Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

need question 2 solved thank you

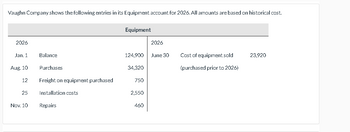

Transcribed Image Text:Vaughn Company shows the following entries in its Equipment account for 2026. All amounts are based on historical cost.

Equipment

2026

2026

Jan. 1

Balance

124,900

June 30

Cost of equipment sold

23,920

Aug. 10

Purchases

34,320

(purchased prior to 2026)

12

Freight on equipment purchased

750

25

Installation costs

2,550

Nov. 10

Repairs

460

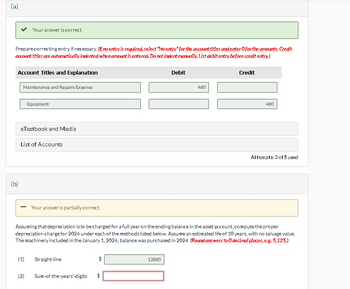

Transcribed Image Text:(a)

Your answer is correct.

Prepare correcting entry if necessary. (if no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit

account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry.)

(b)

Account Titles and Explanation

Maintenance and Repairs Expense

Equipment

eTextbook and Media

List of Accounts

-

Your answer is partially correct.

Debit

460

Credit

460

Attempts: 3 of 5 used

Assuming that depreciation is to be charged for a full year on the ending balance in the asset account, compute the proper

depreciation charge for 2026 under each of the methods listed below. Assume an estimated life of 10 years, with no salvage value.

The machinery included in the January 1, 2026, balance was purchased in 2024. (Round answers to O decimal places, e.g. 5,125.)

(1)

Straight-line

$

(2)

Sum-of-the-years'-digits

$

13660

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- P10.5arrow_forwardEquipment that cost $875000 and had a book value of $384000 was sold for $452000. Data from the comparative balance sheets are: 12/31/21 12/31/20 Equipment $5380000 $4869000 Accumulated Depreciation 1652000 1500000 Depreciation expense for 2021 was O $643000. O $711000. O $143000. O $98000arrow_forwardP10.5A Journalise a series of equipment transactions related to purchase, sale, retirement, and depreciation At December 31, 2021. Grand Regency Limited reported the following as Non-current tangible assets: 4,000,000 16,400,000 June 11 July 1 Dec. 31 Land Buildings Less: Accumulated depreciation - buildings Equipment Less: Accumulated depreciation - equipment Total plant assets During 2022, the following selected cash transactions occurred. April 1 Purchased land for R2,130,000. May 1 (b) (c) (d) 28,500,000 12,100,000 48,000,000 5,000,000 Required: (a) 43,000,000 £63,400,000 Sold equipment that cost R750,000 when purchased on January 1, 2018. The equipment was sold for R450,000. Sold land purchased on June 1, 2012 for R1,500,000. The land cost R400,000. Purchased equipment for R2,500,000. Retired equipment that cost R500,000 when purchased on December 31, 2012. No salvage value was received. Prepare general journal entries the above transactions. The company uses straight-line…arrow_forward

- Good morningarrow_forwardSh61arrow_forwardRefer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000arrow_forward

- CHAIN PROBLEM: Kindly provide solution and answer for the 4 questions below:arrow_forward9. These are the books of Riya Distributers as at 28 February 2021. Equipment R20 000, Accumulated Depreciation R16 000. Depreciation is calculated at 20% p. a. on a diminishing method. An old equipment was disposed for R1 500 cash on 1 December 2020. The equipment originally costed R3 000. The Accumulated depreciation is R 700. The depreciation for the disposed equipment is A.R460 B.R345 C.R225 D.R92 10. These are the books of Riya Distributers as at 28 February 2021. Equipment R20 000, Accumulated Depreciation R16 000. Depreciation is calculated at 20% p. a. on a diminishing method. An old equipment was disposed for R1 500 cash on 1 December 2020. The equipment originally costed R3 000. The Accumulated depreciation is R 700. The profitloss for the disposed equipment is A.Profitloss R300 B.Profit/loss R92 C.Profit/loss R455 D.Profit/loss R460arrow_forwardThe following data relate to the Machinery account of Eshkol, Inc. at December 31, 2020. Aug. Machinery Aug.00AAug.00 Aug. Aug.0BAug.0 Aug. Aug.0CAug.0 Aug. Aug.000DAug.000 Original cost $46,000 $51,000 $80,000 $80,000 Year purchased 2015 2016 2017 2019 Useful life 10 years 15,000 hours 15 years 10 years Salvage value $ 3,100 $ 3,000 $ 5,000 $ 5,000 Depreciation method Sum-of-the-years’-digits Activity Straight-line Double-declining-balance Accum. depr. through 2020* $31,200 $35,200 $15,000 $16,000 *In the year an asset is purchased, Eshkol, Inc. does not record any depreciation expense on the asset. In the year an asset is retired or traded in, Eshkol, Inc. takes a full year’s depreciation on the asset. The following transactions occurred during 2021. a. On May 5, Machine A was sold for $13,000 cash. The company’s bookkeeper recorded this retirement in the following manner in the cash receipts journal.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning