FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

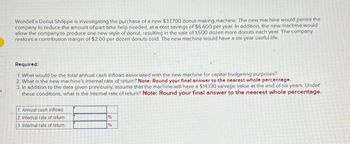

Transcribed Image Text:Wendell's Donut Shoppe is investigating the purchase of a new $37,700 donut-making machine. The new machine would permit the

company to reduce the amount of part-time help needed, at a cost savings of $6,600 per year. In addition, the new machine would

allow the company to produce one new style of donut, resulting in the sale of 1,500 dozen more donuts each year. The company

realizes a contribution margin of $2.00 per dozen donuts sold. The new machine would have a six-year useful life.

Required:

1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes?

2. What is the new machine's internal rate of return? Note: Round your final answer to the nearest whole percentage.

3. In addition to the data given previously, assume that the machine will have a $14,130 salvage value at the end of six years. Under

these conditions, what is the internal rate of return? Note: Round your final answer to the nearest whole percentage.

1. Annual cash inflows

12. Internal rate of return

%

3. Internal rate of return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wendell’s Donut Shoppe is investigating the purchase of a new $44,300 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $6,000 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,000 dozen more donuts each year. The company realizes a contribution margin of $2.00 per dozen donuts sold. The new machine would have a six-year useful life. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. What discount factor should be used to compute the new machine’s internal rate of return? (Round your answers to 3 decimal places.) 3. What is the new machine’s internal rate of return? (Round your final answer to the nearest whole percentage.) 4. In addition to the…arrow_forwardFlatte Restaurant is considering the purchase of a $10,800 soufflé maker. The soufflé maker has an economic life of five years and will be fully depreciated by the straight-line method. The machine will produce 2,400 soufflés per year, with each costing $2.80 to make and priced at $5.65. Assume that the discount rate is 16 percent and the tax rate is 35 percent. What is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forwardWendell's Donut Shoppe is investigating the purchase of a new $48,300 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $6,800 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 1.700 dozen more donuts each year. The company realizes a contribution margin of $2.00 per dozen donuts sold. The new machine would have a six-year useful life. Click here to view Exhibit 148-1 and Exhibit 148-2, to determine the appropriate discount factor(s) using tables. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. What discount factor should be used to compute the new machine's internal rate of return? (Round your answers to 3 decimal places.) 3. What is the new machine's internal rate of return? (Round your final answer to the nearest whole percentage.) 4. In addition to the…arrow_forward

- The engineering team at Manuel’s Manufacturing, Inc., is planning to purchase an enterprise resource planning (ERP) system. The software and installation from Vendor A costs $380,000 initially and is expected to increase revenue $125,000 per year every year. The software and installation from Vendor B costs $280,000 and is expected to increase revenue $95,000 per year. Manuel’s uses a 4-year planning horizon and a 10% per year MARR. What is the annual worth of each investment?Vendor A: $enter a dollar amount rounded to the nearest dollar Vendor B: $enter a dollar amount rounded to the nearest dollararrow_forwardBeryl's Iced Tea currently rents a bottling machine for $54,000 per year, including all maintenance expenses. It is considering purchasing a machine instead, and is comparing two options: a. Purchase the machine it is currently renting for $155,000. This machine will require $24,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $260,000. This machine will require $19,000 per year in ongoing maintenance expenses and will lower bottling costs by $13,000 per year. Also, $35,000 will be spent upfront training the new operators of the machine. Suppose the appropriate discount rate is 8% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines will be depreciated via the straight-line method over seven years and that they have a ten-year life with a negligible salvage value. The corporate tax rate is 20%. Should Beryl's Iced Tea continue…arrow_forwardThe Hub Store at a university in eastern Canada is considering purchasing a self-serve checkout machine similar to those used in many grocery stores and other retail outlets. Currently the university pays part-time wages to students totalling $58,000 per year. A self-serve checkout machine would reduce part-time student wages by $38,000 per year. The machine would cost $300,000 and has a 10-year useful life. Total costs of operating the checkout machine would be $5,600 per year, including maintenance. Major maintenance would be needed on the machine in five years at a total cost of $10,600. The salvage value of the checkout machine in 10 years would be $43,000. The CCA rate is 25%. Management requires a 10% after-tax return on all equipment purchases. The company's tax rate is 30%. Required: 1. Determine the before-tax net annual cost savings that the new checkout machine will provide. Net annual cost savings Net present value $ *********** 2-a. Using the data from (1) above and other…arrow_forward

- es Wendell's Donut Shoppe is investigating the purchase of a new $48,300 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $6,800 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 1,700 dozen more donuts each year. The company realizes a contribution margin of $2.00 per dozen donuts sold. The new machine would have a six-year useful life. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. What discount factor should be used to compute the new machine's internal rate of return? (Round your answers to 3 decimal places.) 3. What is the new machine's internal rate of return? (Round your final answer to the nearest whole percentage.) 4. In addition to the…arrow_forwardAs a result of improvements in product engineering, United Automation is able to sell one of its two milling machines. Both machines perform the same function but differ in age. The newer machine could be sold today for $50,000. Its operating costs are $20,000 a year, but in five years the machine will require a $20,000 overhaul. Thereafter, operating costs will be $30,000 until the machine is finally sold in year 10 for $5,000. The older machine could be sold today for $25,000. If it is kept, it will need an immediate $20,000 overhaul. Thereafter, operating costs will be $30,000 a year until the machine is finally sold in year 5 for $5,000. Both machines are fully depreciated for tax purposes. The company pays tax at 35%. Cash flows have been forecasted in real terms. The real cost of capital is 12%. Which machine should United Automation sell? Explain the assumptions underlying your answer.arrow_forwardA company is considering replacing a machine used in the manufacturing process with a new, more efficient model. The purchase price of the new machine is $150,000 and the old machine can be sold for $100,000. Output for the two machines is identical; they will both be used to produce the same amount of product for five years. However, the annual operating costs of the old machine are $18,000 compared to $10,000 for the new machine. Also, the new machine has a salvage value of $25,000, but the old machine will be worthless at the end of the five years. You are deciding whether the company should sell the old machine and purchase the new model. You have determined that an 8% rate properly reflects the time value of money in this situation and that all operating costs are paid at the end of the year. For this initial comparison you ignore the effect of the decision on income taxes. Required: What is the incremental cash outflow required to acquire the new machine? What is the present…arrow_forward

- Vijayarrow_forwardWendell's Donut Shoppe is investigating the purchase of a new $50,100 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $5,900 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,600 dozen more donuts each year. The company realizes a contribution margin of $1.60 per dozen donuts sold. The new machine would have a six-year useful life. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. What is the new machine's internal rate of return? Note: Round your final answer to the nearest whole percentage. 3. In addition to the data given previously, assume that the machine will have a $17,225 salvage value at the end of six years. Under these conditions, what is the internal rate of return? Note: Round your final answer to the nearest whole percentage. 1. Annual cash…arrow_forwardWendell's Donut Shoppe is investigating the purchase of a new $34,600 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $6,500 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,500 dozen more donuts each year. The company realizes a contribution margin of $1.60 per dozen donuts sold. The new machine would have a six-year useful life.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education