Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Good Day,

Kindly assist me with the following Query.

Regards

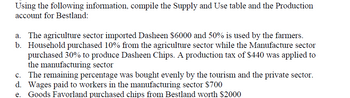

Transcribed Image Text:Using the following information, compile the Supply and Use table and the Production

account for Bestland:

a. The agriculture sector imported Dasheen $6000 and 50% is used by the farmers.

b. Household purchased 10% from the agriculture sector while the Manufacture sector

purchased 30% to produce Dasheen Chips. A production tax of $440 was applied to

the manufacturing sector

c. The remaining percentage was bought evenly by the tourism and the private sector.

d. Wages paid to workers in the manufacturing sector $700

Goods Favorland purchased chips from Bestland worth $2000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forward??arrow_forwardDuring its first year of operations, Silverman Company paid $9,160 for direct materials and $9,700 for production workers' wages. Lease payments and utilities on the production facilities amounted to $8,700 while general, selling, and administrative expenses totaled $4,200. The company produced 5,300 units and sold 3,200 units at a price of $7.70 a unit. What is Silverman's cost of goods sold for the year? Multiple Choice O $27,560 $13,923 $16,640 $23,060arrow_forward

- I need help with this financial accounting question using the proper accounting approach.arrow_forwardPatterson Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. PATTERSON COMPANY Income Statements for the Year 2014 Segment Sales A В C $162,000 $242,000 $263,000 (84,000) (30,000) (80,000) (31,000) Cost of goods sold Sales commissions (128,000) (18,000) Contribution margin General fixed oper. exp. (allocation of president's salary) Advertising expense (specific to individual divisions) 16,000 128,000 152,000 (35,000) (39,000) (33,000) (3,000) (15,000) (26,000) $ 78,000 119,000 Net income Required: a. Prepare a schedule of relevant sales and costs for Segment A. Relevant Rev. and Cost items for Segment A Effect on income b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A PATTERSON COMPANY Comparative Income Statements for the Year 2014 Eliminate Seg. A Keep Seg. A Decision Sales Cost of…arrow_forwardMason Manufacturing is preparing its annual profit plan. As part of its cost analysis, management estimates that $150,000 in purchasing support costs should be allocated to individual suppliers based on the number of shipments received. The company has two major suppliers: • Supplier X received 35 shipments during the year. Supplier Y received 105 shipments during the year. Compute the amount of purchasing costs allocated to Supplier Y, assuming Mason Manufacturing uses number of shipments received to allocate costs. a) $30,000 b) $45,000 c) $90,000 d) $112,500arrow_forward

- A manufacturer of potting soil has the following financial data: Pounds produced and sold 31,000 Sales $248,000 Less: Variable manufacturing costs 157,500 Fixed manufacturing costs 12,600 Variable selling and administrative costs 37,800 Fixed selling and administrative costs 18,900 Net operating income $21,200 (a) What is the company's per unit contribution margin? (Round answer to 2 decimal places, e.g. 1.64.) Per unit contribution margin $arrow_forwardPlease help me figure a-earrow_forwardAnswer thisarrow_forward

- What is its net incomearrow_forwardPatterson Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. PATTERSON COMPANY Income Statements for the Year 2014 Segment Sales А В С $169,000 $243,000 $258,000 (80,000) (31,000) (121,000) (17,000) Cost of goods sold Sales commissions (88,000) (30,000) Contribution margin General fixed oper. exp. (allocation of president's salary) Advertising expense (specific to individual divisions) 132,000 31,000 140,000 (34,000) (48,000) (32,000) (6,000) (11,000) (9,000) $73,000 $108,000 Net income Required: a. Prepare a schedule of relevant sales and costs for Segment A. Relevant Rev. and Cost items for Segment A Effect on income b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. PATTERSON COMPANY Comparative Income Statements for the Year 2014 Eliminate Seg. A Keep Seg.A Decision Sales Cost of goods…arrow_forward4) Wayne Manufacturing Company had the following information for the 2021. Selling price Direct materials cost per unit Indirect materials cost per unit Direct manufacturing labor per unit Indirect manufacturing labor cost per unit Salespersons' company vehicle costs per unit Annual property taxes on manufacturing plant building Annual Depreciation of manufacturing equipment Annual Depreciation of office equipment Miscellaneous plant overhead per unit Plant utilities per unit General office expenses per unit Annual Marketing costs Tax rate Calculate the following: a- Contribution margin per unit $30 4 3.20 4.8 2 1.65 28,000 264,000 118,000 1.35 .92 1.08 e- f- 30,000 30% b- Contribution margin percentage C- How many units does Wayne Company have to sell to break even? d- How many units does Wayne Company have to sell to make operating income of $55,000? How many units does Wayne Company have to sell to make operating income of $46,200? Calculate the operating leverage when expected sale…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning