Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

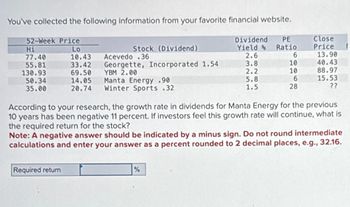

Transcribed Image Text:You've collected the following information from your favorite financial website.

52-Week Price

Hi

Lo

Stock (Dividend)

Dividend

Yield %

PE

Close

Ratio

Price

77.40

10.43

Acevedo .36

2.6

6

13.90

55.81

33.42

Georgette, Incorporated 1.54

3.8

10

40.43

130.93

69.50

YBM 2.00

2.2

10

88.97

50.34

14.05

Manta Energy .90

5.8

6

15.53

35.00

20.74

Winter Sports .32

1.5

28

??

According to your research, the growth rate in dividends for Manta Energy for the previous

10 years has been negative 11 percent. If investors feel this growth rate will continue, what is

the required return for the stock?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

Required return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Constamt urowtl ASset valuauon ти ויקסדד 10. A company plans to pay a dividend of $3.20 exactly one year from today and grow the dividend at a constant rate of 3% per year, indefinitely. Further, the return required by shareholders is 14%. According to the Gordon Model, what is the price of this firm's common stock? Topic с D1 k-g Value Do (1+g) k garrow_forwardExcel Online Structured Activity: Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $2.25 a share at the end of the year (D₁ = $2.25) and has a beta of 0.9. The risk-free rate is 3.9%, and the market risk premium is 5.0%. Justus currently sells for $43.00 a share, and its dividend is expected to grow at some constant rate, g. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. ☑ Open spreadsheet Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is P3?) Round your answer to two decimal places. Do not round your intermediate calculations.arrow_forwardDestin Company Information: Total Assets $940,000 Total Liabilities $600,000 Cost of debt 5.8% Risk-free rate 1.97% Beta 0.89 Market Return 10% A) Using CAPM, what is cost of equity? (so you are not confused, the opportunity cost of using equity is the return we were expecting to receive on the equity). a)8.03% b)7.77% c) 9.12% d) 8.9% B) What is Destin's Weighted Average Cost of Capital? a) 6.22% b) 5.89% c) 6.07% d) 5.72%arrow_forward

- You have assigned the following values to these three firms: Upcoming Dividend $3.15 US Bancorp Praxair Eastman Kodak 2 Price $115.50 57.10 27.45 US Bancorp required return Praxair required return Eastman Kodak required return 1.18 1.00 CAPM % % Growth 9.00% Assume that the market portfolio will earn 12.70 percent and the risk-free rate is 3.40 percent. Compute the required return for each company using both CAPM and the constant-growth model. (Do not round intermediate calculations and round your final answers to 2 decimal places.) % 14.50 9.20 Beta 1.42 2.14 1.84 Constant-Growth Model % % %arrow_forwardHow do I solve the expected return percent and know if i should buy or sell it?arrow_forward. Dollar cost averaging - real Wal*Mart example (from a few years ago) You have decided to invest in Wal*Mart stock for an entire year. The stock paid a quarterly divident of $0.30 per share You paid a 2% commission on the purchase of the stock. You invest $150 per month Month WM Stock Price Jan $54.54 Feb $54.30 Mar $53.43 Apr $54.07 May $55.91 Jun $53.64 Jul $50.56 Aug $48.07 Sep $51.19 Oct $51.00 Nov $53.52 Dec $54.00 As you can see, the stock was down about 1% for the year. What was your individual return?…arrow_forward

- q5- provide step by step explaination (no excel)arrow_forwardQuestion content area top Part 1 (Calculating the geometric and arithmetic average rate of return) The common stock of the Brangus Cattle Company had the following end-of-year stock prices over the last five years and paid no cash dividends: Time Brangus cattle Comapny 1 $ 16 2 8 3 14 4 21 5 25 (Click on the icon in order to copy its contents into a spreadsheet.) a. Calculate the annual rate of return for each year from the above information. b. What is the arithmetic average rate of return earned by investing in Brangus Cattle Company's stock over this period? c. What is the geometric average rate of return earned by investing in Brangus Cattle Company's stock over this period? d. Which type of average rate of return best describes the average annual rate of return earned over the period (the arithmetic or geometric)? Why? Question content area bottom Part 1 a. The annual rate of…arrow_forwardVijayarrow_forward

- Question 31: An analyst has assembled the following information regarding Net-Zone Incorporated and the market in general: Net-Zone dividend (paid yesterday) $2.15 per share Net-Zone expected dividend growth 3% per year Net-Zone expected ROE 16.2% Net-Zone beta 1.8 Net Zone long-term bond yield 8.6% 10.7% Expected return on S&P 500 Index 30-day Treasury bill yield 10-year Treasury bond yield 3.5% 4.8% When reviewing the data provided by the analyst, the CFO of Net-Zone was surprised by the value of the company's beta. The CFO understands that the beta value is an indicator of risk, and investors need to be compensated for their risk of investing. The company's current stock price is just under $17 per share, which the CFO believes is too low considering the company's increased profit margins. If the CFO believes the stock price should be no less than $25 per share, and assuming the CFO is correct, that would imply that the company's beta is a) 1.22 b) 1.19 c) 1.13 d) 1.16arrow_forwarduse EXCEL and provide Cell References for Calculations.arrow_forwardq4- 8.2 Prove step by step working out no excelarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education