Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

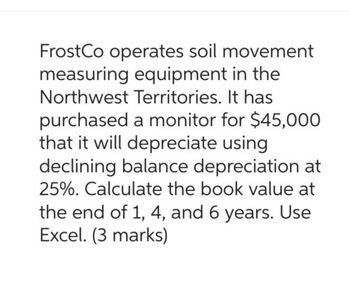

Transcribed Image Text:FrostCo operates soil movement

measuring equipment in the

Northwest Territories. It has

purchased a monitor for $45,000

that it will depreciate using

declining balance depreciation at

25%. Calculate the book value at

the end of 1, 4, and 6 years. Use

Excel. (3 marks)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- I need help with this solutionarrow_forwardOn January 1, 2018, the Allegheny Corporation purchased machinery for $115,000. The estimated service life ofthe machinery is 10 years and the estimated residual value is $5,000. The machine is expected to produce 220,000units during its life.Required:Calculate depreciation for 2018 and 2019 using each of the following methods. Round all computations to thenearest dollar.1. Straight line2. Sum-of-the-years’-digits3. Double-declining balance4. One hundred fifty percent declining balance5. Units of production (units produced in 2018, 30,000; units produced in 2019, 25,000)arrow_forwardLLED has purchased a new chip making machine for $1,500,000 with a salvage value of $100,000in 10 years. The LLED company is trying to determine the best method of depreciation. Create atable and calculate the deprecation amount for each year using straight line, double decliningbalance, and MACRS (10 yr property class). For SL and DDB we will not depreciate below thesalvage value. Using a MARR of 10% calculate the present worth of the depreciation deductions.Which is the preferred method of depreciation for LLED?arrow_forward

- Suncoast Food Centers has provided the following information with regard to the purchase of equipment. Acquisition cost of equipment Useful life Salvage value at end of useful life Annual straight-line depreciation Annual income generated by asset (before deducting depreciation) Year 1 2 3 4 5 Use a 10 percent rate to compute the imputed interest charge. Required: Complete the following table. Income Before Depreciation $900,000 Annual Depreciation 5 years 0 $180,000 $270,000 Income Net of Depreciation Based on Net Book Value Average Net Book Imputed Interest Value Charge Residual Income Based on Gross Book Value Imputed Interest Charge Average Gross Book Value Residual Incomearrow_forwardA machine can be purchased for $50,000 and used for five years, yielding the following income. This income computation includes annual depreciation expense of $10,000. Income Year Year 1 $3,300 Initial invest Year 1 Year 2 Year 3 Year 4 Year 5 Year 2 $8,300 Compute the machine's payback period. Note: Round payback period answer to 2 decimal places. Net Income Depreciation 3,300 8,300 30,000 12,400 33,200 Year 3 $30,000 Year 4 $12,400 Net Cash Flow $ (50,000) $ Payback period = Year 5 $33,200 Cumulative Net Cash Flow (50,000) 0 0arrow_forwardRequired information [The following information applies to the questions displayed below.] NewTech purchases computer equipment for $264,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $28,000. Prepare a table showing depreciation and book value for each of the four years assuming straight-line depreciation. Straight-Line Depreciation Choose Numerator: Choose Denominator: Annual Depreciation Expense = = Year Annual Depreciation Year 1 Year 2 Year 3 Year 4 Total Depreciation expense WHEREL Year-End Book Valuearrow_forward

- XYZ Corporation has purchased a new piece of machinery for $75,000. The piece of equipment should last for 8 years and will have a $5,000 salvage value at the end of its useful life. They plan on using the unit-of-production depreciation method. Use the production information below to calculate the estimated depreciation information for each year. Year Units Produced 1 8,000 2 10,000 3 12,000 4 14,000 5 12,000 6 10,000 7 8,000 8 5,000arrow_forwardAn equipment costing P220,000 has an estimated life of 14 years with a book value of P30,000 at the end of the period. Compute the depreciation charge and its book value after 10 years using: a. straight-line method b. sinking fund method c. declining balance method d. sum of year's digit methodarrow_forwardDragonfly, Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available: Investment A Investment B $101,000 Initial capital investment Estimated useful life $151,000 10 years 10 years Estimated residual value $20.000 $47.000 12% Estimated annual net cash inflow for 10 years $28.000 Required rate of return 12% Calculate the payback period for Investment A. (Round your answer to two decimal places.) O A. 1.00 year О В. 3.61 years O C. 2.22 years O D. 2.89 yearsarrow_forward

- Montello Inc. purchases a delivery truck for $12,000. The truck has a salvage value of $2,000 and is expected to be driven for 100,000 miles. Montello uses the units-of-production depreciation method and in year one it expects to use the truck for 23,000 miles. Calculate the annual depreciation expensarrow_forwardMontello Inc. purchases a delivery truck for $23,051. The truck has a salvage value of $4,562 and is expected to be driven for 132,141 miles. Montello uses the units-of-production depreciation method and in year one it expects to use the truck for 20,068 miles. Calculate the annual depreciation expense. Round to the nearest penny, two decimal places.arrow_forwardA machine can be purchased for $90,000 and used for five years, yielding the following income. This income computation includes annual depreciation expense of $18,000 Income Year 1 Year 3 Year 5. $6,000 $36,000 $60,000 Compute the machine's payback period. (Round payback period answer to 2 decimal places.) Year Initial invest - Year 1 Year 2 Year 3 Year 4 Year 5 Net Income Depreciation $ Year 2 $15,000 6,000 15,000 36,000 22,500 60,000 Year 4 $22,500 Net Cash Flow $ Cumulative Net Cash Flow (90,000) $ Payback period- (90,000)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage