FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

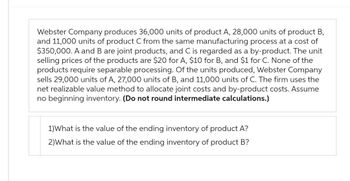

Transcribed Image Text:Webster Company produces 36,000 units of product A, 28,000 units of product B,

and 11,000 units of product C from the same manufacturing process at a cost of

$350,000. A and B are joint products, and C is regarded as a by-product. The unit

selling prices of the products are $20 for A, $10 for B, and $1 for C. None of the

products require separable processing. Of the units produced, Webster Company

sells 29,000 units of A, 27,000 units of B, and 11,000 units of C. The firm uses the

net realizable value method to allocate joint costs and by-product costs. Assume

no beginning inventory. (Do not round intermediate calculations.)

1) What is the value of the ending inventory of product A?

2)What is the value of the ending inventory of product B?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Forest Company has five products in its inventory. Information about ending inventory follows. Product Quantity Unit Cost A 1,000 B 800 с 600 D 200 E 600 $ 10 15 3 7 14 Unit Replacement Unit Selling Cost Price $ 16 18 8 6 13 $ 12 11 2 4 12 The cost to sell for each product consists of a 15 percent sales commission. The normal profit for each product is 40 percent of the selling price. Required: 1. Determine the carrying value of ending inventory, assuming the lower of cost or market (LCM) rule is applied to individual products. 2. Determine the carrying value of inventory, assuming the LCM rule is applied to the entire inventory. 3. Assuming inventory write-downs are common for Forest, record any necessary year-end adjusting entry based on the amount calculated in requirement 2.arrow_forwardHi, Please help with attached questions, thanks much.arrow_forwardNonearrow_forward

- Ames Trading Company has the following products in its ending inventory Cost per Unit Product Mountain bikes. Skateboards Gliders Inventory Items Quantity 12 22 12 Mountain bikes Skateboards Gliders $ 580 330 960 Compute lower of cost or market for inventory applied separately to each product. Units Market per Unit $ 510 370 910 Per Unit Cost Market Cost Total Market LCM applied to each productarrow_forwardBlossom Company sells three different categories of tools (small, medium, and large). The cost and net realizable value of its inventory of tools are as follows. Net Realizable Cost Value Small $63,300 $59,600 Medium 289,600 261,000 Large 151,300 172,500 Determine the value of the company's inventory under the lower-of-cost-or-net realizable value approach. Total inventory value $arrow_forwardThe inventory of Royal Decking consisted of five products. Information about ending inventory is as follows: Product A B C D E Product A Costs to sell consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. Required: What unit value should Royal Decking use for each of its products when applying the lower of cost or net realizable value (LCNRV) rule to units of ending inventory? BUDE Cost $ 180 220 160 140 90 C Per Unit Selling Price $ 200 240 220 240 125 Cost NRV Per Unit Inventory Valuearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education