FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

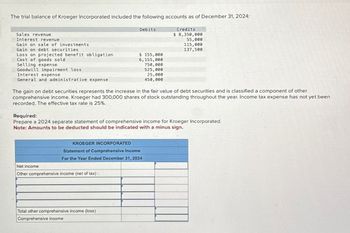

Transcribed Image Text:The trial balance of Kroeger Incorporated included the following accounts as of December 31, 2024:

Sales revenue

Interest revenue

Gain on sale of investments

Gain on debt securities

Cost of goods sold

Loss on projected benefit obligation

Selling expense

Goodwill impairment loss

Interest expense

General and administrative expense

Debits

Credits

$ 8,350,000

55,000

115,000

137,500

$ 155,000

6,155,000

750,000

525,000

25,000

450,000

The gain on debt securities represents the increase in the fair value of debt securities and is classified a component of other

comprehensive income. Kroeger had 300,000 shares of stock outstanding throughout the year. Income tax expense has not yet been

recorded. The effective tax rate is 25%.

Required:

Prepare a 2024 separate statement of comprehensive income for Kroeger Incorporated.

Note: Amounts to be deducted should be indicated with a minus sign.

KROEGER INCORPORATED

Statement of Comprehensive Income

For the Year Ended December 31, 2024

Net income

Other comprehensive income (net of tax):

Total other comprehensive income (loss)

Comprehensive income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The balance sheet for Shankland Corporation follows: 000'009 $ 000006 Current assets Long-term assets (net) Total assets Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings 000 0000 000 00 000 009' 000 006 Total liabilities and stockholders' equity 000'00s Required Compute the following. (Round "Ratios" to 1 decimal place.) Working capital Current ratio Debt-to-assets ratio Debt-to-equity ratioarrow_forwardEffect of Financing on Earnings per Share Henriksen Co., which produces and sells biking equipment, is financed as follows: Bonds payable, 10% (issued at face amount) $650,000 Preferred $1 stock, $10 par 650,000 Common stock, $25 par 650,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is (a) $253,500, (b) $318,500, and (c) $383,500. Enter answers in dollars and cents, rounding to two decimal places. a. Earnings per share on common stock $fill in the blank 1 b. Earnings per share on common stock $fill in the blank 2 c. Earnings per share on common stock $fill in the blank 3arrow_forward15. The income statement of Osborne Company reported net income of $500,000 for the year ended December 31 before considering the following: a. During the year, Osborne purchased trading securities b. At year end, the fair value of the investment portfolio was $35,000 less than the cost 4 c. The balance of Retained Earnings was $743,000 on January 1; d. Osborne paid $46,000 cash dividends during the year. Using the above data, calculate the balance of Retained Earnings on December 31.arrow_forward

- Effect of Financing on Earnings per Share Henriksen Co., which produces and sells biking equipment, is financed as follows: Bonds payable, 10% (issued at face amount) $450,000 Preferred $1 stock, $10 par 450,000 Common stock, $25 par 450,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is (a) $193,500, (b) $238,500, and (c) $283,500. Enter answers in dollars and cents, rounding to two decimal places. a. Earnings per share on common stock b. Earnings per share on common stock $ c. Earnings per share on common stockarrow_forwardA Company provided the following data for the current year: Gain on sale of equipment – P60,000; Proceeds from sale of equipment – P100,000; Purchase of bonds with P2,000,000 face value – P1,800,000; Amortization of bond discount – P20,000; Dividends declared – P450,000; Dividends paid – P380,000; Proceeds from sale of treasury shares (at cost P650,000) – P750,000 What amount should be reported as net cash used in investing activities? [A] 1,700,000 [B] 1,760,000 [C] 1,880,000 [D] 1,940,000arrow_forwardSFP accounts of Sandhill Inc., which follows IFRS, follow: Debit accounts Cash FV-NI investments Accounts receivable Merchandise inventory Machinery Buildings Land Credit accounts Sandhill Inc. Comparative Statement of Financial Position Accounts December 31, 2023 and 2022 Allowance for expected credit losses Accumulated depreciation-machinery Accumulated depreciation-buildings Accounts payable Accrued liabilities Income taxes payable Long-term note payable-non-trade Common shares Retained earnings Additional information: 1 2 3. 4. 2023 $44,900 22,660 67,390 30,430 29,400 67,420 7,500 $269,700 $1,290 5,795 13,350 29,590 2,405 910 26,300 150,000 40,060 $269,700 2022 $33,400 40,000 59,900 24,400 Sandhill's 2023 statement of income is as follows: 18,250 56,250 7,500 $239,700 $540 2,420 8,850 24,350 1,160 1,410 Sandhill has adopted the policy of classifying interest paid as operating activities and dividends paid as financing activities. 31,300 125,000 44,670 $239,700 Cash dividends…arrow_forward

- 1. SLM, Inc., with sales of $1,000, has the following balance sheet: SLM, Incorporated Balance Sheet as of 12/31/X0 Labilities and Equit Trade accounts payable Long-term debt Equity Assets Accounts receivable $ 200 Inventory 400 Plant 800 $1,400 $ 200 600 600 $1,400 It earns 10 percent on sales (after taxes) and pays no dividends. a. Determine the balance sheet entries for sales of $1,500 using the per- cent of sales method of forecasting. b. Will the firm need external financing to grow to sales of $1,500? e. Construct the new balance sheet and use newly issued long-term br to cover any financial deficiency, EXINCarrow_forwardProjected Spontaneous Liabilities Smiley Corporation's current sales and partial balance sheet are shown below. This year Sales $ 10,000 Balance Sheet: Liabilities Accounts payable $ 1,500 Notes payable $ 2,500 Accruals $ 1,800 Total current liabilities $ 5,800 Long-term bonds $ 2,000 Total liabilities $ 7,800 Common stock $ 1,500 Retained earnings $ 2,000 Total common equity $ 3,500 Total liabilities & equity $ 11,300 Sales are expected to grow by 8% next year. Assuming no change in operations from this year to next year, what are the projected spontaneous liabilities? Do not round intermediate calculations. Round your answer to the nearest dollar. $arrow_forwardAtlanta Company $ 429,000 572,000 Atlanta Company Spokane Company Total liabilities Total equity Compute the debt-to-equity ratio for each of the above companies. Debt to equity ratio Choose Numerator: Spokane Company $ 549,000 1,830,000 / Choose Denominator: 1 1 1 = Debt-to-equity ratio =arrow_forward

- a company has the following items: share capital-ordinaty: $920,000 treasury shares : $85,000 deferred taxes $100,000 retained earning : $ 363,000 which ammount should be report as total equity ? A- 1098000 B- 1198000 C- 1298000 D- 1398000arrow_forwardProjected Spontaneous Liabilities Smiley Corporation's current sales and partial balance sheet are shown below. This year Sales $ 10,000 Balance Sheet: Liabilities Accounts payable $ 1,500 Notes payable $ 3,000 Accruals $ 1,600 Total current liabilities $ 6,100 Long-term bonds $ 2,000 Total liabilities $ 8,100 Common stock $ 2,000 Retained earnings $ 3,000 Total common equity $ 5,000 Total liabilities & equity $ 13,100 Sales are expected to grow by 12% next year. Assuming no change in operations from this year to next year, what are the projected spontaneous liabilities? Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardProjected Spontaneous Liabilities Smiley Corporation's current sales and partial balance sheet are shown below. This year Sales $ 10,000 Balance Sheet: Liabilities Accounts payable $ 1,500 Notes payable $ 3,000 Accruals $ 1,600 Total current liabilities $ 6,100 Long-term bonds $ 2,000 Total liabilities $ 8,100 Common stock $ 2,000 Retained earnings $ 3,000 Total common equity $ 5,000 Total liabilities & equity $ 13,100 Sales are expected to grow by 12% next year. Assuming no change in operations from this year to next year, what are the projected spontaneous liabilities? Do not round intermediate calculations. Round your answer to the nearest dollar. Answer is not 6832.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education