Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

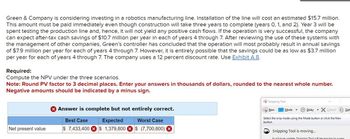

Transcribed Image Text:Green & Company is considering investing in a robotics manufacturing line. Installation of the line will cost an estimated $15.7 million.

This amount must be paid immediately even though construction will take three years to complete (years 0, 1, and 2). Year 3 will be

spent testing the production line and, hence, it will not yield any positive cash flows. If the operation is very successful, the company

can expect after-tax cash savings of $10.7 million per year in each of years 4 through 7. After reviewing the use of these systems with

the management of other companies, Green's controller has concluded that the operation will most probably result in annual savings

of $7.9 million per year for each of years 4 through 7. However, it is entirely possible that the savings could be as low as $3.7 million

per year for each of years 4 through 7. The company uses a 12 percent discount rate. Use Exhibit A.8.

Required:

Compute the NPV under the three scenarios.

Note: Round PV factor to 3 decimal places. Enter your answers in thousands of dollars, rounded to the nearest whole number.

Negative amounts should be indicated by a minus sign.

Net present value

> Answer is complete but not entirely correct.

Best Case

Worst Case

$ (7,700,600)

$ 7,433,400

Expected

$ 1,379,800

Snipping Tool

Delay X Cancel

Select the snip mode using the Mode button or click the New

button.

New

Mode▾

Snipping Tool is moving...

In a future update Snipping Tool will be moving to a new

Opt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- eEgg is considering the purchase of a new distributed network computer system to help handle its warehouse inventories. The system costs $60,000 to purchase and install and $30,000 to operate each year. The system is estimated to be useful for 4 years. Management expects the new system to reduce the cost of managing inventories by $62,000 per year. The firm’s cost of capital (discount rate) is 10%. Required: 1. What is the net present value (NPV) of the proposed investment under each of the following independent situations? (Use the appropriate present value factors from Appendix C, TABLE 1 and Appendix C, TABLE 2.) 1a. The firm is not yet profitable and therefore pays no income taxes. 1b. The firm is in the 30% income tax bracket and uses straight-line (SLN) depreciation with no salvage value. Assume MACRS rules do not apply. 1c. The firm is in the 30% income tax bracket and uses double-declining-balance (DDB) depreciation with no salvage value. Given a four-year life, the DDB…arrow_forwardBlur Corp. is looking at investing in a production facility that will require an initial investment of $500,000. The facility will have a three-year useful life, and it will not have any salvage value at the end of the project’s life. If demand is strong, the facility will be able to generate annual cash flows of $250,000, but if demand turns out to be weak, the facility will generate annual cash flows of only $120,000. Blur Corp. thinks that there is a 50% chance that demand will be strong and a 50% chance that demand will be weak. If the company uses a project cost of capital of 13%, what will be the expected net present value (NPV) of this project? -$66,346 -$63,187 -$34,753 -$44,231 Blur Corp. could spend $510,000 to build the facility. Spending the additional $10,000 on the facility will allow the company to switch the products they produce in the facility after the first year of operations if demand turns out to be weak in year 1. If the…arrow_forwardWavy Inc is examining a project that requires an initial investment of -10 million today. This will be followed by several years of positive incremental after-tax cash flows. However, during the last year of the project's life Wavy expects that the incremental cash flow will again be negative. By which method should Wavy determine whether or not to invest? A) Both NPV or IRR are fine, as they must arrive at same investment decision B) IRR, because there will be no NPV solution in this case C) Neither NPV or IRR are useful in this situation D) NPV, since this project will have two IRRsarrow_forward

- K Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $4.98 million. The product is expected to generate profits of $1.09 million per year for 10 years. The company will have to provide product support expected to cost $98,000 per year in perpetuity. Assume all profits and expenses occur at the end of the year. a. What is the NPV of this investment if the cost of capital is 5.6%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.6% and 14.5%, respectively. b. What is the IRR of this investment opportunity? c. What does the IRR rule indicate about this investment? a. What is the NPV of this investment if the cost of capital is 5.6%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.6% and 14.5%, respectively. If the cost of capital is 5.6%, the NPV will be $ (Round to the nearest dollar.) Should the firm undertake the project? (Select the best choice…arrow_forwardYou are considering opening a new plant. The plant will cost $104.8 million upfront and will take one year to build. After that, it is expected to produce profits of $28.2 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 7.8%. Should you make the investment? Calculate the IRR. Does the IRR rule agree with the NPV rule?arrow_forwardDynamic is considering investing in a rooftop solar network to generate its own power. Any unused power will be sold back to the local utility company. Between cost savings and new revenues, the company expects to generate $1,460,000 per year in net cash inflows from the solar network installation. The solar network would cost $7.2 million and is expected to have a 18-year useful life with no residual value. Calculate (i) the internal rate of return (IRR) and (ii) the net present value (NPV) assuming the company uses a 13% hurdle rate. (i) Calculate the internal rate of return (IRR). Use technology to find this value. (Enter a percentage rounded to two decimal places, X.XX%.) The IRR is %.arrow_forward

- All American Telephones Inc. is considering the productionof a new cell phone. The project will require an investment of $13 million. If the phone iswell received, the project will produce cash flows of $8 million a year for 3 years, but ifthe market does not like the product, the cash flows will be only $2 million per year. Thereis a 50% probability of both good and bad market conditions. All American can delay theproject a year while it conducts a test to determine whether demand will be strong or weak.The delay will not affect the dollar amounts involved for the project’s investment or its cashflows—only their timing. Because of the anticipated shifts in technology, the 1-year delaymeans that cash flows will continue only 2 years after the initial investment is made. AllAmerican’s WACC is 8%. What action do you recommend?arrow_forwardA company is investing in a solar panel system to reduce its electricity costs. The system requires a cash payment of $125,374.60 today. The system is expected to generate net cash flows of $13,000 per year for the next 35 years. The investment has zero salvage value. The company requires an 8% return on its investments. Compute the net present value of this investment.arrow_forwardJamie Williams, the project manager of Arc Systems Ltd. is evaluating a proposal to install solarpanels on the roof of its factory. The panels will cost $150,000 per set. Depending on the price ofelectricity and the efficiency of the panels, the project will increase operating cash flows by either$50,000 per year or $75,000 per year. The useful life of the panels is 5 years. If early resultsindicate savings of $75,000 per year, four additional sets of panels will be installed immediatelyat the same cost with the same projected savings. The probability of either outcome is 50%. Usinga discount rate of 10%:Required:i. Compute the expected NPV of the project if the option to expand is NOT considered. ii. Compute the expected NPV of the project if the option to expand is considered. iii. Why is it important to consider real options in the capital budgeting process? GiveONE (1) specific example.arrow_forward

- Caspian Sea Drinks is considering buying the J-Mix 2000. It will allow them to make and sell more product. The machine cost $1.54 million and create incremental cash flows of $552,182.00 each year for the next five years. The cost of capital is 11.42%. What is the internal rate of return for the J-Mix 2000?arrow_forward| Frontier Corp. is considering a new product that would require an after-tax investment of $1,400,000 at t = 0. If the new product is well received, then the project would produce after-tax cash flows of $650,000 at the end of each of the next 3 years (t = 1, 2, 3), but if the market did not like the product, then the cash flows would be only $100,000 per year. There is a 70% probability that the market will be good. Tsai Corp. could delay the project for a year while it conducted a test to determine if demand would be strong or weak. The project's cost and expected annual cash flows are the same whether the project is delayed or not; however, the timing of the cash flows would change. (There would be the same number of cash flows-only the cash flows would be extended out one extra year.) The project's WACC is 10%. What is the value of the project after considering the investment timing option? a. $108,226.89 b. $137,743.32 c. $167,259.75 d. $196,776.18 e. $216,453.79arrow_forwardFossa Road Paving Corporation is considering an investment in a curb-forming machine. The machine will cost $240,000, will last 10 years, and will have a $40,000 salvage value at the end of 10 years. The machine is expected to generate net cash inflows of $60,000 per year in each of the 10 years. Fossa's discount rate is 18%. The net present value of the proposed investment is closest to (Ignore income taxes.): Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice $69,640 $37,280 $(48,780) $5,840arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education