Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

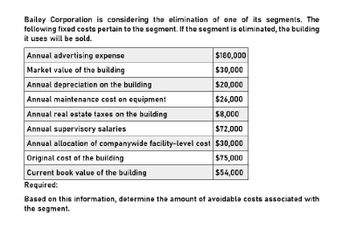

Transcribed Image Text:Bailey Corporation is considering the elimination of one of its segments. The

following fixed costs pertain to the segment. If the segment is eliminated, the building

it uses will be sold.

Annual advertising expense

Market value of the building

Annual depreciation on the building

Annual maintenance cost on equipment

Annual real estate taxes on the building

Annual supervisory salaries

$180,000

$30,000

$20,000

$26,000

$8,000

$72,000

Annual allocation of companywide facility-level cost $30,000

Original cost of the building

Current book value of the building

Required:

$75,000

$54,000

Based on this information, determine the amount of avoidable costs associated with

the segment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Laurman, Inc. is considering the following project: Required investment in equipment Project life Salvage value The project would provide net operating income each year as follows: Sales Variable expenses Contribution margin Fixed expenses: $2,205,000 7 225,000 $2,750,000 1,600,000 $1,150,000 Salaries, rent and other fixed out-of pocket costs Depreciation Total fixed expenses Net operating income. Company discount rate Required: $520,000 350,000 870,000 $280.000 18% (Use cells A4 to C18 from the given information, as well as 824, and A30 to D45 to complete this question. Negative amounts or amounts to be deducted should be input as negative values and will display in parentheses.) 1. Compute the annual net cash inflow from the project. 2. Complete the table to compute the net present value of the investment. $630,000 nitial investment „Annual cost savings Salvage value of the new machine Total cash flows Discount factor Present value of the cash flows Net present value Use Excel's PV…arrow_forwardA piece of production equipment is to be replaced immediately because it no longer meets quality requirements for the end product. The two best alternatives are a used piece of equipment (E1) and a new automated model (E2). The economic estimates for Alt E1 Alt E2 Capital Investment PhP 14,000 PhP 65,000 Aппual Expenses 14,000 9,000 each are shown in the accompanying table. Useful Life (years) 5 20 Market Value (at the end of useful life) 8,000 13,000 The MARR is 15% per year. Which alternative is preferred, based on the (a) coterminated assumption with a five-year study period and an imputed market value for Alternative b? Use FW. ANSWER: FW (E1) = PhP Blank 1 FW (E2) = PhP Blank 2 The best alternative is EBlank 3arrow_forwardSteel insulators is analyzing solution general accounting questionarrow_forward

- After-Tax Net Present Value and IRR (Non-MACRS Rules—Straight-Line vs. DoubleDeclining-Balance Depreciation Methods) eEgg is considering the purchase of a new distributed network computer system to help handle its warehouse inventories. The system costs $60,000to purchase and install and $30,000 to operate each year. The system is estimated to be useful for 4years. Management expects the new system to reduce the cost of managing inventories by $62,000per year. The firm’s cost of capital (discount rate) is 10%.Required1. What is the net present value (NPV) of the proposed investment under each of the following independent situations? Use the NPV built-in function in Excel; round answers to the nearest whole dollar. a. The firm is not yet profitable and therefore pays no income taxes. b. The firm is in the 30% income tax bracket and uses straight-line (SLN) depreciation with no salvagevalue. Assume MACRS rules do not apply; calculate depreciation expense using the SLN functionin Excel.arrow_forwardB2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $144,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product $ 90,000 Expenses Materials, labor, and overhead (except depreciation) 48,000 Depreciation—Equipment 12,000 Selling, general, and administrative expenses 9,000 Income $ 21,000 (a) Compute the annual net cash flow.(b) Compute the payback period.(c) Compute the accounting rate of return for this equipment. I could not include an image for "C" please answer seperatelyarrow_forwardB2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $240,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product $ 150,000 Expenses Materials, labor, and overhead (except depreciation) 80,000 Depreciation—Equipment 20,000 Selling, general, and administrative expenses 15,000 Income $ 35,000 (a) Compute the annual net cash flow.(b) Compute the payback period.(c) Compute the accounting rate of return for this equipment.arrow_forward

- Heer Don't upload any image pleasearrow_forwardUnequal Lives Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $220,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $97,000 per year; and Machine 360-6, which has a cost of $320,000, a 6-year life, and after-tax cash flows of $93,400 per year. Knitting machine prices are not expected to rise, because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins's cost of capital is 12%. Calculate the two projects' extended NPVs. Do not round intermediate calculations. Round your answers to the nearest dollar. Machine 190-3: $ Machine 360-6: $ Should the firm replace its old knitting machine? If so, which new machine should it use? The firm -Select-should replace its old knitting machine with Machine 190-3should replace its old knitting machine with Machine 360-6should not replace…arrow_forwardAn old machine cost P48,000.00 a year to maintain. What expenditures for a new machine is justified if no maintenance will be acquired for the first 3 years, P12,000.00 per year for the next 7 years, and P48,000 a year thereafter? Assume money to cost 4% compounded annually and no other costs to be considered. Answer. P325,293.20arrow_forward

- Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $87,000 per year; and Machine 360-6, which has a cost of $360,000, a 6-year life, and after-tax cash flows of $98,300 per year. Knitting machine prices are not expected to rise because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins’ cost of capital is 14%. Should the firm replace its old knitting machine? If so, which new machine should it use? By how much would the value of the company increase if it accepted the better machine? What is the equivalent annual annuity for each machine?arrow_forwardAn auto repair company needs a new machine that will check for defective sensors. The machine has an Initial investment of $224,000. Incremental revenues, including cost savings, are $120,000, and Incremental expenses, including depreciation, are $50,000. There is no salvage value. What is the accounting rate of return (ARR)?arrow_forwardB2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $432,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product $ 270,000 Expenses Materials, labor, and overhead (except depreciation) 144,000 Depreciation—Equipment 36,000 Selling, general, and administrative expenses 27,000 Income $ 63,000 (a) Compute the annual net cash flow.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT