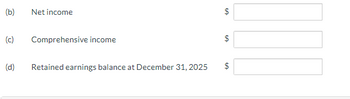

Transcribed Image Text:(b)

Net income

(c) Comprehensive income

(d)

Retained earnings balance at December 31, 2025

LA

GA

$

tA

$

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is net income, comprehensive income, and

Solution

by Bartleby Expert

Follow-up Question

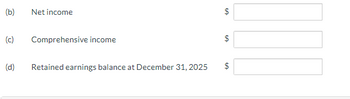

Transcribed Image Text:(b)

Net income

(c) Comprehensive income

(d)

Retained earnings balance at December 31, 2025

LA

GA

$

tA

$

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blossom Limited reported the following selected information for the year ended March 31, 2021: Advertising expense $5,000 Interest expense $5,800 Cash dividends—common 6,000 Loss on discontinued operations 11,000 Depreciation expense 2,000 Rent revenue 36,000 Fees earned 57,000 Retained earnings, April 1, 2020 16,000 Gain on disposal of equipment 1,400 Telephone expense 6,000 Holding loss on equity investments 3,000 Income tax payable 6,500 The company’s income tax rate is 30%. The company reports gains and losses on its equity investments as other comprehensive income. Prepare an income statement and a separate statement of comprehensive income for Blossom Limited. BLOSSOM LIMITEDIncome Statementchoose the accounting period select an opening name for section one…arrow_forwardV5.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- The following is information for Novak Corp. for the year ended December 31, 2020: Sales revenue $1,420,000 Loss on inventory due to decline in net realizable value $70,000 Unrealized gain on FV-OCI equity investments 46,000 Loss on disposal of equipment 45,000 Interest income 9,000 Depreciation expense related to buildings omitted by mistake in 2019 56,000 Cost of goods sold 852,000 Retained earnings at December 31, 2019 950,000 Selling expenses 71,000 Loss from expropriation of land 57,000 Administrative expenses 52,000 Dividends declared 46,000 Dividend revenue 15,000 The effective tax rate is 25% on all items. Novak prepares financial statements in accordance with IFRS. The FV-OCI equity investments trade on the stock exchange. Gains/losses on FV-OCI investments are not recycled through net income. a)Prepare the retained earnings section of the statement of changes in equity for 2020. (List…arrow_forwardWB Inc. reported profits of P 100,000 in its March 31, 2022 interim financial statements. Additional information is shown below (amounts are net of tax): • AP 10,000 cumulative-effect gain resulting from a change in inventory cost flow formula was recognized in profit or loss during the 1 quarter. • In March 2022, a component of an entity was classified as held for sale. Of the total loss on discontinued operations of P 12,000, only P 3,000 has been recognized in the 1" quarter. WB Inc. intends to allocate the remaining P 9,000 loss to the other quarters in 2022. REQUIRED: Compute for the restated profit after tax for the 1" quarter of 2022.arrow_forwardasarrow_forward

- During the current year, Dale Corporation sold a segment of its business at a gain of $315,000.Until it was sold, the segment had a current period operating loss of $112,500. The company had$1,275,000 from continuing operations for the current year.Prepare the lower part of the income statement, beginning with the $1,275,000 income fromcontinuing operations. Follow tax allocation procedures, assuming that all changes in incomeare subject to a 20% income tax rate. Disregard earnings per share disclosures. (Round all calculations to nearest dollar amount.)arrow_forwardOn June 30, Pronghorn Corp discontinued its operations in Mexico. During the year, the operating income was $270,000 before taxes. On September 1, Pronghorn disposed of the Mexico facility at a pretax loss of $670,000. The applicable tax rate is 30%. Show the discontinued operations section of Pronghorn’s income statement. PRONGHORN CORPPartial Income Statement select an opening section name enter an income statement item $enter a dollar amount enter an income statement item $enter a dollar amount $enter a total dollar amountarrow_forwardPlease answer it in good accounting formarrow_forward

- Crane Limited reported the following selected information for the year ended March 31, 2024: Advertising expense Cash dividends-common Depreciation expense Fees earned Gain on disposal of equipment Holding loss on equity investments $5,000 6.000 4,000 62,000 2.000 3,000 Income tax payable Interest expense 4 Loss on discontinued operations Rent revenue Retained earnings, April 1, 2023 Telephone expense $5,300 5,800 20,000 CRANE LIMITED Income Statement Year Ended March 31:2024 32.000 21,000 8,000 The company's income tax rate is 30%. The company reports gains and losses on its equity investments as other comprehensive in Prepare a multi-step income statement and a separate statement of comprehensive income for Crane Limited. Carrow_forwardDuring the current year, Newtech Corporation sold a segment of its business at a loss of $225,000. Until it was sold, the segment had a current period operating loss of $200,000. The company had $750,000 from continuing operations for the current year. Prepare the lower part of the income statement, beginning with the $750,000 income from continuing operations. Follow tax allocation procedures, assuming that all changes in income are subject to a 40% income tax rate. Disregard earnings per share disclosures. Newtech Corporation Partial Income Statement Income from continuing operations Discontinued operations Current Year Loss from operations of discontinued segment (net of tax) $ 200,000 Loss on disposal of discontinued segment (net of tax) Net income $ 750,000 0 0 $ 0arrow_forwardThe following items were taken from the adjusted trial balance of the Dylex Corporation for the year ended December 31, 2020. Assume an average 25% income tax on all ens. The accounting period ends December 31, and all amounts given are pre-tax. Dylex Corporation had 11,000 common shares outstanding in 2020 and follows IFRS Cost of goods sold Depreciation expense, building Gain on exchange Gain on sale of assets from discontinued operations Insurance expense Interest expense Interest income Loss on sale of trading investment 140,000 23,000 a) Prepare a multi-step income statement in good form. Please make sure your final anewarts) are accurate to 2 decimal places Dylex Corporation For the Year Ended December 31, 200 125,000 100,000 54,000 52,000 X 58,000 135,000 Operating loss of discontinued operation to disposal date 100,000 Salaries expense 160.000 Sales ** 900,000 REQUIRED DISCLOSURES b) Calculate basic eamings per share (EPS) from continuing operations. Please make sure your final…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education