FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

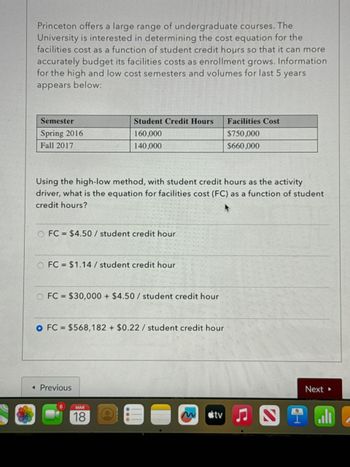

Transcribed Image Text:Princeton offers a large range of undergraduate courses. The

University is interested in determining the cost equation for the

facilities cost as a function of student credit hours so that it can more

accurately budget its facilities costs as enrollment grows. Information

for the high and low cost semesters and volumes for last 5 years

appears below:

Semester

Spring 2016

Fall 2017

Student Credit Hours

Facilities Cost

160,000

$750,000

140,000

$660,000

Using the high-low method, with student credit hours as the activity

driver, what is the equation for facilities cost (FC) as a function of student

credit hours?

FC $4.50/ student credit hour

O FC = $1.14 / student credit hour

O FC $30,000+ $4.50/ student credit hour

O FC $568,182 + $0.22 / student credit hour

◄ Previous

MAR

18

tv

C

Next▸

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Professor John Morton has just been appointed chairperson of the Finance Department at Westland University. In reviewing the department's cost records, Professor Morton has found the following total cost associated with Finance 101 over the last five terms: Term Fall, last year Winter, last year Summer, last year. Fall, this year Winter, this year. Number of Sections Offered Required 38 4 6 2 Fixed cost Variable cost Total expected cost 5 3 Professor Morton knows that there are some variable costs, such as amounts paid to graduate assistants, associated with the course. He would like to have the variable and fixed costs separated for planning purposes. Total Cost $ 10,000 $ 14,000 3-a. Assume that because of the small number of sections offered during the Winter Term this year, Professor Morton will have to offer eight sections of Finance 101 during the Fall Term. Compute the expected total cost…arrow_forwardBellevie college cost $7612.00 a year, the graduation rate is 25%, salary after attending is $42,400. Edmonds college cost $7,207.00 a year, the graduation rate is 27%, salary after attending is $34,300. What is the explanatory? What is the responsearrow_forwardVariable Costing Income Statement for a Service Company The actual and planned data for Underwater University for the Fall term were as follows: Actual Planned Enrollment 4,500 4,125 Tuition per credit hour $120 $135 Credit hours 60,450 43,200 Registration, records, and marketing costs per enrolled student $275 $275 Instructional costs per credit hour $64 $60 Depreciation on classrooms and equipment $825,600 $825,600 Registration, records, and marketing costs vary by the number of enrolled students, while instructional costs vary by the number of credit hours. Depreciation is a fixed cost. Prepare a variable costing income statement showing the contribution margin and operating income for the Fall term.arrow_forward

- Excaster University is considering launching a new 12 month taught Masters programme in Data Analytics. In order to offer the programme the University will incur the following fixed costs: a) One full time administrator at an annual cost of £40,000 b) Advertising and promotional costs of £25,000 per year c) Subscriptions to data providers £50,000 per year d) Licenses for analytical software £35,000 per year e) In addition the course will incur an overhead charge for use of shared resources of £45,000 per year. Teaching on the course will be delivered at an estimated cost of £500,000 per year. The variable costs associated with delivering an excellent student experience are estimated at £2000 per student. Bathchester University (about 60 miles away) offers a competitive course priced at £13,000 which attracts 60 students. Plymhampton University (about 30 miles away) also offers a competitive course and charges £9,000 and has recruited 40 students for the most recent intake. Excaster are…arrow_forwardCalculate the B/C ratio (modified) of a building that houses students during their classroom discussion. Theaccommodation equates to $525,000 annually. However, the annual maintenance is $135,000. Its constructioncosts for about $2.3 M. If sold 20 years from its first operating year, it will amount to $250,000. Take MARR = 15%arrow_forwardVariable costing income statement for a service companyThe actual and planned data for Underwater University for the Fall termwere as follows: EnrollmentTuition per credit hourCredit hoursRegistration, records, and marketing cost per enrolled studentInstructional costs per credit hourDepreciation on classrooms and equipment 4,500$12060,450$275 $64$825,600 4,125$13543,200$275 $60$825,600 Registration, records, and marketing costs vary by the number ofenrolled students, while instructional costs vary by the number of credithours. Depreciation is a fixed cost. A. Prepare a variable costing income statement showing thecontribution margin and operating income for the Fall term.B. Prepare a contribution margin analysis report comparingplanned with actual performance for the Fall term.arrow_forward

- Variable Costing Income Statement for a Service Company The actual and planned data for Broadwater Institute & Technical School for the Fall term were as follows: Actual Planned Enrollment Tuition per credit hour Credit hours Line Item Description Revenue Variable costs Registration, records, and marketing costs Registration, records, and marketing costs per enrolled student Instructional costs per credit hour Depreciation on classrooms and equipment $1,875,000 $1,875,000 Registration, records, and marketing costs vary by the number of enrolled students, while instructional costs vary by the number of credit hours. Depreciation is a fixed cost. Prepare a variable costing income statement showing the contribution margin and operating income for the Fall term Broadwater Institute & Technical School Variable Costing Income Statement For the Fall Term Instructional costs Total variable costs Contribution margin Depreciation on classrooms and equipment Operating income Amount 9.200.000 ✓…arrow_forwardSunset Office Park asks LawnCare USA to give an estimate for providing its services for a 2-year period. What are the advantages and disadvantages for LawnCare USA to provide a 2-year estimate?arrow_forwardVariable Costing Income Statement for a Service Company The actual and planned data for Underwater University for the Fall term were as follows: Actual Planned Enrollment 4,500 4,125 Tuition per credit hour $120 $135 Credit hours 43,200 60,450 Registration, records, and marketing costs per enrolled student $275 $275 Instructional costs per credit hour $60 $64 Depreciation on classrooms and equipment $825,600 $825,600 Registration, records, and marketing costs vary by the number of enrolled students, while instructional costs vary by the number of credit hours. Depreciation is a fixed cost. Prepare a variable costing income statement showing the contribution margin and operating income for the Fall term.arrow_forward

- The director of public works needs to distribute the indirect cost allocation of $1.2 million to the three branches around the city. She will use the information from last year to determine the rates for this year. a. Determine this year’s indirect cost rates for each branch. b. Use the rates from last year and records for this year to distribute the allocation for this year. How much of the $1.2 million is actually distributed?arrow_forwardNovello Medical Center has a single operating room that is used by local physicians to perform surgical procedures. The cost of using the operating room is accumulated by each patient procedure and includes the direct materials costs (drugs and medical devices), physician surgical time, and operating room overhead. On January 1 of the current year, the annual operating room overhead is estimated to be: Disposable supplies $350,100 Depreciation expense 63,100 Utilities 36,700 Nurse salaries 525,800 Technician wages 172,300 Total operating room overhead $1,148,000 The overhead costs will be assigned to procedures based on the number of surgical room hours. Novello Medical Center expects to use the operating room an average of eight hours per day, seven days per week. In addition, the operating room will be shut down two weeks per year for general repairs. a. Compute the estimated number of operating room hours for the year. hours b. Determine the predetermined operating room overhead…arrow_forwardCapital University has four departments. Each student takes 10 classes per year, and only takes course in their own faculty. The only sources of revenue are tuition and government grants. The University receives a grant of $10,000 a year for each student. Costs: Item Amount Note Total Salaries 15,500,000 Each professor teaches 6 classes per year and all get paid the same amount. Building Student Support 13,020,000 Each classroom is the same size. 195,000,000 Each student generally requires an equal amount of support and Administration Other 17,000,000 Science labs $10 million, Business trading room $2 million, Engineering labs $5 million Total 240,520,000 Student enrollment: Faculty: Number of classes per year Number of Students in Faculty Science Engineering 150 Arts Business Total 120 198 150 618 4,800 2,000 600 2,700 10,100 In order to break-even, the university estimates that tuition should be $13,814 per student ($240,520,000 in costs divided by 10,100 students, less the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education