Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Vinubhai

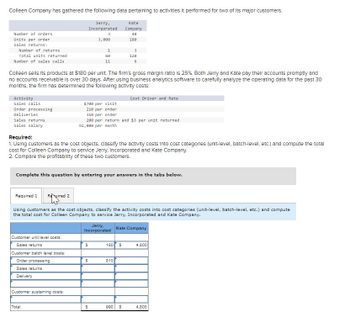

Transcribed Image Text:Colleen Company has gathered the following data pertaining to activities it performed for two of its major customers.

Jerry,

Incorporated

3

3,000

Number of orders

Units per order

Sales returns:

Number of returns

Total units returned

Number of sales calls

Activity

Sales calls

Order processing

Deliveries

Sales returns

Sales salary

Colleen sells its products at $180 per unit. The firm's gross margin ratio is 25%. Both Jerry and Kate pay their accounts promptly and

no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30

months, the firm has determined the following activity costs:

Required 2

Customer unit level costs:

Sales returns

Required:

1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total

cost for Colleen Company to service Jerry, Incorporated and Kate Company.

2. Compare the profitability of these two customers.

Customer batch level costs:

Order processing

Sales returns

Delivery

Complete this question by entering your answers in the tabs below.

Customer sustaining costs:

Total

1

60

11.

Required 1

Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute

the total cost for Colleen Company to service Jerry, Incorporated and Kate Company.

$700 per visit

210 per order

310 per order

200 per return and $3 per unit returned

92,000 per month

Jerry,

Incorporated

$

$

Kate

Company

48

180

$

3

120

Cost Driver and Rate

180 $

810

990 $

Kate Company

4,800

4,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Colleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units returned Number of sales calls Jerry, Incorporated Kate Company 6 30 1,000 420 4 5 50 13 140 5 Colleen sells its products at $290 per unit. The firm's gross margin ratio is 20%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Sales calls Cost Driver and Rate $800 per visit Order processing Deliveries Sales returns Sales salary Required: 180 per order 410 per order 270 per return and $3 per unit returned 107,000 per month 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen Company…arrow_forwardColleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units returned Jerry, Incorporated 5 Kate Company 60 2,000 220 3 30 13 5 190 6 Number of sales calls Colleen sells its products at $290 per unit. The firm's gross margin ratio is 25%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Sales calls Deliveries Cost Driver and Rate $1,000 per visit 200 per order 440 per order Order processing 290 per return and $6 per unit returned 99,000 per month Sales returns Sales salary Required: 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen Company…arrow_forwardColleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units returned Number of sales calls Jerry, Incorporated 6 Kate Company 38 1,000 420 4 50 13 148 5 Colleen sells its products at $290 per unit. The firm's gross margin ratio is 20%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Sales calls Order processing Deliveries Sales returns Sales salary Required: Cost Driver and Rate $800 per visit 180 per order 410 per order 270 per return and $3 per unit returned 107,000 per month 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen Company to…arrow_forward

- Colleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units returned Jerry, Incorporated 6 Kate Company 60 3,000 460 4 50 15 3 190 4 es Number of sales calls Colleen sells its products at $230 per unit. The firm's gross margin ratio is 25%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Sales calls Deliveries Cost Driver and Rate $800 per visit 280 per order. 440 per order Order processing 240 per return and $3 per unit returned 83,000 per month. Sales returns Sales salary Required: 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen…arrow_forwardColleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Jerry, Inc. Kate Co. Number of orders 6 30 Units per order 2,000 440 Sales returns: Number of returns 4 5 Total units returned 60 180 Number of sales calls 11 3 Colleen sells its products at $180 per unit. The firm’s gross margin ratio is 25%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Cost Driver and Rate Sales calls $ 800 per visit Order processing 420 per order Deliveries 400 per order Sales returns 290 per return and $3 per unit returned Sales salary 114,000 per month Required: 1. Using customers as the cost objects, classify the activity costs…arrow_forwardColleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Jerry, Incorporated Kate Company Number of orders 4 50 Units per order 3,000 160 Sales returns: Number of returns 2 5 Total units returned 40 120 Number of sales calls 14 3 Colleen sells its products at $280 per unit. The firm’s gross margin ratio is 25%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Cost Driver and Rate Sales calls $600 per visit Order processing 240 per order Deliveries 480 per order Sales returns 270 per return and $6 per unit returned Sales salary 94,000 per month Required: 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level,…arrow_forward

- The monster truck operates serveral specialtyarrow_forwardR&R Savings Bank finds that its basic transaction account, which requires a $1000 minimum balance, costs this savings bank an average of $3.25 per month in servicing costs (including labor and computer time) and $1.25 per month in overhead expenses. The savings bank also tries to build in a $0.50 per month profit margin on these accounts. Further analysis of customer accounts reveals that for each $100 above the $500 minimum in average balance maintained in its transaction accounts, R&R Savings saves about 5 percent in operating expenses with each account. (Note: If the bank saves about 5 percent in operating expenses for each $100 held in balances above the $500 minimum, then a customer maintaining an average monthly balance of $1,000 should save the bank 25 percent in operating costs) For a customer who consistently maintains an average balance of $1,200 per month, how much should the bank charge in order to protect its profit margin? 05.00 4.68 O 0.32 325arrow_forwardGambarini Corporation is a wholesaler that sells a single product. Please provide answer this general accounting questionarrow_forward

- The following is select account information for Sunrise Motors. Sales: $256,400; Sales Returns and Allowances: $34,890; COGS: $120,470; Sales Discounts: $44,760. Given this information, what is the Gross Profit Margin Ratio for Sunrise Motors? (Round to the nearest whole percentage.)arrow_forwardMedwig Corporation has a DSO of 17 days. The company averages 3,500 in sales each day (all customers take credit). What is the companys average accounts receivable?arrow_forwardCustomers as a Cost Object Morrisom National Bank has requested an analysis of checking account profitability by customer type. Customers are categorized according to the size of their account: low balances, medium balances, and high balances. The activities associated with the three different customer categories and their associated annual costs are as follows: Additional data concerning the usage of the activities by the various customers are also provided: Required: (Note: Round answers to two decimal places.) 1. Calculate a cost per account per year by dividing the total cost of processing and maintaining checking accounts by the total number of accounts. What is the average fee per month that the bank should charge to cover the costs incurred because of checking accounts? 2. Calculate a cost per account by customer category by using activity rates. 3. Currently, the bank offers free checking to all of its customers. The interest revenues average 90 per account; however, the interest revenues earned per account by category are 80, 100, and 165 for the low-, medium-, and high-balance accounts, respectively. Calculate the average profit per account (average revenue minus average cost from Requirement 1). Then calculate the profit per account by using the revenue per customer type and the unit cost per customer type calculated in Requirement 2. 4. CONCEPTUAL CONNECTION After the analysis in Requirement 3, a vice president recommended eliminating the free checking feature for low-balance customers. The bank president expressed reluctance to do so, arguing that the low-balance customers more than made up for the loss through cross-sales. He presented a survey that showed that 50% of the customers would switch banks if a checking fee were imposed. Explain how you could verify the presidents argument by using ABC.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning