FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

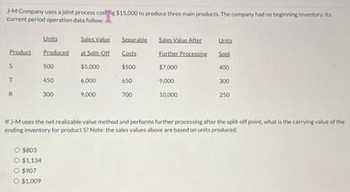

Transcribed Image Text:J-M Company uses a joint process costing $15,000 to produce three main products. The company had no beginning inventory. Its

current period operation data follow

Product

S

T

R

Units

Produced

500

450

300

O $803

O $1,134

O $907

O $1,009

Sales Value

at Solit-Off

$5,000

6,000

9,000

Separable Sales Value After

Further Processing

$7,000

9,000

10,000

Costs

$500

650

700

Units

Sold

400

300

250

If J-M uses the net realizable value method and performs further processing after the split-off point, what is the carrying value of the

ending inventory for product S? Note: the sales values above are based on units produced,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dengerarrow_forwardJax Incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses absorption costing. Sales price $ 57.50 per unit Direct materials $ 10.50 per unit Direct labor $ 8.00 per unit Variable overhead $ 12.50 per unit Fixed overhead $ 1,237,500 per year 1. Compute gross profit assuming (a) 75,000 units are produced and 75,000 units are sold and (b) 110,000 units are produced and 75,000 units are sold.2. By how much would the company’s gross profit increase or decrease from producing 35,000 more units than it sells?arrow_forwardY Company produces two joint products: Sweet and Sour. Joint cost is allocated using the net realizable value method at split-off point. Joint production cost is $70,000. Neither product is salable at split-off point. During May, the additional costs incurred beyond split-off point are as follows: Sweet $ 32,000 Sour $ 48,000 Production: Sweet: 3,200 units Sour: 1,600 units Selling prices: Sweet: $50.00 per unit Sour: $ 90.00 per unit What is the amount of joint cost allocated to Sweet and Sour using the NRV Method at split-off point. (Must show calculations or no credit) Joint cost allocated to Sweet: $_____________________________ Joint cost allocated to Sour:…arrow_forward

- Do not give image formatarrow_forwardForest Products, Incorporated manufactures three products (FP-10, FP-20, and FP-40) from a single, joint input. None of the products can be sold without further processing. In November, joint product costs were $241,300. Additional information follows: Product FP-10 FP-20 FP-40 Units Produced 105,000 157,500 87,500 Product FP-10 FP-20 FP-40 Sales Values $ 177,750 311,250 85,300 Required: Forest Products uses the physical quantities (units produced) method to allocate joint costs. What joint costs would be allocated to each of the three products in November? Joint Costs Allocated Processing Costs (After Split-Off) $ 29,300 109,300 25,300arrow_forwardHi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Incorporated Income Statement Sales Cost of goods sold Selling and administrative expenses Gross margin Net operating loss $ 1,651,800 1,211,394 440,406 640,000 $ (199,594) Hi-Tek produced and sold 60,200 units of B300 at a price of $19 per unit and 12,700 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold B300 $ 400,700 $ 162,000 $ 120,200 $ 42,000 T500 Total $ 562,700 162,200 486,494 $ 1,211,394 The company has created an activity-based costing system to evaluate the profitability…arrow_forward

- The following data relates to Alpha Company. Units in beginning inventory — Units produced 25,000 Units sold ($250 per unit) 21,000 Variable costs per unit: Direct materials $35 Direct labor 60 Variable overhead 25 Fixed costs: Fixed overhead per unit produced $50 Fixed selling and administrative expenses 160,000 Determine the value of ending inventory under variable costing.arrow_forwardNonearrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education