FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

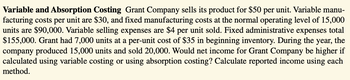

Transcribed Image Text:Variable and Absorption Costing Grant Company sells its product for $50 per unit. Variable manu-

facturing costs per unit are $30, and fixed manufacturing costs at the normal operating level of 15,000

units are $90,000. Variable selling expenses are $4 per unit sold. Fixed administrative expenses total

$155,000. Grant had 7,000 units at a per-unit cost of $35 in beginning inventory. During the year, the

company produced 15,000 units and sold 20,000. Would net income for Grant Company be higher if

calculated using variable costing or using absorption costing? Calculate reported income using each

method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Diego Company manufactures one product that is sold for $75 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 46,000 units and sold 42,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense E al gross margin Okay The company sold 31,000 units in the East region and 11,000 units in the West region. It determined that $200,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $38,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. What is the company's total gross margin…arrow_forwardDiego Company manufactures one product that is sold for $75 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 46,000 units and sold 42,000 units. 2 W Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense Profit will # S The company sold 31,000 units in the East region and 11,000 units in the West region. It determined that $200,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $38,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. 15. Assume the West region invests $36,000…arrow_forwardLynch Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: Variable costs per unit: Manufacturing: Direct materials $ 14 Direct labor $ 8 Variable manufacturing overhead $ 2 Variable selling and administrative $2 Fixed costs per year: Fixed manufacturing overhead $ 250,000 Fixed selling and administrative $ 160,000 During the year, the company produced 25,000 units and sold 21,000 units. The selling price of the company's product is $47 per unit. Required: Assume the company uses absorption costing: Compute the unit product cost. Prepare an income statement for the year. Assume the company uses variable costing: Compute the unit product cost. Prepare an income statement for the year.arrow_forward

- Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Product Weedban $ 10.00 $2.40 $ 131,000 Greengrow $ 34.00 $14.00 $ 31,000 Last year the company produced and sold 42,000 units of Weedban and 16,500 units of Greengrow. Its annual common fixed expenses are $111,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forward8 00:07:23 eBook A corporation that claimed the small business deduction must pay its taxes within three months of its fiscal year end. True or False True Falsearrow_forwardJay-Zee Company makes an in-car navigation system. Next year, Jay-Zee plans to sell 16,000units at a price of $320 each. Product costs include: Direct materials $68Direct labor $40Variable overhead $12Total fixed factory overhead $500,000 Variable selling expense is a commission of 5 percent of price; fixed selling and administrativeexpenses total $116,400.Required:1. Calculate the sales commission per unit sold. Calculate the contribution margin per unit.2. How many units must Jay-Zee Company sell to break even? Prepare an income statementfor the calculated number of units.3. Calculate the number of units Jay-Zee Company must sell to achieve target operatingincome (profit) of $333,408.4. What if the Jay-Zee Company wanted to achieve a target operating income of $322,000?Would the number of units needed increase or decrease compared to your answer inRequirement 3? Compute the number of units needed for the new target operating income.arrow_forward

- Variable and Absorption CostingChandler Company sells its product for $108 per unit. Variable manufacturing costs per unit are $49, and fixed manufacturing costs at the normal operating level of 12,000 units are $240,000. Variable selling expenses are $17 per unit sold. Fixed administrative expenses total $104,000. Chandler had no beginning inventory for the year. During the year, the company produced 12,000 units and sold 9,000. Would net income for Chandler Company be higher if calculated using variable costing or using absorption costing?Calculate reported income using each method.Do not use negative signs with any answers.arrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Weedban $9.00 $ 2.60 $ 137,000 Product Greengrow $36.00 $ 10.00 $ 38,000 Last year the company produced and sold 36,500 units of Weedban and 17,500 units of Greengrow. Its annual common fixed expenses are $98,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forwardSwisher, Incorporated reports the following annual cost data for its single product: Normal production level 30,000 units Direct materials $6.40 per unit Direct labor $3.93 per unit Variable overhead $5.80 per unit Fixed overhead $150,000 in total This product is normally sold for $48 per unit. If Swisher increases its production to 50,000 units, while sales remain at the current 30,000 unit level, by how much would the company's income increase or decrease under variable costing? $60,000 decrease. b. $90,000 decrease. c.There is no change in gross margin. d. $90,000 increase. e. $60,000 increase.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education