FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Compute the following:

(a)

Income from continuing operations

(b)

Net income

$

(c)

Net income attributable to Sunland Company's controlling shareholders

$

(d)

Comprehensive income

(e)

Retained earnings balance at December 31, 2017

%24

%24

%24

%24

%24

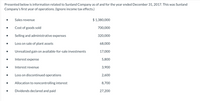

Transcribed Image Text:Presented below is information related to Sunland Company as of and for the year ended December 31, 2017. This was Sunland

Company's first year of operations. (Ignore income tax effects.)

Sales revenue

$ 1,380,000

Cost of goods sold

700,000

Selling and administrative expenses

320,000

Loss on sale of plant assets

68,000

Unrealized gain on available-for-sale investments

17,000

Interest expense

5,800

Interest revenue

3,900

Loss on discontinued operations

2,600

Allocation to noncontrolling interest

8,700

Div

declared and paid

27,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Repurchased share transactions are reported on the: A) income statement as a part of continuing operations B) statement of changes in shareholders' equity C) income statement D) statement of retained earningsarrow_forwardThe following are the consolidated financial statements of Maya Group for the financial year ended 31 December 2021. Consolidated Statement of Profit or Loss and Other Comprehensive Income For the year ended 31 December 2021 Revenue Operating expenses Profit from operations Gain on disposal of subsidiary Finance costs Share of profit of associate Profit before tax Tax expense Profit after tax Other comprehensive income (OCI) Investment thorough OCI Other comprehensive income from associate Total comprehensive income Profit attributable to: Non-controlling interest Equity holders of the parent OCI attributable to: Non-controlling interest Equity holders of the parent Non-current assets Property, plant and equipment Goodwill Investment in associate Current assets Inventories Trade receivables Cash and cash equivalents Total assets Equity Contributed ordinary share capital Revaluation reserves Non-controlling interest Retained earnings Non-current liabilities Long-term loan Deferred tax…arrow_forwardam. 17.arrow_forward

- 15. The net necessary net adjustment involves an adjustment to additional paid in capital in the amount of:arrow_forward6. Complete the table below for the 100% shareholder of the S-corporation. Schedule M-2 Accumulated Schedule M-2 Other Schedule M-2 Earnings and Tax basis in Adjustment Adjustments S-Corp event stock Account Account Profits account Capital gains Amounts on Jan. 1, 2024 30,000 10,000 3,000 20,000 What is the effect if the S-corporation has taxable profit of $50,000 in 2024? What is the effect if the S-corporation makes a $62,000 cash distribution in 2024? What is the effect if the S-corporation makes a $21,000 cash distribution in 2025, and there is no income or loss? What is the effect if the S-corporation makes a $20,000 cash distribution in 2026, and there is no income or loss? What are the balances at the end of 2026?arrow_forwardReyarrow_forward

- 1. The cost method of accounting for stock investments is used when the company acquires a. Greater than 50% of the company's stock b. Between 20% to 50% of the company's stock c. Less than 20% of the company's stock 2. The significance of percentage of ownership relates to how much _____________ the acquiring company has in the new company. a. data b. control c. confidencearrow_forwardssarrow_forwardThe following are the ending balances of accounts at December 31, 2021, for the Valley Pump Corporation. Credits Account Title Cash Accounts receivable Inventory Interest payable Investment in equity securities Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Copyright (net) Prepaid expenses (next 12 months) Accounts payable Deferred revenue (next 12 months) Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals $ Debits 44,000 94,000 119,000 82,000 158,000 395,000 113,000 31,000 51,000 $ 29,000 119,000 44,000 84,000 39,000 345,000 6,000 390,000 31,000 $1,087,000 $1,087,000 Additional Information: 1. The $158,000 balance in the land account consists of $119,000 for the cost of land where the plant and office buildings are located. The remaining $39,000 represents the cost of land being held for speculation. 2. The $82,000 balance in the investment in equity securities account represents an investment in the…arrow_forward

- q17arrow_forwardThe balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional Information for 2024: 1. Net Income is $150,600. 2. Sales on account are $1,215,500. (All sales are credit sales.) 3. Cost of goods sold is $973,400. Complete this question by entering your answers in the tabs below. a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity 2024 19.9 % 13.9 % %6 $208,600 60,000 86,000 3,100 times %6 390,000 390,000 700,000 580,000 (338,000) (178,000)…arrow_forwardAccounting equation The total assets and total liabilities (in millions) of ABC Corporation and XYZ Corporation follow: Assets ABC Liabilities XYZ $47,172 $45,757 20,756 21,963 Determine the stockholders' equity of each company. ABC Corporation stockholders' equity $ XYZ Corporation stockholders' equity $ million millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education