FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

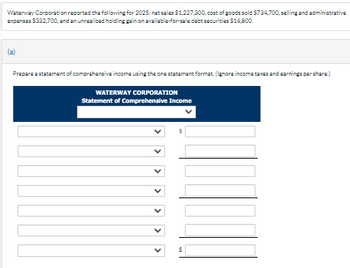

Transcribed Image Text:Waterway Corporation reported the following for 2025: net sales $1,227,300, cost of goods sold $734,700, selling and administrative

expenses $332,700, and an unrealized holding gain on available-for-sale debt securities $16,800.

Prepare a statement of comprehensive income using the one statement format. (Ignore income taxes and earnings per share)

WATERWAY CORPORATION

Statement of Comprehensive Income

MA

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wichita, Inc. reported the following amounts on its financial statements prepared as of the end of the current accounting period: Revenues Expenses Net income Current assets; Long-term assets Total assets Current liabilities Long-term liabilities Total liabilities. Common stock Retained earnings Total equity Total liabilities and equity What is the company's debt-to-assets ratio? $200,000 180,000 $50,000 150,000 $ 20,000 80,000 $ 40,000 60,000 $ 20,000 $200,000 100,000 100,000 $200,000arrow_forwardam. 17.arrow_forwardFinancial statements for Askew Industries for 2024 are shown below (in thousands): 2024 Income statement Net sales Cost of goods sold Gross profit Operating expenses Interest expense Income tax expense Net income Assets Cash $ 9,400 (6,400) 3,000 (2,200) (240) (224) $ 336 Bonds payable Common stock Retained earnings Comparative Balance Sheets. Accounts receivable Inventory Property, plant, and equipment (net) Liabilities and Shareholders' Equity Current liabilities December 31 2024 $ 640 640 840 2,400 $ 4,520 $ 1,340 1,600 640 940 $ 4,520 2023 $ 540 440 640 2,500 $4,120 $ 1,090 1,600 640 790 $ 4,220 Required: Calculate the following ratios for 2024 Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places.arrow_forward

- Condensed financial data are presented below for the Tulsa Corporation: Accounts receivable Inventory C. d. Total current assets Total assets Current liabilities Long-term liabilities Sales Cost of goods sold Interest expense Net income Tax rate 2021 $277,500 310,000 675,000 800,000 700,000 250,000 200,000 77,500 75,000 1,640,000 985,000 10,000 130,000 25% 2020 $230,000 250,000 565,000 The profit margin used to calculate return on assets for 2021 is (rounded): a. b. 8.9% 16.3% 17.2% 18.3%arrow_forward1arrow_forwardSome recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Earnings before interest and taxes Interest paid Net income Dividends Retained earnings 2020 $35,585 $38,940 28,846 43,112 18,401 3,970 SMOLIRA GOLF CORPORATION 2021 Income Statement a. Price-earnings ratio b. Dividends per share c. Market-to-book ratio d. PEG ratio SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities $57,956 $110,898 $ 465,585 $ 27,000 37,022 Accounts payable Notes payable Other $ 521,433 Total $ 523,541 $ 632,331 Total liabilities and owners' equity Long-term debt times Owners' equity Common stock and paid-in surplus Accumulated retained earnings times times Total $ 512,454 363,528 45,963 $102,963 20,883 $ 82,080 18,058 $ 64,022 Smolira Golf Corporation has 52,000…arrow_forward

- On January 1, 2025, Artic Inc. had the following balance sheet: Cash Total Debt investments (available-for-sale) 363,000 $434,000 Assets Interest revenue ARTIC INC. BALANCE SHEET AS OF JANUARY 1, 2025 ARTIC INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2025 $11,000 Gain on sale of investments Net income $71,000 Common stock (a) The accumulated other comprehensive income related to unrealized holding gains on available-for-sale debt securities. The fair value of Artic Inc.'s available-for-sale debt securities at December 31, 2025, was $310,000; its cost was $277,000. No debt securities were purchased during the year. Artic Inc.'s income statement for 2025 was as follows: (Ignore income taxes.) 28,000 $39,000 (Assume all transactions during the year were for cash.) Accumulated other comprehensive income Total Equity $389,000 Debit 45,000 $434,000 Prepare the journal entry to record the sale of the available-for-sale debt securities in 2025. (Credit account titles are…arrow_forwardGive answer with explanationarrow_forwardPresented below are the comparative income and retained eamings statements for Buffalo Inc. for the years 2020 and 2021. 2021 2020 Sales $314,000 $272,000 Cost of sales 200,000 147,000 Gross profit 114,000 125,000 Еxpenses 94,500 52,700 Net income $19,500 $72,300 Retained earnings (Jan. 1) $116,900 $70,700 Net income 19,500 72,300 Dividends (27,000 ) (26,100 ) Retained earnings (Dec. 31) $109,400 $116,900 The follawing additional information is provided: In 2021, Buffalo Inc. decided to switch its depreciation method from sum-of-the-years' digits to the straight-line method. The assets were purchased at the beginning of 2020 for $98,000 with an estimated useful life of 4 years and no salvage value. (The 2021 income statement contains depreciation expense of $29,400 on the assets purchased at the beginning of 2020.) 1. In 2021, the company discovered that the ending inventory for 2020 was overstated by $24,100; ending inventory for 2021 is correctly stated. 2. Prepare the revised…arrow_forward

- Here are simplified financial statements for Phone Corporation in 2020: Net sales Cost of goods sold Other expenses INCOME STATEMENT (Figures in $ millions) Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 21%) Net income Dividends Assets Cash and marketable securities Receivables Inventories Other current assets BALANCE SHEET (Figures in $ millions) Total current assets Net property, plant, and equipment Other long-term assets. Total assets Liabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 13,600 4,310 4,162 2,668 $2,460 718 $1,750 368 a. Return on equity (use average balance sheet figures) b. Return on assets (use average balance sheet figures) c. Return on capital (use average balance sheet figures) d. Days in inventory (use start-of-year balance sheet…arrow_forward- What are the firm’s current ratios for 2018 and 2019?arrow_forwardThe following is information for Concord Corp. for the year ended December 31, 2020: Sales revenue Unrealized gain on FV-OCI equity investments Interest income Cost of goods sold Selling expenses Administrative expenses Dividend revenue $1,450,000 40,000 Concord Corp. Statement of Financial Performance 5,000 870,000 72,500 46,000 25,000 Loss on inventory due to decline in net realizable value Loss on disposal of equipment Depreciation expense related to buildings omitted by mistake in 2019 Retained earnings at December 31, 2019 Loss from expropriation of land Dividends declared The effective tax rate is 35% on all items. Concord prepares financial statements in accordance with IFRS. The FV-OCI equity investments trade on the stock exchange. Gains/losses on FV-OCI investments are not recycled through net income. $76,000 25,000 53,000 980,000 58,000 43,000 Prepare a multiple-step statement of financial performance for 2020, showing expenses by function. Ignore calculation of EPS.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education