Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no

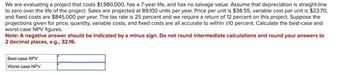

Transcribed Image Text:We are evaluating a project that costs $1,980,000, has a 7-year life, and has no salvage value. Assume that depreciation is straight-line

to zero over the life of the project. Sales are projected at 89,100 units per year. Price per unit is $38.55, variable cost per unit is $23.70,

and fixed costs are $845,000 per year. The tax rate is 25 percent and we require a return of 12 percent on this project. Suppose the

projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and

worst-case NPV figures.

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to

2 decimal places, e.g., 32.16.

Best-case NPV

Worst-case NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Your division is considering two investment projects, each of which requires an up-front expenditure of 25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): a. What is the regular payback period for each of the projects? b. What is the discounted payback period for each of the projects? c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake? d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? f. What is the crossover rate? g. If the cost of capital is 10%, what is the modified IRR (MIRR) of each project?arrow_forwardFriedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.arrow_forwardAlthough the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $110,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $19,000 per year. It would have zero salvage value at the end of its life. The project cost of capital is 10%, and its marginal tax rate is 25%. Should Chen buy the new machine?arrow_forward

- Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forwardWe are evaluating a project that costs $2,100,000, has a 7-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 98,600 units per year. Price per unit is $37.79, variable cost per unit is $23.90, and fixed costs are $857,000 per year. The tax rate is 24 percent and we require a return of 12 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within +10 percent. Calculate the best-case and worst-case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Best-case NPV Worst-case NParrow_forwardWe are evaluating a project that costs $2,190,000, has a 8-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 91,200 units per year. Price per unit is $38.97, variable cost per unit is $24.05, and fixed costs are $866,000 per year. The tax rate is 22 percent and we require a return of 11 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within +10 percent. Calculate the best-case and worst-case NPV figures. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. $ 3,537,150.96 $ -3,452,007.15 Best-case NPV Worst-case NPVarrow_forward

- We are evaluating a project that costs $2,190,000, has a 8-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 91,200 units per year. Price per unit is $38.97, variable cost per unit is $24.05, and fixed costs are $866,000 per year. The tax rate is 22 percent and we require a return of 11 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Best-case NPV Worst-case NPVarrow_forwardWe are evaluating a project that costs $2,250,000, has a 8-year life, and has no salvage value. Assume that depreciation is straight- line to zero over the life of the project. Sales are projected at 94,900 units per year. Price per unit is $39.09, variable cost per unit is $24.15, and fixed costs are $872,000 per year. The tax rate is 24 percent and we require a return of 11 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Best-case NPV Worst-case NPV +arrow_forwardWe are evaluating a project that costs $2,160,000, has a 8-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 90,900 units per year. Price per unit is $38.91, variable cost per unit is $24.00, and fixed costs are $863,000 per year. The tax rate is 21 percent and we require a return of 11 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures.arrow_forward

- We are evaluating a project that costs RM604,000, has an 8-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 55,000 units per year. Price per unit is RM36, variable cost per unit is RM17, and fixed costs are RM685,000 per year. The tax rate is 21 percent and we require a return of 15 percent on this project. (i) Calculate the base-case cash flow and NPV., (ii) Assume the sales figure increases to 56,000 units per year, calculate the sensitivity of NPV to changes in the sales figure?arrow_forwardWe are evaluating a project that costs $820,000, has a life of 7 years, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 159,000 units per year. Price per unit is $43, variable cost per unit is $28, and fixed costs are $833,120 per year. The tax rate is 25 percent, and we require a return of 14 percent on this project. 1a. Calculate the accounting break-even point. Break-even point 1b. What is the degree of operating leverage at the accounting break-even point? DOL 2a. Calculate the base-case cash flow. Cash flowarrow_forwardWe are evaluating a project that costs $800,000, has a life of 8 years, and has no salvage value. Assume that depreciation is straight line to zero over the life of the project. Sales are projected at 60, 000 units per year. Price per unit is $40, variable cost per unit is $20, and fixed costs are $800,000 per year. The tax rate is 21 percent, and we require a return of 11 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within \pm 10 percent. Calculate the best - case and worst-case NPV figures. (arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning