Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Please give me answer general accounting

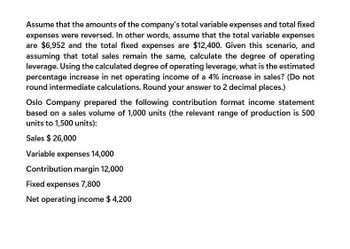

Transcribed Image Text:Assume that the amounts of the company's total variable expenses and total fixed

expenses were reversed. In other words, assume that the total variable expenses

are $6,952 and the total fixed expenses are $12,400. Given this scenario, and

assuming that total sales remain the same, calculate the degree of operating

leverage. Using the calculated degree of operating leverage, what is the estimated

percentage increase in net operating income of a 4% increase in sales? (Do not

round intermediate calculations. Round your answer to 2 decimal places.)

Oslo Company prepared the following contribution format income statement

based on a sales volume of 1,000 units (the relevant range of production is 500

units to 1,500 units):

Sales $ 26,000

Variable expenses 14,000

Contribution margin 12,000

Fixed expenses 7,800

Net operating income $ 4,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following is true regarding the contribution margin ratio of asingle product company? a. As fixed expenses decrease, the contribution margin ratio increases b. The contribution margin ratio increases as the number of units sold increase c. The contribution margin ratio multiplied by the variable expense per unit equals thecontribution margin per unit d. If sales increase, the peso increase in net operating income can be computed bymultiplying the contribution margin ratio by the peso increase in salesarrow_forwardWhich of the following is true regarding the contribution margin ratio of a single product company? As fixed expenses decrease, the contribution margin ratio increases. The contribution margin ratio multiplied by the variable expense per unit equals the contribution margin per unit. The contribution margin ratio increases as the number of units sold increases. If sales increase, the dollar increase in net operating income can be computed by multiplying the contribution margin ratio by the dollar increase in sales.arrow_forwardPlease, use these formulas that are in the image only.arrow_forward

- the question is in the attached picturesarrow_forwardf net profit of the firm is OMR 280,000 and capital employed is OMR 1,400, 000 the return on capital employed will be 20%. During inflation with net profit calculated with replacement cost is OMR 180,000 and capital employed is OMR 22,00,000 the return on capital employed will be 8.2%. This situation expresses the following problem. a. Under historical cost accounting, the profits are overstated, and fixed assets are understated specially when there is increase in the price of the old fixed assets. b. Under historical cost accounting, return on capital employed which is very useful for the valuation of the business by its owners, creditors and management will not be correct and may lead to misleading decision c. Both the given statements are true in the given situation d. Both the given statements are false in the given situationarrow_forwardDuring the current year, XYZ Company increased its variable SG&A expenses while keeping fixed SG&A expenses the same. As a result, XYZ's: a) Contribution margin and gross margin will be lower. b) Contribution margin will be higher, while its gross margin will remain the same. c) Operating income will be the same under both the financial accounting income statement and contribution income statementarrow_forward

- 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the East region. 3. Compute the break-even point in dollar sales for the West region. 4. Prepare a new segmented income statement based on the break-even dollar sales that you computed in requirements 2 and 3. Use the same format as shown above. What is Crossfire’s net operating income (loss) in your new segmented income statement? 5. Do you think that Crossfire should allocate its common fixed expenses to the East and West regions when computing the break-even points for each region?arrow_forwardUsing these formulas: 1-Breakeven Point Formula: FC Q = P – vc 2-Degree of Operating Leverage (DOL): Percentage change in EBIT Percentage change in sales DOL 3-The formula for calculating the degree of operating leverage at a base sales level, Q, is the following: QX (P- vc) QX (P– vc) – FC Q: the sales level. P: sale price. vc: variable operating costs per unit. DOL(Q) = %3D FC: fixed operating costs. 4-The Degree Of Financial Leverage (DFL): Percentage change in EPS Percentage change in EBIT DFL EBIT DFL at base level EBIT - EBIT - I- (PD x 5-degree of total leverage (DTL) Percentage change in EPS Percentage change in sales DTL = QX (P- vc) PD Q x (P – vc) – FC –-1-) DTL at Q units =arrow_forwardUsing the ratio definitions from Exhibit 4.6, calculate the financial ratios for the Boeing Company and determine whether the company is a good investment. Assume an effective tax rate of 20 percentarrow_forward

- For the period just ended, Trek Corporation's Trailer Division reported profit of $54 million and invested capital of $450 million. Assuming an imputed interest rate of 10 per cent, calculate Trailer’s return on investment (ROI) and residual income. Explain what each calculation of ROI and RI means for Trekarrow_forwardI need this general account qualification please not use gpt..arrow_forwardFrom the information provided in the table (i) Calculate EBIT, Fixed Cost, Variable cost and Profit after tax for Company A and S as per financial data given below. (ii) Comment on the Operating and Financial risk for both the firms. Give reasons for your answer. Particulars A S Variable Expenses as a percentage of sales 75% 50% Interest Expense in Amount Rs. 300 1000 Degree of Operating Leverage 6 2 Degree of Financial Leverage 4 2 Income Tax Rate 35% 35%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning