Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

need help about this general account question

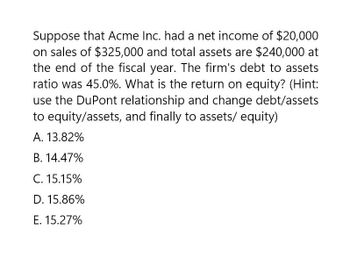

Transcribed Image Text:Suppose that Acme Inc. had a net income of $20,000

on sales of $325,000 and total assets are $240,000 at

the end of the fiscal year. The firm's debt to assets

ratio was 45.0%. What is the return on equity? (Hint:

use the DuPont relationship and change debt/assets

to equity/assets, and finally to assets/equity)

A. 13.82%

B. 14.47%

C. 15.15%

D. 15.86%

E. 15.27%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardNonearrow_forwardNeed answer the accounting questionarrow_forward

- I need answer Accounting questionarrow_forwardSuppose that you are given the following data for Niles Company : Note: The data and calculations are based on a 365-day year. Cash and equivalents Fixed assets Sales Net income Current liabilities Current ratio DSO ROE The current ratio is equal to assets value of Return on equity (ROE) is to approximately $225,000 $650,000 $2,500,000 $112,500 $240,000 2.5 18.25 12.00% The days sales outstanding (DSO) ratio is equal to accounts receivable balance of Plugging in the relevant values for the current ratio and current liabilities, and then solving yields a current . Adding fixed assets to current assets yields a value of total assets of Recall the following identity: Recall that Total Assets = Total Liabilities and Equity. Plugging in the relevant values for ROE and net income yields a value of total common equity of Mathematically, total liabilities and equity is equal to ▼. Plugging in the relevant values for total liabilities and equity, current liabilities, and equity (calculated…arrow_forwardNeed help ASAP :(arrow_forward

- Company has return on assets 12.4% and debt-equity ratio is 0.25. What is ROE? Select one: a.35.43% b.9.18% c.9.3% d.15.5%arrow_forwardTotal debt to total assets% ratio: ?? Round your answer to the nearest hundredth percent Return on equity% ratio: ?? Round your answer to the nearest hundredth percent Asset turnover ratio: ?? Round your answer to the nearest centarrow_forwardROAarrow_forward

- 4. What is the debt to total assets ratio of the Company? a. 107% c. 35% b. 30%. d. 14% 5. What is the times interest earned ratio of the company?a. 5% c. 22% b. 2.5%. d. 2%arrow_forwardPara el año que culmina el 30 de junio de 2018, Northern Air Cooling Corporation tiene: Total assets = $87,631,181 ROA = 11.67 % ROE = 21.19 % Net profit margin = 11.59 % Determina lo siguiente Net income: _____________ Sales: _____________ Debt-to-equity ratio: _____________arrow_forwardTOPIC: Financial Statement Analysis1. Calculate the debt ratio of a company that as an equity multiplier of 2.5 2. A company's sales last year were $615,000 and its net income was $45,800. It has $465,000 in assets financed only by common equity. Determine the profit margin needed to achieve a 14.5% ROE. Use 4 decimal places in your final answer. Express in percentage3. Net income for 2020 was P1,825,600. In 2021, it decreased by 53%. Still using the 2020 net income as the base year, by 2022, net income increased by 130%. Determine the net income for 2021 and 2022, respectively. 4. P240,000 will be deposited in a fund at the beginning of each six months for 5 yrs. Using 11% as the interest rate compounded semiannually, compute how much is in the fund at the end of 4 ½ years just after the last deposit. (use 2 decimal places for your final answer) 5. A company has $6,435,000 in common equity and 1,063,000 in outstanding shares. Shares sell at a price of $30.70 each. Calculate the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT