Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need general accounting question solution

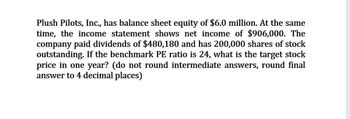

Transcribed Image Text:Plush Pilots, Inc., has balance sheet equity of $6.0 million. At the same

time, the income statement shows net income of $906,000. The

company paid dividends of $480,180 and has 200,000 shares of stock

outstanding. If the benchmark PE ratio is 24, what is the target stock

price in one year? (do not round intermediate answers, round final

answer to 4 decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardLast year, Big W Company reported earnings per share of $3.50 when its stock was selling for $87.50. If its earnings this year increase by 10 percent and the P/E ratio remains constant, what will be the price of its stock? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Stock Pricearrow_forward

- Penguin, Incorporated, has balance sheet equity of $5.8 million. At the same time, the income statement shows net income of $864,200. The company paid dividends of $466,668 and has 100,000 shares of stock outstanding. If the benchmark PE ratio is 22, what is the target stock price in one year? Assume the firm will grow at the sustainable growth rate. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Target stock pricearrow_forwardFondren Machine Tools has total assets of $3,180,000 and current assets of $882,000. It turns over Its fixed assets 1.8 times per year. Its return on sales is 5.5 percent. It has $1,410,000 of debt. What is its return on stockholders' equlty? (Do not round Intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Return on stockholders' equityarrow_forwardLast year, Rec Room Sports reported earnings per share of $7.80 when its stock price was $140.40. This year. its earnings increased by 25 percent. If the P/E ratio remains constant, what is likely to be the price of the Stock? (Round your answer to 2 declmal places.) Pice bf thssocearrow_forward

- At year end, Sampson Company's balance sheet showed total assets of $80 million, total liabilities of $50 million, and 1,000,000 shares of common stock outstanding. Next year, Malta is projecting that it will have net income of $2.9 million. If the average P/E multiple in Malta's industry is 16, (and this is an average stock) what should be the price of Sampson's stock? O $50.43 O $46.40 O $44.57 O $41.60arrow_forwardVriend Software Inc.'s book value per share is $13.70. Eamings per share is $1.81, and the firm's stock trades in the stock market at 2.5 times book value per share. What will the P/E ratio be? (Do not round Intermediate calculations. Round your final answer to 2 decimal places.) P/E ratio timesarrow_forwardPlease correct sir and explanation too and not on page.arrow_forward

- PQR Co. has earnings of $2.65 per share. The benchmark PE for company is 22. What stock price (to two decimals) would you consider appropriate?arrow_forwardEllington Electronics wants you to calculate its cost of common stock. During the next 12 months, the company expects to pay dividends (D1) of $3.70 per share, and the current price of its common stock is $76 per share. The expected growth rate is 7 percent. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) a. Compute the cost of retained earnings (Ke). Cost of retained earnings % b. If a $7.0 flotation cost is involved, compute the cost of new common stock (Kn). Cost of new common stock %arrow_forwardYou have found the following historical information for the Daniela Company: Stock price EPS Year 1 Year 2 Year 3 Year 4 $49.24 2.59 $67.43 $61.19 $67.07 2.65 2.82 2.81 Earnings are expected to grow at 8 percent for the next year. What is the PE ratio for each year? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Year 1 Year 2 Year 3 Year 4 What is the average PE ratio over this period? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Average PE Using the company's historical average PE as a benchmark, what is the target stock price in one year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Target pricearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT