FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

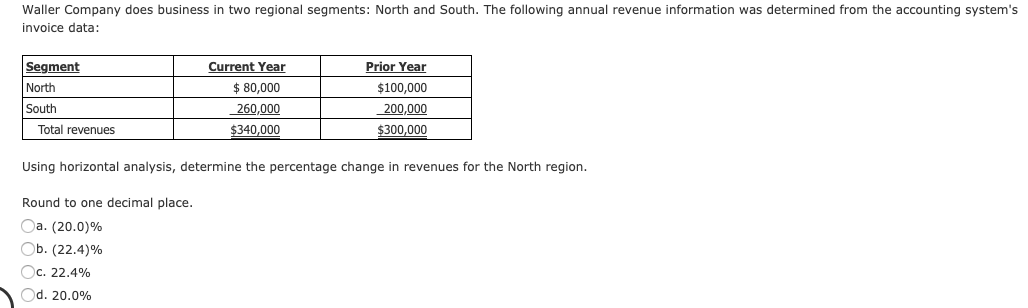

Transcribed Image Text:Waller Company does business in two regional segments: North and South. The following annual revenue information was determined from the accounting system's

invoice data:

Current Year

Prior Year

Segment

North

South

$ 80,000

260,000

$100,000

200,000

Total revenues

$340,000

$300,000

Using horizontal analysis, determine the percentage change in revenues for the North region.

Round to one decimal place.

Oa. (20.0)%

Ob. (22.4)%

Oc. 22.4%

Od. 20.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume Carla Vista Company has the following reported amounts: Sales revenue $1,489,000, Sales returns and allowances $44,000. Cost of goods sold $955,145, and Operating expenses $321,200. (a) Compute net sales. Net sales $ (b) Compute gross profit. Gross profit $ (c) Compute income from operations. Income from operations $ (d) Compute the gross profit rate. (Round answer to 1 decimal place, e.g. 25.2%.) Gross profit rate %arrow_forwardAssume the following sales data for a company:Current year$832,402 Preceding year608,082What is the percentage increase in sales from the preceding year to the current year? a.136.89% b.36.89% c.73.05% d.26.95% The relationship of $242,729 to $104,267, expressed as a ratio, is a.0.8 b.2.3 c.0.4 d.0.7arrow_forwardHorizontal Analysis of the Income Statement Income statement data for Boone Company for the years ended December 31, 20Y5 and 20Y4, are as follows: 20Υ5 20Υ4 Sales $673,200 $510,000 Cost of goods sold (572,000) (440,000) Gross profit $101,200 $70,000 Selling expenses $(30,500) $(25,000) Administrative expenses (27,300) (21,000) Total operating expenses $(57,800) $(46,000) Income before income tax $43,400 $24,000 Income tax expenses (17,400) (9,600) Net income $26,000 $14,400 a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for 20Y5 when compared with 20Y4. Round percentage answers to one decimal place. Boone Company Comparative Income Statement For the Years Ended December 31, 20Y5 and 20Y4 20Y5 Amount 20Y4 Amount Increase (Decrease) Amount Increase (Decrease) Percent Sales $673,200 $510,000 % Cost of goods sold (572,000) (440,000) Gross profit $101,200 $70,000 % Selling expenses $(30,500) $(25,000) Administrative expenses (27,300)…arrow_forward

- Benson Company’s net income was $225,000 for Year 1, $243,750 for Year 2, and $293,160 for Year 3. Assume trend percentages for net income over the three-year period are computed, with Year 1 serving as the base year.The trend percentage for Year 3’s net income is: Select one: A. 117.30% B. 86.36% C. 120.92% D. 130.29%arrow_forwardSellall Department Stores reported the following amounts as of its December 31 year-end: Administrative Expenses, $2,400; Cost of Goods Sold, $22,728; Income Tax Expense, $3,000; Interest Expense, $1,600; Interest Revenue, $200; General Expenses, $2,600; Net Sales, $37,880; and Delivery (freight-out) Expense, $300. Required: 1. Calculate the gross profit percentage. 2. How has Sellall performed, relative to the 24.5 percent gross profit percentage reported for Walmart in 2019? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.)check all that apply Sellall Department Stores earned a higher gross profit percentage than Walmart. Walmart earned a higher gross profit percentage than Sellall Department Stores. Sellall includes more mark-up in the prices it charges customers than Walmart. Walmart includes more mark-up in prices it…arrow_forwardCochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forward

- Income statement data for Winthrop Company for two recent years ended December 31, are as follows: Current Year Previous Year Sales $369,600 $280,000 Cost of goods sold 312,000 240,000 Gross profit $57,600 $40,000 Selling expenses $17,080 $14,000 Administrative expenses 15,600 12,000 Total operating expenses $32,680 $26,000 Income before income tax $24,920 $14,000 Income tax expenses 10,000 5,600 Net income $14,920 $8,400 a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Winthrop Company Comparative Income Statement For the Years Ended December 31 Current Previous Increase Increase year year (Decrease) (Decrease) Amount Amount Amount Percent Sales $369,600 $280,000 $ % Cost of goods sold 312,000 240,000 % Gross profit $57,600 $40,000 %arrow_forwardSegment Analysis Verity Company does business in two customer segments: Retail and Wholesale. The following annual revenue information was determined from the accounting system's invoice information: 20Y5 20Y4 Retail $145,400 $138,500 Wholesale 173,100 189,300 Total revenue $318,500 $327,800 Prepare a horizontal analysis of the segments. Round percentages to one decimal place. Enter negative values as negative numbers. Verity Company Horizontal Analysis For the Years 20Y4 and 20Y5 20Y5 20Y4 Difference - Amount Difference - Percent Retail $145,400 $138,500 $fill in the blank fill in the blank % Wholesale 173,100 189,300 fill in the blank fill in the blank % Total revenue $318,500 $327,800 $fill in the blank fill in the blank % Prepare a vertical analysis of the segments. If required, round percentages to one decimal place. Verity Company Vertical Analysis For the Years 20Y4 and 20Y5 20Y5 Amount 20Y5 Percent 20Y4…arrow_forwardSelected data from the financial statements of Rags to Riches are provided below: Current Year Prior Year Accounts Receivable $120,000 $ 76,000 Inventory 24,000 32,000 Total Assets 900,000 760,000 Net Sales 760,000 540,000 Cost of Goods Sold 320,000 420,000 Which of the following would result from vertical analysis of the company's income statement? a. The accounts receivable turnover ratio is 7.76 in the current year. b. Gross profit is 57.9% of net sales for the current year. c. Net sales are 84.4% of total assets for the current year. d. Cost of goods sold decreased by $50,000 or 23.8% duringarrow_forward

- Return on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $661,910Interest expense 116,810Average total assets 6,280,000Determine the return on total assets. If required, round the answer to one decimal place.fill in the blank 1 %arrow_forwardSubject:arrow_forwardThe income statement of Booker T Industries Inc. for the current year ended June 30 is as follows: Sales $570,960 Cost of merchandise sold 324,190 Gross profit $246,770 Operating expenses: Depreciation expense $43,810 Other operating expenses 115,830 Total operating expenses 159,640 Income before income tax S87,130 Income tax expense 24,180 Net income $62,950 Changes in the balances of selected accounts from the beginning to the end of the current year are as follows: Increase Decrease Accounts receivable (net) S(12,650) Inventories 4,410 Prepaid expenses (4,220) Accounts payable (merchandise creditors) (9,000) Accrued expenses payable (operating expenses) 1,260 Income tax payable (3,020) a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the direct method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Booker T Industries Inc. Cash Flows from Operating Activities…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education