FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

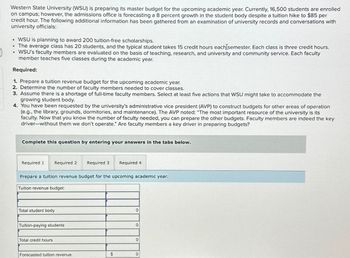

Transcribed Image Text:Western State University (WSU) is preparing its master budget for the upcoming academic year. Currently, 16,500 students are enrolled

on campus; however, the admissions office is forecasting a 8 percent growth in the student body despite a tuition hike to $85 per

credit hour. The following additional information has been gathered from an examination of university records and conversations with

university officials:

• WSU is planning to award 200 tuition-free scholarships.

"

⚫ The average class has 20 students, and the typical student takes 15 credit hours each semester. Each class is three credit hours.

WSU's faculty members are evaluated on the basis of teaching, research, and university and community service. Each faculty

member teaches five classes during the academic year.

Required:

1. Prepare a tuition revenue budget for the upcoming academic year.

2. Determine the number of faculty members needed to cover classes.

3. Assume there is a shortage of full-time faculty members. Select at least five actions that WSU might take to accommodate the

growing student body.

4. You have been requested by the university's administrative vice president (AVP) to construct budgets for other areas of operation

(e.g., the library, grounds, dormitories, and maintenance). The AVP noted: "The most important resource of the university is its

faculty. Now that you know the number of faculty needed, you can prepare the other budgets. Faculty members are indeed the key

driver-without them we don't operate." Are faculty members a key driver in preparing budgets?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3 Required 4

Prepare a tuition revenue budget for the upcoming academic year.

Tuition revenue budget:

Total student body

Tuition-paying students

Total credit hours

0

0

0

Forecasted tuition revenue

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Could you help me produce the expected cash collection from customers?arrow_forwardBudget planners for a certain community have determined that $7,293,000 will be required to provide all government services next year. The total assessed property value in the community is $130,000,000. What tax rate is required to meet the budgetary demands? (Express your answer as a tax rate per $100 to two decimal places rounded up.) 2$arrow_forwardMonroe Outpatient Surgery Center (MOSC) is developing an operating budget for the month ending June 30, 2024. MOSC expects to perform 80 surgical procedures during the month. MOSC’s average charge (price) per surgical procedure is $2,500. The cost of disposable surgical supplies is $300 per surgical procedure. MOSC also contracts with orthopedic surgeons at a fee of $1,500 per surgical procedure. The monthly salaries for MOSC’s receptionist, bookkeeper, and two surgical nurses total $10,500. MOSC’s occupancy costs, which include space rental, insurance, and all utilities, are $8,200 per month. Average monthly communication costs are $1,200. Office and operating room equipment was installed at a cost of $240,000. The equipment is expected to have a 5-year life and has no salvage value (Depreciation of $4,000 for every month). Prepare MOSC’s operating budget for the month of June 2024. My response: June 2024 Operating Budget for Monroe Outpatient Surgery Center June…arrow_forward

- A car rental agency has a budget of $2.38 million to purchase at most 110 new cars. The agency will purchase either subcompact cars at $17,000 each or midsized cars at $34,000 each. From past rental patterns, the agency decides to purchase at most 50 midsized cars and expects an annual profit of $7,500 per subcompact car and $14,000 per midsized car. How many of each type of car should be purchased to obtain the maximum profit while satisfying budgetary and other planning constraints? Subcompact Cars- Midsize cars - Maximum profit -arrow_forwardThe total assessed property value in Belletown is $108,000,000. Budget planners have determined that $8,305,200 will be required to provide all government services next year. What tax rate is required to meet the budgetary demands? (Round to the nearest hundredth).arrow_forwardA company that manufactures air-operated drain valve assemblies currently has $85,000 available to pay for plastic components over a 5-year period. If the company spent only $42,000 in year 1, what uniform annual amount can the company spend in each of the next 4 years to deplete the entire budget? Let i = 10% per year.arrow_forward

- Please help mearrow_forwardMetropolitan Dental Associates is a large dental practice in Chicago. The firm's controller is preparing the budget for the next year. The controller projects a total of 48,000 office visits, to be evenly distributed throughout the year. Eighty percent of the visits will be half-hour appointments, and the remainder will be one-hour visits. The average rates for professional dental services are $60 for half-hour appointments and $115 for one-hour office visits. Ninety percent of each month's professional service revenue is collected during the month when services are rendered, and the remainder is collected the month following service. Uncollectible billings are negligible. Metropolitan's dental associates earn $95 per hour. Metropolitan uses activity-based budgeting to budget office overhead and administrative expenses. Two cost drivers are used: office visits and direct professional labor. The cost-driver rates are as follows: Patient registration and records All other overhead and…arrow_forwardBudgeting for a Service Firm Refer to the AccuTax Inc. example in the chapter. One of thepartners is planning to retire at the end of the year. May Higgins, the sole remaining partner, plansto add a manager at an annual salary of $90,000. She expects the manager to work, on average, 45hours a week for 45 weeks per year. She plans to change the required staff time for each hour spentto complete a tax return to the following:Business ReturnComplex IndividualReturnSimple IndividualReturnPartner 0.3 hour 0.05 hour —Manager 0.2 hour 0.15 hour —Senior consultant 0.5 hour 0.40 hour 0.2 hourConsultant — 0.40 hour 0.8 hourThe manager is salaried and earns no overtime pay. Senior consultants are salaried but receivetime and a half for any overtime worked. The firm plans to keep all the senior consultants and adjustthe number of consultants as needed including employing part-time consultants, who also are paidon an hourly basis. Higgins has also decided to have five supporting staff at $40,000…arrow_forward

- Budget planners for a certain community have determined that $6,391,000 will be required to provide all government services next year. The total assessed property value in the community is $110,000,000. What tax rate is required to meet the budgetary demands? (Express your answer as a tax rate per $100 to two decimal places rounded up.) ______arrow_forwardA company that manufactures air-operated drain valve assemblies currently has $110,000 available to pay for plastic components over a 5-year period. If the company spent only $44,000 in year 1, what uniform annual amount can the company spend in each of the next 4 years to deplete the entire budget? Let i= 12% per year. The uniform annual amount the company can spend is $|arrow_forwardTop executive officers of Zachary Company, a merchandising firm, are preparing the next year's budget. The controller has provided everyone with the current year's projected income statement. Sales revenue Cost of goods sold Gross profit Selling & administrative expenses Net income Cost of goods sold is usually 75 percent of sales revenue, and selling and administrative expenses are usually 10 percent of sales plus a fixed cost of $80,000. The president has announced that the company's goal is to increase net income by 15 percent. Required The following items are independent of each other: a. Prepare a pro forma income statement. What percentage increase in sales would enable the company to reach its goal? b. The market may become stagnant next year, and the company does not expect an increase in sales revenue. The production manager believes that an improved production procedure can cut cost of goods sold by 1 percent. Prepare a pro forma income statement still assuming the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education