Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

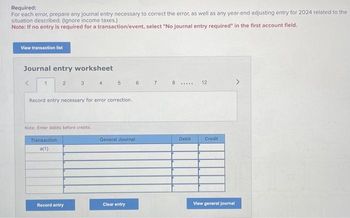

Transcribed Image Text:Required:

For each error, prepare any journal entry necessary to correct the error, as well as any year-end adjusting entry for 2024 related to the

situation described. (Ignore income taxes.)

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry worksheet

<

1

2

3

4

5

6

7

8

12

*****

Record entry necessary for error correction.

Note: Enter debits before credits.

Transaction

a(1)

General Journal

Debit

Credit

View general journal

Clear entry

Record entry

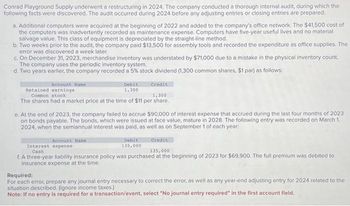

Transcribed Image Text:Conrad Playground Supply underwent a restructuring in 2024. The company conducted a thorough internal audit, during which the

following facts were discovered. The audit occurred during 2024 before any adjusting entries or closing entries are prepared.

a. Additional computers were acquired at the beginning of 2022 and added to the company's office network. The $41,500 cost of

the computers was inadvertently recorded as maintenance expense. Computers have five-year useful lives and no material

salvage value. This class of equipment is depreciated by the straight-line method.

b. Two weeks prior to the audit, the company paid $13,500 for assembly tools and recorded the expenditure as office supplies. The

error was discovered a week later.

c. On December 31, 2023, merchandise inventory was understated by $71,000 due to a mistake in the physical inventory count.

The company uses the periodic inventory system.

d. Two years earlier, the company recorded a 5% stock dividend (1,300 common shares, $1 par) as follows:

Account Name

Retained earnings

Common stock

Debit

1,300

Credit

1,300

The shares had a market price at the time of $11 per share.

e. At the end of 2023, the company failed to accrue $90,000 of interest expense that accrued during the last four months of 2023

on bonds payable. The bonds, which were issued at face value, mature in 2028. The following entry was recorded on March 1,

2024, when the semiannual interest was paid, as well as on September 1 of each year:

Account Name:

Interest expense

Cash

Debit

135,000

Credit

135,000

f. A three-year liability insurance policy was purchased at the beginning of 2023 for $69,900. The full premium was debited to

insurance expense at the time.

Required:

For each error, prepare any journal entry necessary to correct the error, as well as any year-end adjusting entry for 2024 related to the

situation described. (Ignore income taxes.)

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- naruarrow_forwardUrmilabenarrow_forwardConrad Playground Supply underwent a restructuring in 2021. The company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred during 2021 before any adjusting entries or closing entries are prepared. a. Additional computers were acquired at the beginning of 2019 and added to the company's office network. The $45,000 cost of the computers was inadvertently recorded as maintenance expense. Computers have five-year useful lives and no material salvage value. This class of equipment is depreciated by the straight-line method. b. Two weeks prior to the audit, the company paid $17,000 for assembly tools and recorded the expenditure as office supplies. The error was discovered a week later. c. On December 31, 2020, merchandise inventory was understated by $78,000 due to a mistake in the physical inventory count. The company uses the periodic inventory system. d. Two years earlier, the company recorded a 4% stock dividend (2,000 common…arrow_forward

- Conrad Playground Supply underwent a restructuring in 2021. The company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred during 2021 before any adjusting entries or closing entries are prepared. Additional computers were acquired at the beginning of 2019 and added to the company’s office network. The $48,500 cost of the computers was inadvertently recorded as maintenance expense. Computers have five-year useful lives and no material salvage value. This class of equipment is depreciated by the straight-line method. Two weeks prior to the audit, the company paid $20,500 for assembly tools and recorded the expenditure as office supplies. The error was discovered a week later. On December 31, 2020, merchandise inventory was understated by $85,000 due to a mistake in the physical inventory count. The company uses the periodic inventory system. Two years earlier, the company recorded a 3% stock dividend (2,700 common shares, $1 par)…arrow_forwardConrad Playground Supply underwent a restructuring in 2021. The company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred during 2021 before any adjusting entries or closing entries are prepared. Additional computers were acquired at the beginning of 2019 and added to the company’s office network. The $42,000 cost of the computers was inadvertently recorded as maintenance expense. Computers have five-year useful lives and no material salvage value. This class of equipment is depreciated by the straight-line method. Two weeks prior to the audit, the company paid $14,000 for assembly tools and recorded the expenditure as office supplies. The error was discovered a week later. On December 31, 2020, merchandise inventory was understated by $72,000 due to a mistake in the physical inventory count. The company uses the periodic inventory system. Two years earlier, the company recorded a 3% stock dividend (1,400 common shares, $1 par)…arrow_forwardConrad Playground Supply underwent a restructuring in 2021. The company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred during 2021 before any adjusting entries or closing entries are prepared. Additional computers were acquired at the beginning of 2019 and added to the company’s office network. The $50,000 cost of the computers was inadvertently recorded as maintenance expense. Computers have five-year useful lives and no material salvage value. This class of equipment is depreciated by the straight-line method. Two weeks prior to the audit, the company paid $22,000 for assembly tools and recorded the expenditure as office supplies. The error was discovered a week later. On December 31, 2020, merchandise inventory was understated by $88,000 due to a mistake in the physical inventory count. The company uses the periodic inventory system. Two years earlier, the company recorded a 3% stock dividend (3,000 common shares, $1 par)…arrow_forward

- Sound Audio manufactures and sells audio equipment for automobiles. Engineers notified management inDecember 2018 of a circuit flaw in an amplifier that poses a potential fire hazard. An intense investigation indicated that a product recall is virtually certain, estimated to cost the company $2 million. The fiscal year ends onDecember 31.Required:1. Should this loss contingency be accrued, only disclosed, or neither? Explain.2. What loss, if any, should Sound Audio report in its 2018 income statement?3. What liability, if any, should Sound Audio report in its 2018 balance sheet?4. Prepare any journal entry needed.arrow_forwardLangley Corporation replaced an HVAC system in one of its warehouses in July, 2021, at a cost of $430,000. The accountant recording the purchase charged it to repairs and maintenance expense. The error was discovered late in 2022 while reconciling depreciation expense for 2022. The system should last about 7 years with no salvage value. What entry should be made before the 2022 books are closed if the company uses straight-line depreciation? (Round intermediate calculations to the nearest cent and your final answer to the nearest dollar.) Group of answer choices Warehouse 430,000 Depreciation Expense—Warehouse 61,429 Retained Earnings 491,429 Warehouse 430,000 Depreciation Expense (2022)—Warehouse 61,429 Accumulated Depreciation—Warehouse92,144 Retained Earnings—Prior Period Adjustment 399,285 Warehouse 430,000 Accumulated Depreciation -Warehouse 61,429 Retained Earnings—Prior Period Adjustment 368,571 Retained…arrow_forwardIn 2018, internal auditors discovered that PKE Displays, Inc., had debited an expense account for the $350,000 cost of a machine purchased on January 1, 2015. The machine's useful life was expected to be five years with no residual value. Straight-line depreciation is used by PKE. Ignoring income taxes, prepare the journal entry PKE will use to correct the error. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Event 1 1 Equipment Accumulated depreciation Retained earnings Answer is not complete. General Journal Debit Credit 350,000arrow_forward

- In 2026, after the 2025 financial statements were issued, internal auditors discovered that PKE Displays, Incorporated, had debited an expense account for the $350,000 cost of a machine purchased on January 1, 2021. The machine’s useful life was expected to be five years with no residual value. Straight-line depreciation is used by PKE. Ignoring income taxes, prepare the journal entry PKE will use to correct the error.arrow_forwardSound Audio manufactures and sells audio equipment for automobiles. Engineers notified management in December 2016 of a circuit flaw in an amplifier that poses a potential fire hazard. An intense investigation indicated that a product recall is virtually certain, estimated to cost the company $2 million. The fiscal year ends on December 31. Required: 1. Should this loss contingency be accrued, only disclosed, or neither? Explain. 2. What loss, if any, should Sound Audio report in its 2016 income statement? 3. What liability, if any, should Sound Audio report in its 2016 balance sheet? 4. Prepare any journal entry needed.arrow_forwardWilliams-Santana Incorporated is a manufacturer of high-tech industrial parts that was started in 2012 by two talented engineers with little business training. In 2024, the company was acquired by one of its major customers. As part of an internal audit, the following facts were discovered. The audit occurred during 2024 before any adjusting entries or closing entries were prepared. a. A five-year casualty insurance policy was purchased at the beginning of 2022 for $35,000. The full amount was debited to insurance expense at the time. b. Effective January 1, 2024, the company changed the salvage value used in calculating depreciation for its office building. The building cost $600,000 on December 29, 2013, and has been depreciated on a straight-line basis assuming a useful life of 40 years and a salvage value of $100,000. Declining real estate values in the area indicate that the salvage value will be no more than $25,000. c. On December 31, 2023, merchandise inventory was overstated…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning