ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

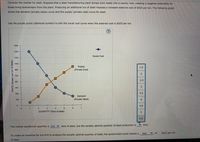

Transcribed Image Text:Consider the market for steel. Suppose that a steel manufacturing plant dumps toxic waste into a nearby river, creating a negative externality for

those living downstream from the plant. Producing an additional ton of steel imposes a constant external cost of $525 per ton. The following graph

shows the demand (private value) curve and the supply (private cost) curve for steel.

Use the purple points (diamond symbol) to plot the social cost curve when the external cost is $525 per ton.

1500

1350

Social Cost

1200

1050

Supply

(Private Cost)

1.5

900

750

2.5

600

450

300

3.5

Demand

150

(Private Value)

4

0.

4.5

0.

1

3.

4

QUANTITY (Tons of steel)

5.5

tons.

The market equilibrium quantity is 3.5 tons of steel, but the socially optimal quantity of steel production is

tax

of

$525 per ton

To create an incentive for the firm to produce the socially optimal quantity of steel, the government could impose a

of steel.

2.

3.

5,

PRICE (Dollars per ton of steel)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Use the graph attached What is the dead weight loss that results from this externality. a) QE - Q* b) Pc- PE c) Pc- Pp d) (Pc-Pp) * QE e) (Pc-Pp) * (QE-Q*) x ½arrow_forwardGive some instances of environmental issues that the Pigovian tax can be used to resolve.arrow_forwardA local school administrator observes an increase in the number of flu cases in the public schools over the last two years. She is concerned that some families cannot afford flu vaccine and are therefore not having children vaccinated. She is also concerned that the failure to vaccinate some children is putting other children at risk, so she proposes that the state subsidize vaccines to increase coverage rates. a. Determine whether the failure to vaccinate some children is an external benefit or an external cost. If an external cost is present, move point A and point B to show the marginal social cost curve. If an external benefit is present, move point A and point B to show the marginal social benefit curve. Place point C at the equilibrium outcome. Place point D at the socially optimal outcome. Flu vaccines A B D Supply (marginal private cost) Pricearrow_forward

- (Figure: Output Levels II) The socially optimal output level could be achieved by a government quota of: Price ($) 100 80 60 40 20 0 SMC S = MC 100 200 300 400 500 Quantity of electricity 250 units of electricity. approximately 212 units of electricity. 175 units of electricity. 100 units of electricity.arrow_forwardhow a tax on pollution affects the market equilibrium, consumer surplus, and producer surplus (Ctrl) ▼arrow_forward2. A perfectly competitive market exists for almonds. Demand for almonds is Q= 200 – P where P is the price of almonds and Q is the total quantity of almonds. The private total Q? The production of almonds cost for the unregulated market is C 50 + 80Q + Q² First, solve for the 2 creates an externality where the total external cost is E = Pigouvian tax (per unit of output of almonds) that results in the social optimum. Suppose that one company, MegaAlmonds, becomes a monopolist in the production of almonds. What is the optimal tax that should be placed on the almonds in this case?arrow_forward

- Show work..arrow_forwardConsider the supply of soybeans in South America and the demand for soybeans in China. Draw a graph in which you show the current market equilibrium price of soybeans and quantity of soybeans traded. Include the curve that shows the true social costs of soybean production. Show the socially optimal amount of soybeans traded. Show the price that should really be charged for soybeans to ensure that production moves to the socially optimal level. Ensure that you label your graph correctly (all curves, axes, prices and quantities labeled). Show the deadweight loss of soybean production. What intervention could be used to change the market price for soybeans to the level that would move the quantity of soybeans traded to the optimal level? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPrice 10 9 8 7 6 Cr 4 3 2 1 0 0 100 200 300 400 500 600 Quantity Answers typed in all of the blanks will be automatically saved. X₂ X² Ω· equilibrium, the price is 3 PMC=S 700 800 900 1,000 1,100 1,200 SWTP Consider the attached graph showing a market with a positive externality. At the competitive market and the quantity is 600 D=WTP At this competitive equilibrium, consumer surplus is Type your answer here, producer surplus is the damage to the environment is Type your answer here Type your answer here, and the total external benefits caused in the production of the good is Type your answer here. Societal welfare - the sum of consumer surplus and producer surplus lessarrow_forward

- Compared to a good with no externalities, a good with a negative externality will appear to have experienced a Increase in Supply ODecrease in Supply Olncrease in Demand i ODecrease in Demand i at each corresponding price.arrow_forwardConsider the market for fire extinguishers. d. If the external benefit is $10 per extinguisher,describe a government policy that would yield theefficient outcome.arrow_forwardLet Q be the quantity of natural gas in tons from fracking. Assume fracking imposes a negative externality of $24 per ton. The private demand for natural gas from fracking is P = 200 - 4Q while the private supply curve is P = 20 + 2Q. If the government imposes a $24 tax per ton of natural gas from fracking, what is the change in the total surplus from before to after the imposition of the tax? O -$672. O $48. O $672. -$48.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education