Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Solve general accounting question

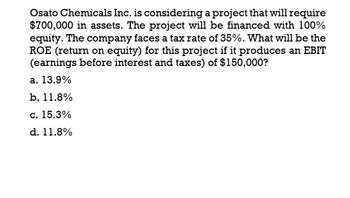

Transcribed Image Text:Osato Chemicals Inc. is considering a project that will require

$700,000 in assets. The project will be financed with 100%

equity. The company faces a tax rate of 35%. What will be the

ROE (return on equity) for this project if it produces an EBIT

(earnings before interest and taxes) of $150,000?

a. 13.9%

b. 11.8%

c. 15.3%

d. 11.8%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?arrow_forwardFalkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardOgier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forward

- The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has an initial after-tax cost of 170,000. The project will produce 1,000 cases of mineral water per year indefinitely, starting at Year 1. The Year-1 sales price will be 138 per case, and the Year-1 cost per case will be 105. The firm is taxed at a rate of 25%. Both prices and costs are expected to rise after Year 1 at a rate of 6% per year due to inflation. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits because the spring has an indefinite life and will not be depreciated. a. What is the present value of future cash flows? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) What is the NPV? b. Suppose that the company had forgotten to include future inflation. What would they have incorrectly calculated as the projects NPV?arrow_forwardMason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated revenue producing lite of 4 years. Mason has a required rate of return that is 12% and a cost of capital of 11%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardAbcarrow_forward

- I need help with this problem and accountingarrow_forwardAAA Inc. is evaluating a project that will require $500,000 in assets. The project is financed with equity only and is expected to generate earnings before interest and taxes of $90,000. The firm has a tax rate of 16%. What is the ROE (return on equit for this project? a. 16.00% b. 18.15% O c. 10.75% O d. 15.12%arrow_forward????arrow_forward

- Wizard Co. is considering a project that will require $650,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 40%. What will be the ROE (return on equity) for this project if it produces an EBIT of -$40,000? When calculating the tax effects, assume that Wizard Co. as a whole will have a large, positive income this year. O -3.0% O -3.7% O -4.4% O -3.1%arrow_forwardUniversal Exports Inc. is a small company and is considering a project that will require $650,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 25%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $155,000? 10.73% 17.88% 18.77% 12.52% Determine what the project’s ROE will be if its EBIT is –$50,000. When calculating the tax effects, assume that Universal Exports Inc. as a whole will have a large, positive income this year. -4.64% -6.67% -5.22% -5.8% Universal Exports Inc. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company’s debt will be 12%. What will be the project’s ROE if it produces an EBIT of $155,000? 28.11% 18.74% 26.77% 21.42% What will be the project’s ROE if it produces an EBIT of –$50,000 and it…arrow_forwardWizard Co. is considering a project that will require $500,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 30%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $145,000? 20.3% 17.3% 14.2% 16.2% Determine what the project’s ROE will be if its EBIT is –$60,000. When calculating the tax effects, assume that Wizard Co. as a whole will have a large, positive income this year. -9.2% -8.4% -8.8% -7.6% Wizard Co. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company’s debt will be 13%. What will be the project’s ROE if it produces an EBIT of $145,000? 25.2% 36.2% 29.9% 31.5% What will be the project’s ROE if it produces an EBIT of –$60,000 and it finances 50% of the project with equity and 50% with debt? When calculating the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College