Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

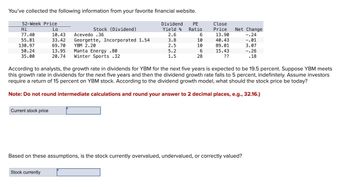

Transcribed Image Text:You've collected the following information from your favorite financial website.

52-Week Price

Hi

77.40

Lo

Stock (Dividend)

10.43

Acevedo .36

Dividend

Yield %

2.6

55.81

33.42

Georgette, Incorporated 1.54

3.8

130.97

50.24

69.70

YBM 2.20

2.5

13.95

Manta Energy .80

5.2

35.00

20.74

Winter Sports .32

1.5

T

PE

Ratio

Close

Price

Net Change

6

13.90

-.24

10

40.43

-.01

10

89.01

3.07

6

15.43

-.26

28

??

.18

According to analysts, the growth rate in dividends for YBM for the next five years is expected to be 19.5 percent. Suppose YBM meets

this growth rate in dividends for the next five years and then the dividend growth rate falls to 5 percent, indefinitely. Assume investors

require a return of 15 percent on YBM stock. According to the dividend growth model, what should the stock price be today?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Current stock price

Based on these assumptions, is the stock currently overvalued, undervalued, or correctly valued?

Stock currently

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- what is your portfolio dollar return and percentage return?arrow_forwardAccording to analysts, the growth rate in dividends for Acevedo for the previous 10 years has been 4%. If investors feel this growth rate will continue, what is the required return for the companys stock?arrow_forwardIn the cell, by using cell references to the given data, calculate the value of stock C. Stock C Dividend expected next year $ 0.65 Dividend growth rate 10% Required return 14% Stock valuearrow_forward

- You've collected the following information from your favorite financial website. 52-Week Price Lo 10.49 Acevedo .42 33.42 69.50 13.95 20.74 Hi 78.00 55.81 130.93 50.24 35.00 Stock (Dividend) Required return Georgette, Incorporated 1.54 YBM 2.00 Manta Energy .80 Winter Sports .32 Dividend PE Yield % Ratio 2.9 3.8 2.2 5.2 1.5 % 6 10 10 28 Close Price 14.50 40.43 88.97 15.43 ?? Net Change -.24 -.01 3.07 -.26 · According to analysts, the growth rate in dividends for Acevedo for the previous 10 years has been 4 percent. If investors feel this growth rate will continue, what is the required return for the company's stock? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. 18arrow_forwardnaranarrow_forwardaa.3arrow_forward

- . Dollar cost averaging - real Wal*Mart example (from a few years ago) You have decided to invest in Wal*Mart stock for an entire year. The stock paid a quarterly divident of $0.30 per share You paid a 2% commission on the purchase of the stock. You invest $150 per month Month WM Stock Price Jan $54.54 Feb $54.30 Mar $53.43 Apr $54.07 May $55.91 Jun $53.64 Jul $50.56 Aug $48.07 Sep $51.19 Oct $51.00 Nov $53.52 Dec $54.00 As you can see, the stock was down about 1% for the year. What was your individual return?…arrow_forwardson.2arrow_forward3. Financial analysts forecast Safeco Corp.s (SAF) growth rate for the future to be 12 percent Safeco's recent dividend was $1.60. What is the value of Safeco stock when the required return is 14 percent? (Round your answer to 2 declmal places.) Value of stock here to search 0 0 0 O F4 F5 F7arrow_forward

- (Related to Checkpoint 10.1) (Common stock valuation) Header Motor, Inc., paid a $2.83 dividend last year. At a constant growth rate of 3 percent, what is the value of the common stock if the investors require a 11 percent rate of return? Question content area bottom Part 1 The value of the common stock is $enter your response here. (Round to the nearest cent.)arrow_forwardYou've collected the following information from your favorite financial website. 52-Week Price Dividend Hi Lo Stock (Dividend) Yield % PE Ratio Close Price Net Change 77.40 10.43 Acevedo .36 2.6 6 13.90 -.24 55.96 33.57 Georgette, Incorporated 1.69 4.2 10 40.58 -.01 130.93 69.50 YBM 2.00 2.2 10 88.97 3.07 50.24 35.00 13.95 Manta Energy .80 5.2 15.43 -.26 20.74 winter sports .32 1.5 28 ?? .18 Find the quote for the Georgette, Incorporated. Assume that the dividend is constant. a. What was the highest dividend yield over the past year? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What was the lowest dividend yield over the past year? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Highest dividend yield b. Lowest dividend yield -7.54% 3.96 %arrow_forward7. You invest $7,873 in stock and receive $102, $123, $121, and $155 in dividends over the following 4 years. At the end of the 4 years, you sell the stock for $11,900. What was the IRR on this investment? Review Only Click the icon to see the Worked Solution (Calculator Use). Click the icon to see the Worked Solution (Spreadsheet Use). The IRR on this investment is %. (Round to the nearest whole percent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education